The famed British – though Indian-owned – luxury car company, Jaguar, recently caused a social media storm on X as it unveiled its latest ‘Copy nothing’ commercial.

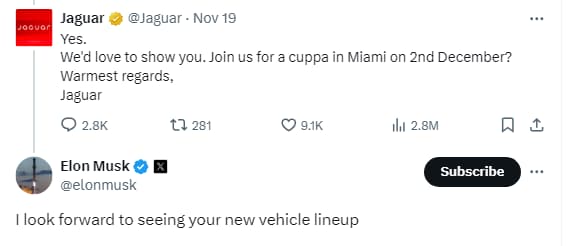

Many commentators, including billionaire Elon Musk, quickly mocked the firm over the ad’s strange and apparently disconnected nature. Musk, for example, simply asked if the company even sells cars in his comment.

Furthermore, due to the advertisement featuring vivid colors, flamboyantly dressed actors, and gender non-conforming individuals, some have seemingly taken it to be part of the ‘culture war’ and threatened to will the ‘go woke, go broke’ slogan into existence by threatening a boycott.

The notion that the new direction would lead to Jaguar’s downfall was seemingly confirmed by the fact the car maker’s parent company, Tata Motors (NSE: TATAMOTORS), experienced a price drop in the 24-hour charts in the Indian national stock exchange and the BSE.

Is the new Jaguar ad behind the Tata stock drop?

Zooming out, however, reveals there is likely no connection between the flamboyant commercial and the stock market drop. To begin with, Jaguar is one of many subsidiaries of Tata Motors, meaning the shares’ fortunes are not reflective of a single company. Furthermore, the downtrend started already in August.

Indeed, since August, Tata stock has fallen 30%, dwarfing the 1% 24-hour drop. Additionally, Jaguar’s latest commercial was unveiled on November 19, which is simultaneously one of the few days in recent weeks to feature a discernible rally.

It is far more likely that the latest Tata share woes are linked to the substantial sales drop in August, a UBS September 11 forecast downgrade, and a warning of even weaker results to come—particularly for the luxury division, also known as Jaguar.

Other subsidiaries of the Indian industrial giant have also contributed to the downtrend. For example, the country’s supreme court upheld the state’s right to levy additional taxes on mineral extraction retrospectively from April 1, 2005 – a decision likely to affect Tata Steel.

Finally, the Indian stock market entered a decline in September amidst fears of an economic slowdown, heightened geopolitical tensions, regulatory changes, an overall weak earnings season, and analyst downgrades.

The NIFTY 50 index, for example, is down 5.78% in the last 30 days.

Is JaGUar stock out of the woods after the rebrand?

Still, the fact that the recent showing of Jaguar’s marketing department likely had no bearing on Tata stock’s performance doesn’t mean it will not eventually have a negative impact.

The first and most direct risk is that, as many commentators threatened, a social media and boycott campaign will target the brand.

The bigger danger, however, is that Jaguar’s overall rebranding will not stick the landing. The firm has initiated a major pivot to electric vehicles (EVs), with three models scheduled for release by 2026. It also changed its famous logo and is now stylized as JaGUar – a fact likely to cause even more mockery online.

Ultimately, the luxury car maker’s future will depend on how the image change will be received by the broader public and on how well it researched its customer base.

Despite its popularity as a slogan in some circles, there are few undisputed instances of the ‘go woke, go broke’ slogan turning true, with Bud Light (NYSE: BUD) being the only clear example due to the demographics of its customer base.

Finally, and perhaps unsurprisingly, given that the new commercial is in line with many historical examples of art house-inspired advertisements, the backlash was far more centered on its lack of connection to cars.

Elon Musk, for example, expressed his eagerness to view Jaguar’s new vehicle offering despite joining the mockery in the comment section.

The more optimistic case is also bolstered by May 2024 reports indicating that, despite going quiet for the rebrand, Jaguar Land Rover’s profits rocketed to highs not seen since 2015.

UPDATE: Jaguar stock rallies day after social media backlash

In line with the fact that the social media backlash on X – and the positive reactions to the rebrand elsewhere – had little impact on Jaguar’s stock, the luxury car maker’s parent company rallied on November 22.

Still, it is worth pointing out that it is possible that the share price rise on Friday is not so much linked to any development pertaining to Tata Motors’ (NSE: TATAMOTORS) subsidiaries but to a broader recovery for Indian stocks: the NIFTY 50 benchmark index likewise rallied on November 22.

Finally, as pointed out by Ravi Singh, Senior Vice-President at Religare Broking, and Kranthi Bathini, Director of Equity Strategy at WealthMills Securities, several weeks ago, Tata Motors’ stock market trend is driven mostly by weakening sales and investors should not have their hopes up whenever the shares rally – as they have done on multiple occasions since the downtrend started in August.

The stock has been facing selling pressure due to soft auto sales. Investors with a longer-term horizon can hold on to Tata Motors as China’s stimulus package could have a positive impact on JLR (Jaguar Land Rover) sales.

Kranthi Bathini

Additionally, though one of the experts pointed toward China’s stimulus package as a potential upward catalyst, it is worth remembering that numerous investors were burned in late September and early October when they flooded the People’s Republic’s markets with investments, only to begin fleeing as the injection proved underwhelming.

Featured image via Shutterstock