The Kingdom of Bhutan’s Bitcoin (BTC) strategy may shift after the country moved a significant portion of its holdings to Binance.

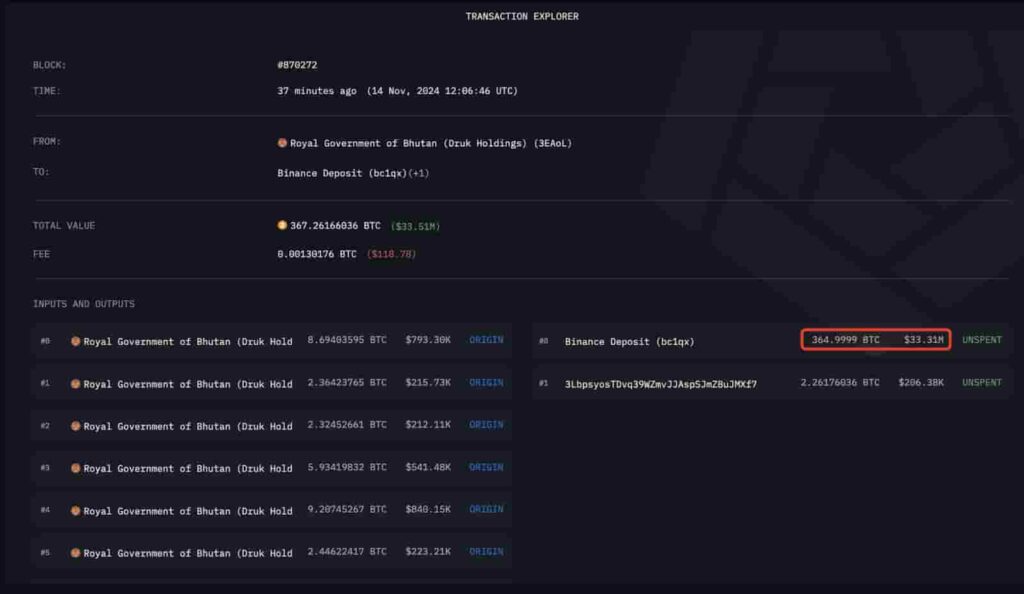

The Asian country transferred about 365 BTC, valued at approximately $33.3 million, to a Binance deposit address on November 14, coinciding with a period when Bitcoin was trading around its all-time high of over $90,000, according to data retrieved by Finbold from on-chain analysis platform Arkham.

This transfer adds to the growing number of the country’s crypto holdings being moved to Binance. For instance, toward the end of October, Bhutan shifted 929 BTC (worth $66.1 million) to the exchange.

Another notable transfer to a trading platform occurred on July 1, when Bhutan deposited 381 BTC to Kraken. Despite these transfers to exchanges, the small Asian country still holds about 12,573 BTC, valued at slightly over $1 billion.

Will Bhutan sell its Bitcoin?

There is no specific reason behind the latest Binance deposit, but historically, moving funds to exchanges is usually motivated by the intention to sell. In this case, selling a significant amount could lead to short-term volatility for Bitcoin.

Indeed, if the country proceeds with the sale, it will be interesting to see why it opted to dump Bitcoin on the open market rather than sell it over the counter.

Bhutan is among the few select countries besides El Salvador that are strategically holding Bitcoin. The government has been mining Bitcoin using the abundant hydroelectric energy. Its BTC holdings are managed by the state’s investment wing, Druk Holding & Investments.

For El Salvador, the country declared Bitcoin a legal tender and maintains a no-sell strategy with periodic purchases of the cryptocurrency. As reported by Finbold, the Central American nation has unrealized profits exceeding $200 million on its Bitcoin holdings since they began accumulating in late 2021.

Most countries that hold Bitcoin have acquired the asset primarily through criminal seizures. The United States is the largest Bitcoin-holding country, primarily due to the Silk Road seizure, with its holdings amounting to about 208,109 BTC.

Other countries with significant Bitcoin holdings include China (194,000 BTC), the United Kingdom (61,245 BTC), and Ukraine (46,351 BTC).

Possible change in Bitcoin strategy

Countries may change their stance on Bitcoin and begin to accumulate the asset following Donald Trump’s election.

The U.S. president-elect has vowed to make Bitcoin part of the national reserves once in office, with plans to hold rather than sell the current holdings as part of this strategy.

The ongoing bullish momentum in the crypto market has been fueled by optimism that Trump will keep this promise during his second term in the White House.

Bitcoin was trading at $87,810 at press time, having dropped over 6% in the last 24 hours. On the weekly chart, however, it is up 15%.

Featured image via Shutterstock