XRP is trading at $3, gaining 4.39% in the past 24 hours, making it the strongest performer among the top ten cryptocurrencies by market capitalization.

While this rebound offers some relief, it comes after a bruising week in which the token lost 7.54% of its value. Trading volumes reflect a cooling from the July surge, with 24-hour turnover down 24.14% to $5.66 billion.

Nevertheless, XRP remains up 34.84% over the past month, underscoring that buyers are still willing to accumulate at these levels despite heightened volatility and the broader risk-off sentiment weighing on digital assets.

A near-term catalyst looms in the form of a joint status update due August 15 in the SEC v. Ripple case. The procedural nature of the filing should not be overstated, speculation across institutional and retail circles is growing that the SEC may seek to de-escalate litigation, a move that could effectively reaffirm XRP’s non-security status under U.S. law. Such an outcome would likely alter the regulatory overhang that has capped institutional inflows into the asset class.

Finbold AI predicts XRP price

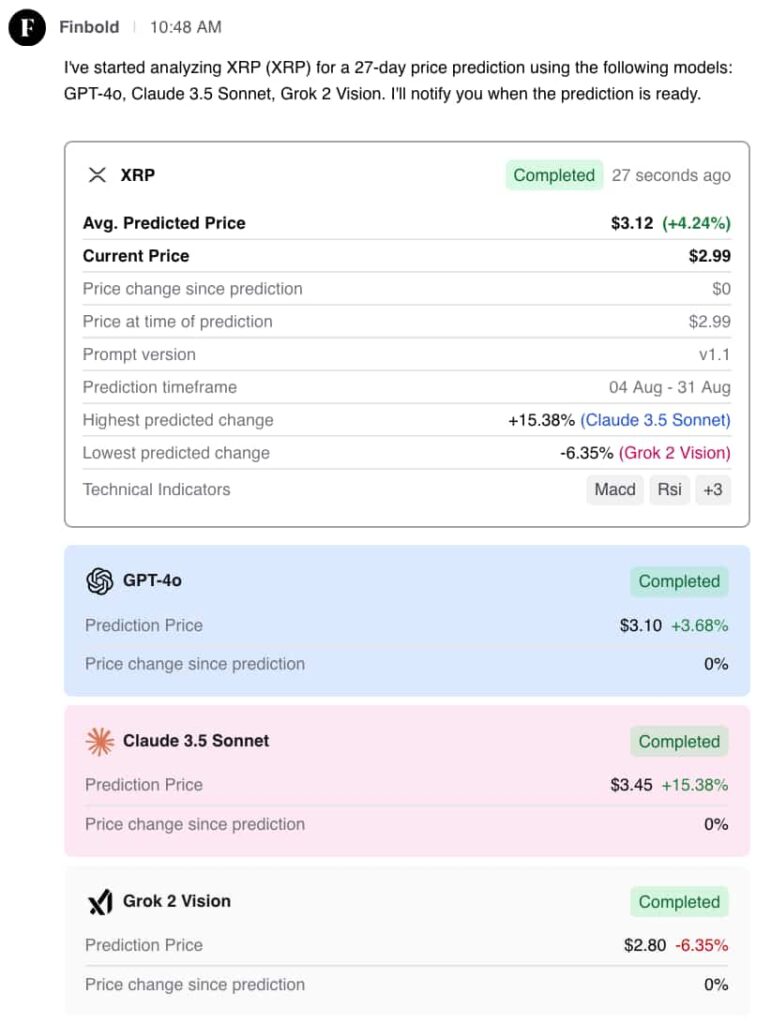

To provide a clearer view of the likely price trajectory into month-end, Finbold’s AI prediction agent used multiple LLMs to generate an average forecast for improved accuracy while incorporating momentum-based indicators into its context. You can experiment with the existing prompts or create your own. Try here now.

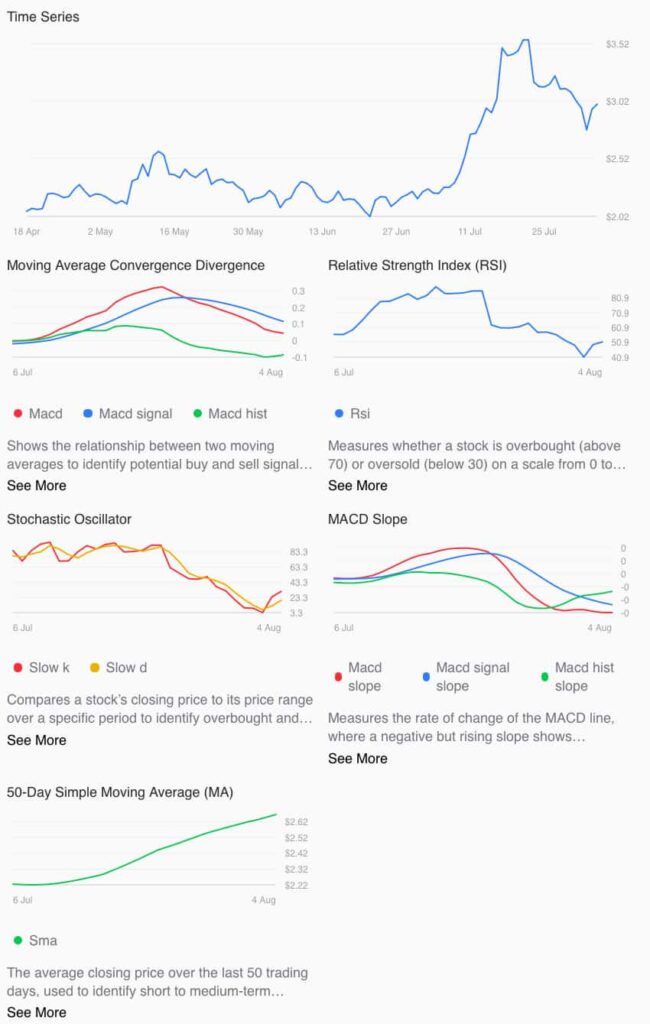

These were supported by a range of technical indicators, including MACD, RSI, stochastic oscillators, and 50-day moving averages, all designed to capture both trend strength and momentum shifts.

The aggregate forecast places XRP at an average price of $3.12 by August 31, suggesting a modest 4.24% upside from current levels. Notably, model dispersion was high, reflecting the inherent uncertainty of this market.

Claude 3.5 Sonnet leaned strongly bullish, projecting a 15% rally on improving liquidity conditions and the potential for renewed inflows if regulatory clarity emerges. GPT‑4o delivered a more conservative forecast, anticipating XRP to trade slightly above current levels, while Grok 2 Vision flagged the risk of renewed downside, modeling a retracement to $2.80.

Technically, XRP continues to trade above its 50-day simple moving average, maintaining a constructive structure, yet momentum indicators point to a market still searching for conviction after failing to hold the late-July highs near $3.50.

At this juncture, XRP appears to be consolidating, with the $3 level emerging as a key psychological support. Whether the asset can break higher will likely depend on how the regulatory narrative evolves over the next two weeks. As such, professional investors should be prepared for outsized volatility as these legal and supply-side developments unfold, with August potentially shaping up to be a decisive month for the asset’s medium-term trajectory.