Amid a grim outlook for the economy and expectations of higher taxes in the United States, macroeconomist Henrik Zeberg has warned that the situation might be the worst since the Great Depression that swept the country back in 1929 but that there could be one final rally before that.

Specifically, Zeberg shared the observations earlier listed by the team at the data-driven research platform Game of Trades and pointed out that the worst recession since 1929 was still coming but also that one final rally could take place before it does, as he explained in an X post on May 6.

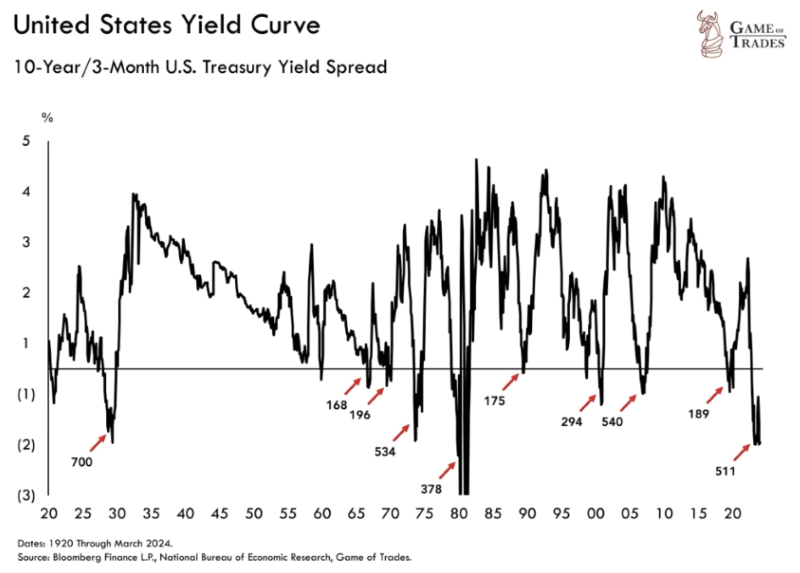

Indeed, according to the post by Game of Trades, the inverted 10-year/3-month US Treasury yield curve has been happening for more than 500 days, which has taken place only three times since 1920 – in 2008, 1974, and 1929 – and these periods all saw ensuing market declines of over 50%.

Picks for you

Specifically, the 10-year/3-month treasury yield spread refers to the difference between the 10-year treasury rate and the 3-month treasury rate and often serves as a gauge to study the yield curve, alongside the New York Federal Reserve Bank using it to predict recessions two to six quarters ahead.

One final rally?

On top of that, the Game of Trades analysts noted that they expected a “final rally to occur before recessionary concerns finally kick in later in 2024,” referring to the fears coming true and the worst recession since 1929 that many finance experts and investors have been warning about truly happening.

As a reminder, Zeberg warned about the biggest market crash since 1929 in January, arguing that “Titanic has already hit the iceberg” and addressing common counterpoints to his warnings, such as that the recession had already occurred in 2022 or that the Federal Reserve’s interventions would prevent it.

Elsewhere, Robert Kiyosaki, a renowned investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ has been issuing similar warnings, recently updating them to state that the crash has already begun and that it “will be a bad one,” but also stressing that “crashes are the best time to get rich.”

Furthermore, Finbold reported on Game of Trades suggesting that the trajectory of the US government debt market, which has “massive implications for the economy,” was starting to collapse, specifying that US government bonds had shattered a 40-year uptrend, with prices plummeting to 2013 levels.

All things considered, markets might be looking at a last sigh before the recession sets in, giving investors one more chance to prepare for what is coming. However, caution and doing one’s own research is necessary before making any final investment decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.