In late November, Indian stocks reentered the collective consciousness of Western investors first due to the fraud and bribery charges filed against the industrial mogul Gautam Adani and then thanks to a social media storm surrounding the Jaguar rebrand.

Though a famous British luxury car brand, Jaguar is in fact owned by the Indian automotive and industrial conglomerate, Tata (NSE: TATAMOTORS).

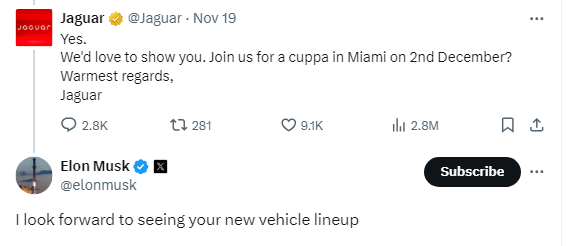

As Finbold reported on November 21, Jaguar’s latest commercial was received by mockery and even threats of a boycott on Elon Musk’s social media platform X, including by the billionaire owner himself, over its perceived positioning in the ‘Culture War.’

Despite the flare-up in negative coverage stemming from the online backlash, Tata shares are up 2.60% in the 24-hour chart and boast a press time price of ₹794 (~$9.40).

Why the Jaguar online backlash had little effect on Tata stock price

Though the release of the ‘Copy nothing’ advertisement at face value coincided with a stock market drop for Tata which fell below ₹770 before retracing to -₹9.2 (1.17%), indicating it may have triggered a chain of events akin to what Bud Light (NYSE: BUD) has been facing for about a year, a deeper analysis revealed the downturn had more to do with a greater – and unrelated – downtrend.

Indeed, though the advertisement was mocked, most of the comments were focused on the fact it, apparently, had nothing to do with vehicles. Elon Musk himself asked Jaguar if they still ‘make cars’ in his initial quip, before stating he is looking forward to seeing Jaguar’s new products.

Jaguar’s rebranding campaign was designed to accompany a strong pivot to electric vehicles (EV), with three such models due by 2026.

Furthermore, the commercial itself wasn’t particularly unusual, as numerous companies have published commercials with no apparent link to their products. Apple’s (NASDAQ: AAPL) famous 1984 ad for Macintosh is perhaps the most notable example.

What is behind the Tata Motors stock market rally

Given such circumstances, it hardly comes as a surprise that the previous downturn – and the latest upward moves – resulted from broader circumstances in the Indian market, than for any singular move of a single subsidiary of Tata.

Tata Motors stock decline started already in August on weakened sales and analyst estimates of more weakness to come and was reinforced in September by a brother slump in the Indian market.

Similarly, much like Tata shares are 2.60% in the green on November 22, the benchmark NIFTY 50 index is up 2.39% in the 24-hour chart on wide buying activity and bolstered by optimism ahead of the Maharashtra and Jharkhand election results, per CNBC TV18’s reporting.

Such a situation means it is difficult to gauge just how much of an impact any individual development had on the stock of firms such as Tata Motors.

For example, Jaguar’s rebranding and advertisement could have proven an upward catalyst if interpreted as a positive sign of change for the aging car maker and a grand return after a long hiatus.

Similarly, Tata Motors stock could have experienced tailwinds from spillover effects from a $4.25 billion partnership between the Asian Development Bank and Tata Power – another company within the greater Tata Group.

Featured image via Shutterstock