As the global financial landscape continues to evolve, recent developments have sparked discussions about the potential return of the gold standard.

In particular, the Federal Reserve Board’s announcement of final individual capital requirements for large banks, effective October 1, 2024, has ignited speculation about the role of gold in the modern banking system.

The gold standard was a monetary system where a country’s currency was directly linked to gold. Most nations abandoned this standard in the 20th century with the surge of unbacked fiat currencies. However, recent changes in banking regulations have brought gold back into focus as a crucial asset for financial institutions.

Under the new Basel III regulations, gold has been reclassified as a Tier 1 asset, placing it on par with cash and government bonds.

The Basel III framework and a new ‘Gold standard’

The implementation of Basel III has significantly altered the landscape for gold in the banking sector. Notably, allocated gold holds a zero-risk weighting, making it an attractive option for banks seeking to bolster their capital reserves.

Furthermore, the new regulations require banks to hold higher capital levels to absorb potential losses and increase their resilience to financial shocks. The minimum capital requirement is now 4.5%, with an additional stress capital buffer requirement of at least 2.5%.

These changes have prompted large banks to reassess their asset portfolios, potentially leading to increased gold holdings. As a result, some experts believe this could pave the way for a modern version of the gold standard.

Implications for the global financial system

The reclassification of gold as a Tier 1 asset has far-reaching implications for the global financial system. For one, it may lead to increased demand for physical gold from banks, potentially driving up its price.

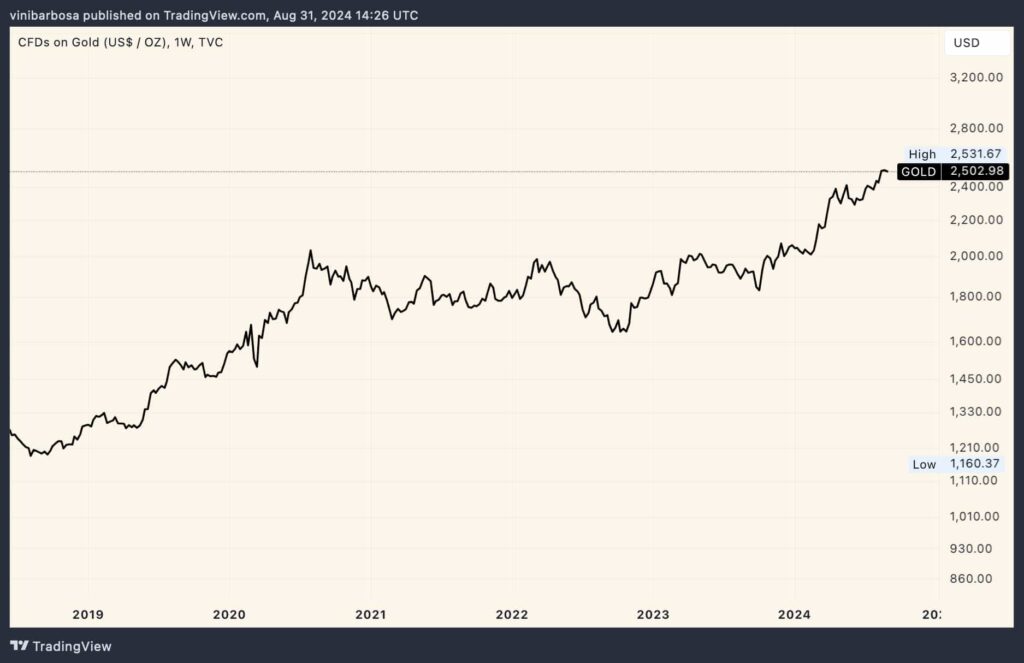

This phenomenon is already observed in price charts, with gold consistently reaching new all-time highs. As of this writing, gold trades at $2,503, holding higher grounds after breaking recent records, as Finbold previously reported.

Moreover, this shift could enhance gold’s role as a safe-haven asset during times of economic uncertainty. As banks increase their gold holdings, it may also influence central banks’ decisions regarding their reserves, further solidifying gold’s position in the global financial landscape.

A Forbes report has also highlighted an upcoming gold standard following increased demand from central banks worldwide.

“Central banks in recent years have been purchasing gold at record levels. Buyers include China, India, Russia and a number of other nations such as Poland. These countries are reacting to growing doubts about the long-term value of the dollar, which in turn is a symptom of the perceived decline of the United States.”

– Forbes

A new era for gold in banking

While the recent changes brought about by Basel III do not signal an immediate return to the gold standard, they undoubtedly mark a new era for gold in the banking sector. The reclassification of gold as a Tier 1 asset has elevated its status and importance within the financial system.

As banks adapt to these new regulations, we may see a shift in how gold is perceived and utilized in financial markets. While a full-fledged gold standard may not be on the horizon, the increased prominence of gold in banking regulations suggests that its role in the global financial system will continue to evolve and expand.

Ultimately, these developments underscore the enduring value of gold as a financial asset. As the world navigates uncertain economic times, gold’s renewed importance in banking regulations may provide a stabilizing force in the global financial landscape.