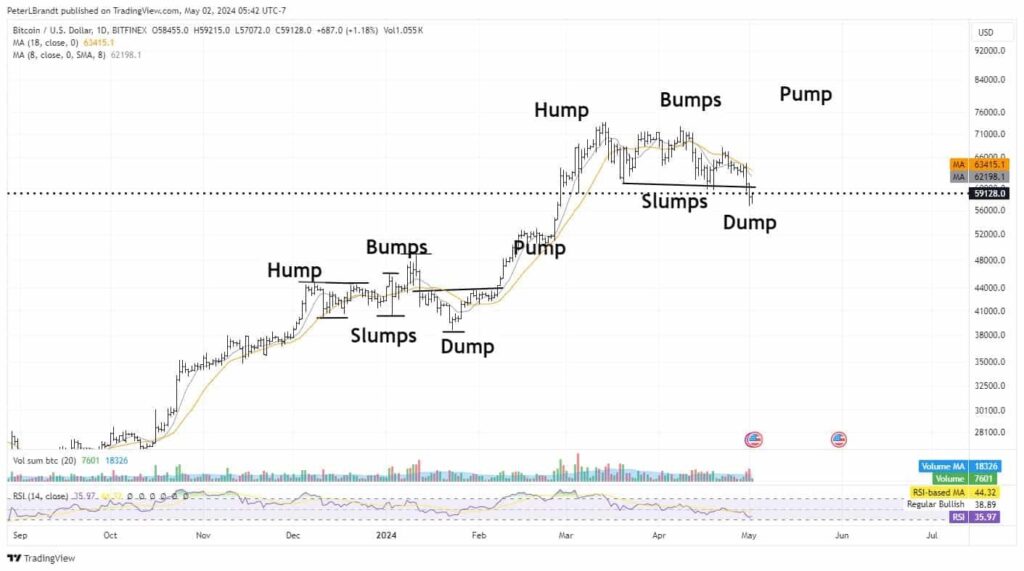

Veteran trader Peter Brandt has sparked significant discussions in the cryptocurrency sector with his latest forecast, suggesting that Bitcoin (BTC) could potentially approach its previous highs if it continues to follow a classic bullish pattern.

In a post shared on X (formerly Twitter) on May 2, Brandt presented a scenario where, by sustaining its current stability and upward momentum, Bitcoin might witness a substantial price increase, nearing its historical peak values.

This optimistic outlook, however, has not been well embraced. Some skeptics have questioned Brandt’s credibility, given his previous predictions suggested both a correction to $40,000 per BTC and the possibility that Bitcoin had already reached its peak.

Despite these criticisms, he remains optimistic in his belief that Bitcoin is on a bullish path.

Peter Brandt’s perspective on Bitcoin’s attributes

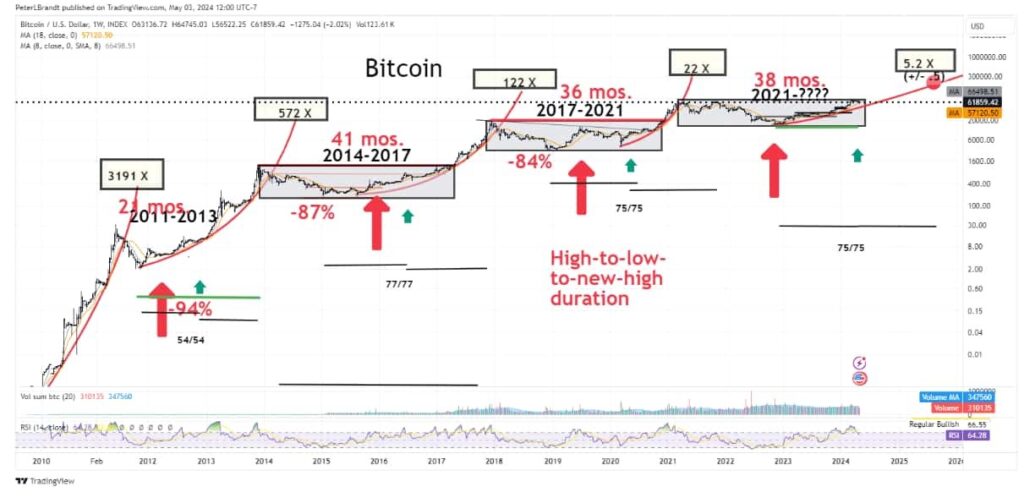

In his latest blog, Peter Brandt highlighted several unique aspects of Bitcoin that set it apart: non-hackable, limited quantity, globally accepted, trackable, and almost instantly transactional. Additionally, Bitcoin’s price behavior is notably distinct, according to him.

Not only have the major advances in BTC been of a parabolic nature, but of parabolic on a log scale. I can find no other stock, commodity, or publicly traded asset that can make the same claim.

Peter Brandt

This assertion underscores his confidence in Bitcoin’s long-term value and distinctive market behavior.

Market reactions and analyst perspectives

Critics of Peter Brandt‘s forecast recall his earlier inconsistent predictions, but he holds firm on his current bullish stance, underscoring the importance of adaptability in successful trading. On the supportive side, Marco Johanning, a noted crypto analyst, reiterated a bullish sentiment on social media:

“We are in a bull market, and this is merely a correction, not a rally in a bear market,” suggesting confidence in the market’s potential for a rebound.

Contrarily, Scott Melker presents a more cautious perspective, highlighting the lack of key support levels, which, if not maintained, could precipitate a further drop to as low as $52,000.

BTC price analysis

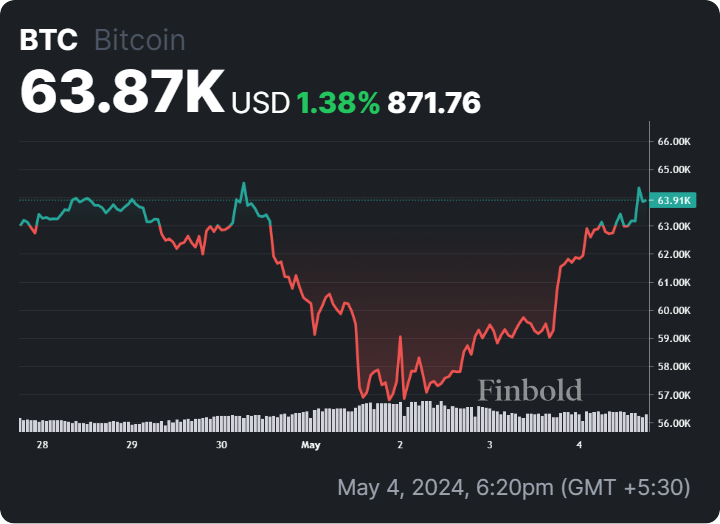

By press time, Bitcoin was trading at $63,870, marking daily gains of almost 6%. On the weekly chart, BTC showed a modest increase of less than 1.5%. For Bitcoin to initiate a sustained rally, it requires bullish momentum to push the asset towards the $65,000 threshold. However, Bitcoin currently remains vulnerable to a potential drop to $60,000.

This period of uncertainty is critical for traders and investors alike as they weigh the mixed signals and brace for potential shifts in the market’s direction.

Whether Brandt’s bullish scenario will materialize remains an open question, but the ongoing debate illustrates the dynamic and unpredictable nature of the cryptocurrency landscape.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.