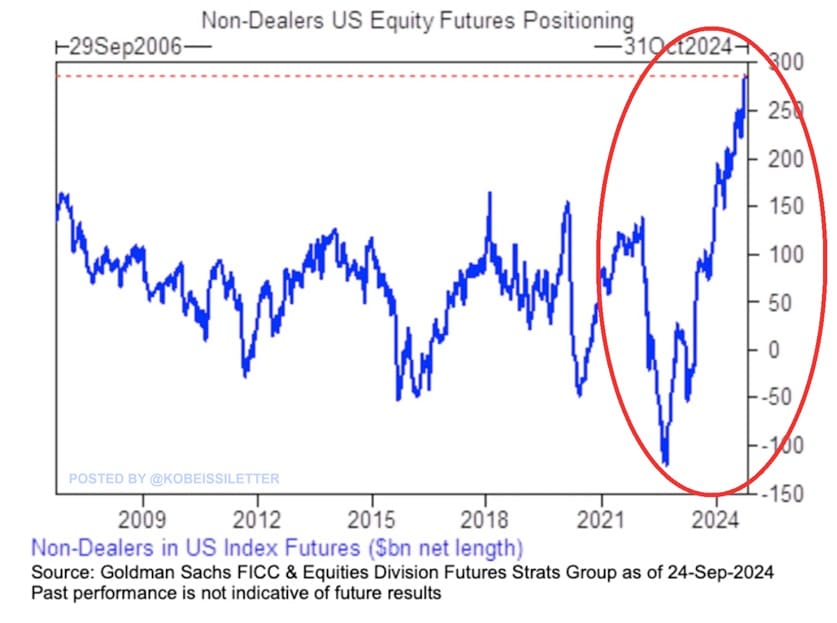

Investors are piling into U.S. stocks like never before. The net long positions in U.S. equity futures by investors—excluding market-makers—have surged to an unprecedented $290 billion. Such a heavily weighted bullish sentiment could, however, initiate a long squeeze in the stock market.

Notably, this marks the highest level on record, according to data from The Kobeissi Letter published on October 2. Since the start of the year, these bullish bets have more than doubled, eclipsing previous peaks in early 2018 and 2020.

“Investors are all-in on stocks,” noted the analyst, highlighting that the “Bullish sentiment is through the roof.” Meanwhile, U.S. households’ stock allocation reached a new record of 41.8% of financial assets in the 2024 Q2.

Record-breaking net longs raise caution

This overwhelming optimism raises concerns about a potential long squeeze. When too many investors hold bullish positions, the market becomes vulnerable to sharp reversals if sentiment shifts.

The $290 billion net long positioning doubles the levels from earlier peaks and highlights how concentrated bullish bets have become.

Moreover, the aggressive accumulation of long positions suggests that investors are betting heavily on continued market gains. Such crowded trades can amplify market volatility if economic data disappoints or if unexpected events occur.

The upcoming non-farm payrolls report, due this Friday, could catalyze such volatility.

Economic indicators flash warning signs

While the stock market soars, underlying economic indicators tell a different story, suggesting a bearish divergence.

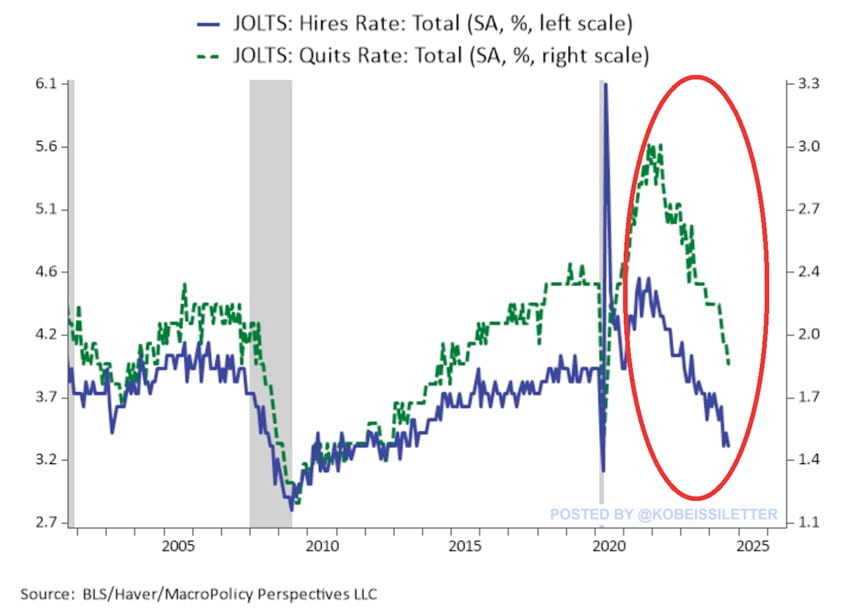

For example, the labor market is showing signs of weakening. The Kobeissi Letter reported that the number of new hires as a percentage of total employment dropped to 3.3% in August, the lowest since 2013, excluding the pandemic slump in 2020.

Since November 2021, the hiring rate has fallen by 1.3 percentage points—a decline comparable to the one seen during the 2008 Financial Crisis. At the same time, the share of workers voluntarily quitting their jobs has decreased to 1.9%, the lowest since 2020. This suggests that Americans’ confidence in finding new employment has dipped to recessionary levels.

“The labor market is weakening,” The Kobeissi Letter emphasized, highlighting the disconnect between bullish market sentiment and labor market realities.

Adding to the cautionary signals, U.S. homebuyer demand declined by 7% year-over-year in September, building on a similar drop in August.

Since the 2022 peak, homebuyer demand is down by a staggering 35%. Google searches for “home for sale” fell 16% year-over-year and 8% month-over-month. The housing market appears frozen with mortgage demand near its lowest levels since 1995. High interest rates and soaring prices are keeping buyers at bay. “Something must give,” warned analysts.

Gold shines amid market uncertainties

In contrast to the exuberant stock market, gold is signaling caution. Cumulative gold ETF inflows, including gold miners ETFs, have reached $3.3 billion since August.

The most popular gold ETF, GLD, has recorded $644 million in cumulative inflows year-to-date. Remarkably, gold is up 28% year-to-date, putting it on track for its best annual return since 1979, as Finbold reported earlier today. Gold miners’ ETFs, such as GDX and GDXJ, are up over 30% and are set for their best year since 2020.

Long squeeze alert

In conclusion, the record-breaking bullish sentiment in U.S. stocks is unparalleled. However, weakening economic indicators and substantial inflows into safe-haven assets like gold suggest underlying market vulnerabilities.

With the non-farm payrolls report on the horizon—an event that has historically moved markets more than GDP or CPI data—investors should brace for heightened volatility.

Market watchers advise caution. If economic data fails to meet expectations or if geopolitical events unfold, the crowded long positions could unwind rapidly, leading to a long squeeze.

Investors would do well to stay informed and consider hedging their positions. In times of extreme bullishness, being prepared for all market outcomes is prudent. The convergence of record net long positions and economic warning signs makes this a critical juncture for market participants.