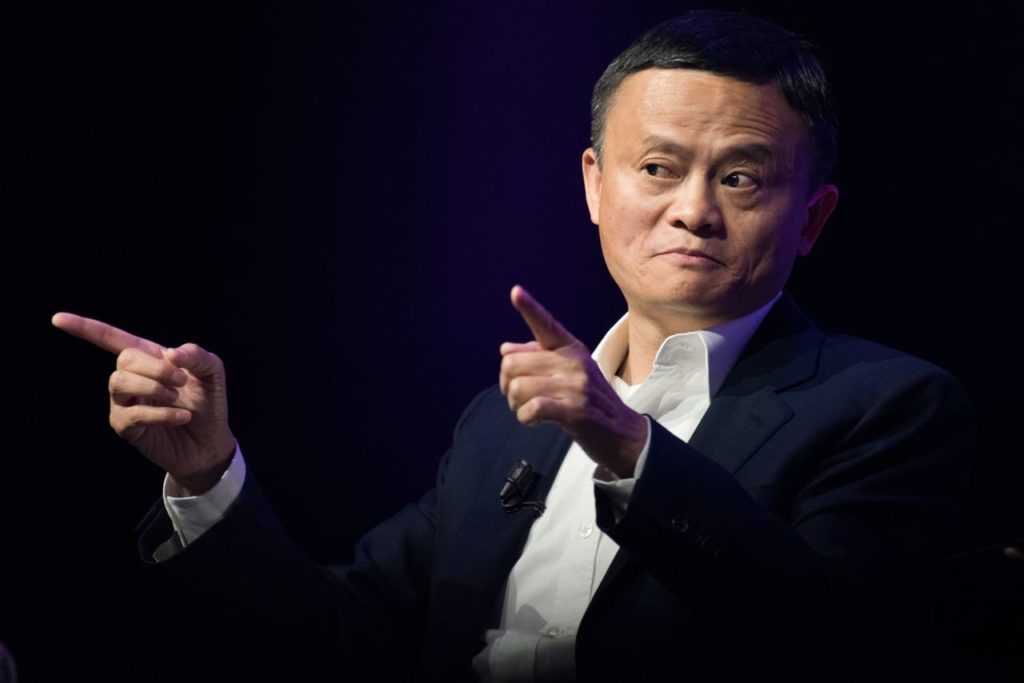

After almost a full year of exceptional pressure from the Chinese regulators, billionaire Jack Ma is planning to give up control of Ant Group. This move comes in an effort to move away Ant from Alibaba (NYSE: BABA).

The halt of the $34 billion initial public offering (IPO) Ant planned in 2020, forced the company to reorganize, and now it is looking to reduce the role of Ma in the company. Meanwhile, Ma does not hold an executive role in Ant; he controls 50.52% of its shares through Hangzhou Yunbo Investment Consultancy, in which he holds a dominant position with a 34% stake, according to a report by The Wall Street Journal, on July 28.

Further, the regulatory pressure has seen both companies terminating long-running commercial and data-sharing agreements that were giving Alibaba an edge.

BABA chart and analysis

In the last month, BABA has been trading between $97.84 and $125.84, remaining at the lower part of its 52-week range. The support zone ranges from $100.61 to $102.02, while the resistance zone ranges from $102.79 to $105.13.

Keeping the above analysis in mind, BABA has been trading choppily in 2022, so the set-up for possible quick entries and exists is not ideal at the moment.

Analysts on Wall Street agree that the stock is a ‘strong buy,’ with average price predictions for the next 12 months at $154.36, 50.18% higher than the current trading price of $102.78.

Regulation is good

Despite the stock of BABA losing 66% from its peak, due to, in part, the regulatory pressure, it has been doing well operationally, as the core business of the firm keeps growing.

If the IPO for Ant is now pushed for another year or if it spins off segments of the company and IPOs in smaller parts, it could stand to benefit Alibaba in the long run.

The premise for bullishness on Ant breaking up or moving the IPO for another year, rests on the belief that China will look to regulate more but not stifle innovative and high-growth companies. It’s possible that the government wants to exert more control over the processes and data of its people than it already does; in this case, regulation of huge companies is necessary.

Thus, investors looking to stay in Alibaba for the long-term could potentially benefit once the saga around Ant is finalized.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.