November 2024 has been turbulent for Jaguar, the Indian-owned British luxury car maker. The company’s rebranding caused a social media storm but did not prevent a slight stock price recovery by early December.

Despite the heated discussion over whether the company went ‘woke’ and whether it would go ‘broke’ because of the commercial, it swiftly faded from public consciousness in the ensuing months.

As it turned out, the shares of Tata Motors (NSE: TATAMOTORS), Jaguar’s parent company and a subsidiary of the even larger Tata Group, also began fading.

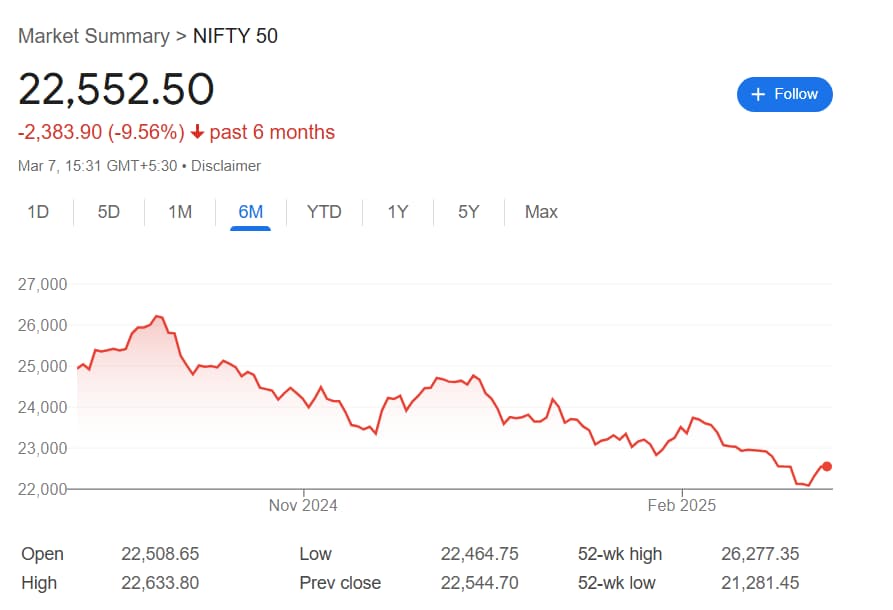

Though some aligned with Nigel Farage might be quick to take Tata’s 17.3% stock market drop since the controversial ad aired as a sign that the rebrand backfired, the story is more complex and related to the firm’s overall performance and the workings of the greater Indian economy.

Why Jaguar stock has fallen

Tata Motors’ decline predates the Jaguar ad and relaunch by several months and has been driven by rising competition in the country, weak earnings, and a broader decline in Indian benchmark indices.

Indeed, in September 2024, a competitor, Mahindra & Mahindra (M&M), overtook it to become the country’s third-biggest car company by volume, with a particular loss in the SUV department.

Likewise, Tata suffered from three consecutive revenue and earnings per share (EPS) misses in quarterly reports, further shaking confidence and solidifying the downtrend.

Wider economic factors have also been working against the automotive giant. The greater Indian market has been under pressure due to Donald Trump’s escalating trade war, and even the latest rally is not likely to signal a greater recovery.

As multiple analysts noted, the March uptick was more of an upward correction following a string of losing sessions than a sign of better things to come.

Lastly, renewed talk of Tesla’s entry into the Indian market before the end of 2025 shook investor confidence in Tata Motors’ ability to grow in the mid-term, with concerns exacerbated by Jaguar’s pivot to electric vehicles.

The impact of Jaguar’s rebranding

Despite the significant and widespread reasons behind the stock market drop, it would be inaccurate to say that the situation with Jaguar is entirely unrelated.

The company’s managing director, Rawdon Glover, broke down the tumult caused by the rebrand, revealing that the perceived ‘wokeness’ of the ad wasn’t intentional. He, however, tepidly reaffirmed that Jaguar will not be changing course once again by stating that the EV course is set and that Nigel Farage – who predicted the car maker’s swift fall following the rebrand – is not the target audience.

Glover did, on the other hand, hint that the expected price tag and the apparent alienating of the existing customer base through the radical change in vehicle design philosophy are points of concern, though the company is willing to accept a lower sales volume.

Featured image via Shutterstock