In recent weeks, several major companies with market capitalization valuations exceeding $100 billion—and even $1 trillion—have seen their market value plummet by more than 30% in a few days.

The “Magnificent 7” tech giants have collectively witnessed a swing of over $3 trillion in market value within the past three weeks, propelling markets into a fear of recession.

For example, Intel (NASDAQ: INTC) lost one-third of its market capitalization on August 1, while Nvidia (NASDAQ: NVDA) experienced daily fluctuations of $500 billion in market cap, adding $330 billion on July 31 but then erasing $270 billion on August, resembling the volatility of meme stocks.

August 1 was a bad day for the stock market

The beginning of August brought significant volatility into the markets, as the Dow Jones Industrial Average experienced a significant drop during the daily trading session, with losses of 500 points in a mere 45 minutes, extending to losses of 700 points in two hours.

At one point, the DJI index fell 1,000 points from its intra-day high of 41,032 before recovering some losses and closing the August 1 trading session with a 1.21% loss.

Stock market volatility was worsened by worrying ISM report

The Purchasing Managers’ Index (PMI) is important as it is a vital economic tool and one of the most reliable leading indicators of the U.S. economy.

The PMI, reported separately for the manufacturing and services sectors, provides valuable insights into the business environment and helps companies gauge the direction of the economy.

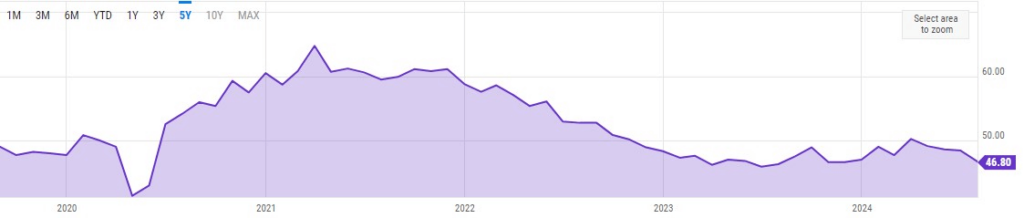

On August 1, the Institute for Supply Management (ISM) reported that the July reading of the Manufacturing PMI was 46.8, 1.7 percentage points lower than June’s figure of 48.5 percent.

This means the U.S. economy has experienced contraction in 20 out of 21 previous months.

The only previous instance of this happening in the past 100 years was from 1989 to 1991 when the U.S. economy experienced a recession.