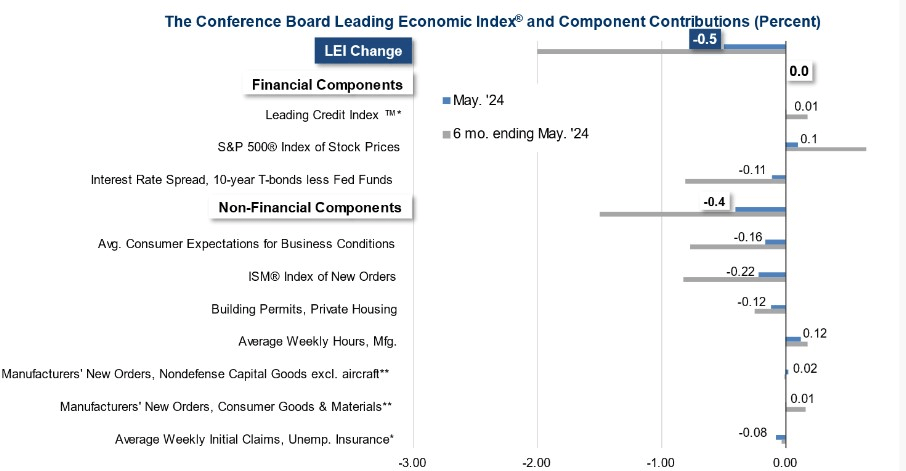

A recent report from the Conference Board revealed that leading U.S. economic indicators fell more sharply than expected in May. The Leading Economic Index (LEI) decreased by 0.5% in May, following a 0.6% decline in April, whereas economists had anticipated a smaller dip of 0.3%.

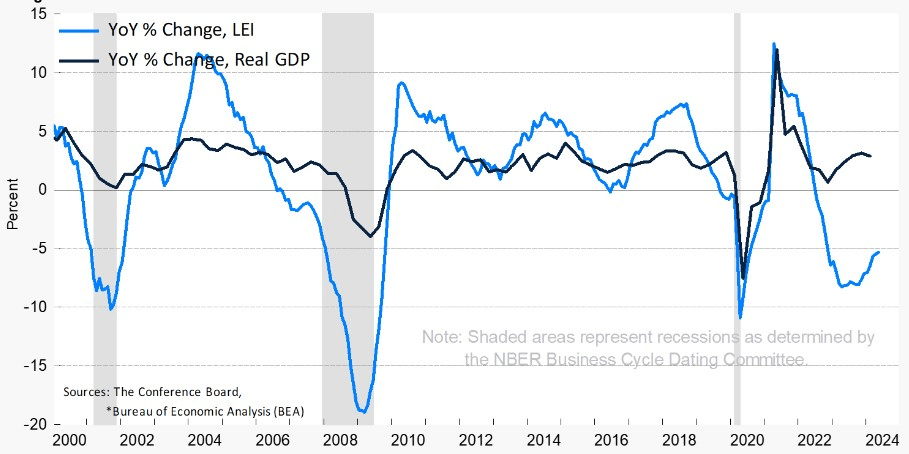

Over the six-month period from November 2023 to May 2024, the index saw a 2% decline, a slight improvement compared to the 3.4% contraction in the preceding six months.

However, the index is down 14.7% from the peak of this economic cycle, with such discrepancies only happening during recessions in the previous 65 years.

Experts believe there is nothing to worry about

According to Justyna Zabinska-La Monica, Senior Manager of Business Cycle Indicators at the Conference Board, the decrease in the U.S. Leading Economic Index (LEI) in May was mainly due to a drop in new orders, weak consumer sentiment about future business conditions, and a reduction in building permits.

Despite the index’s continuous negative growth over six months, Zabinska-La Monica noted that the LEI does not currently indicate a recession.

The near future doesn’t indicate a better situation

Zabinska-La Monica projected that real GDP growth will further slow to below 1% (annualized) over the second and third quarters of 2024 as elevated inflation and high interest rates continue to dampen consumer spending.

The report also indicated that the lagging economic index slightly decreased by 0.1% in May, following a 0.3% increase in April.

This suggests that while some economic indicators are worsening, the overall economic situation remains complex, with various factors contributing to the mixed signals in economic performance.