Unusual trading activity on decentralized prediction market Polymarket has drawn scrutiny after three newly created wallets collectively generated more than $630,000 in profits by betting on Venezuelan President Nicolás Maduro being out of office just hours before his arrest.

Blockchain data shows the wallets were set up and pre-funded several days in advance, remaining dormant until shortly before the key political event, according to insights shared by Lookonchain on January 4.

In the final hours ahead of Maduro’s arrest, the accounts suddenly placed large “Yes” positions on markets predicting that he would be out of office by late January or February 2026.

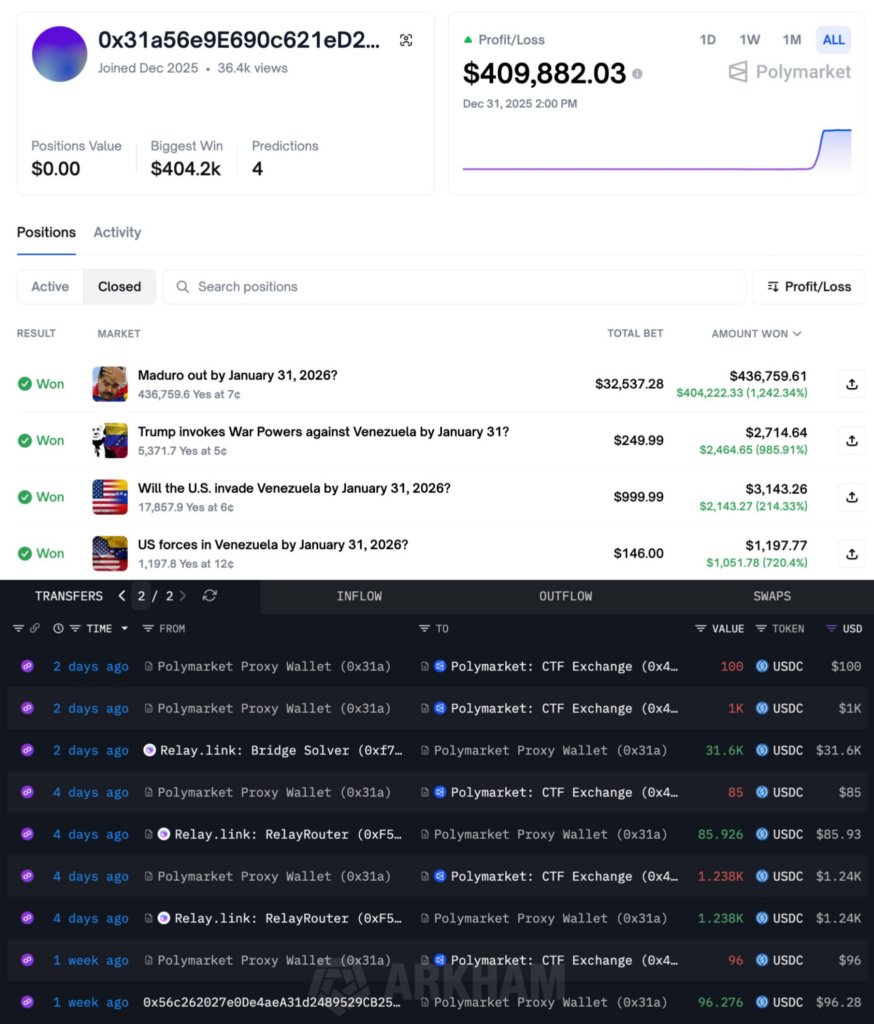

The largest gains came from wallet 0x31a5, which invested roughly $34,000 and walked away with close to $410,000 in profit after the market resolved.

A second wallet, 0xa72D, committed just under $6,000 and realized profits of about $75,000, while a third account operating under the name SBet365 invested around $25,000 and earned approximately $145,600. Together, the three wallets generated total profits of about $630,484.

Source of suspicion

Suspicion has intensified due to the narrow focus of the activity. All three wallets traded exclusively in Venezuela- and Maduro-related markets, with no history of betting on other political, economic, or social events.

Combined with the precise timing of the wagers, this has fueled claims that the traders acted on non-public information rather than market sentiment or probability-based analysis.

On-chain transfer records further show coordinated funding patterns, with capital routed into Polymarket shortly before the bets were placed and rapidly withdrawn after the outcomes resolved.

This behavior contrasts with that of typical Polymarket participants, who tend to spread risk across multiple markets and longer time horizons.

The controversy gained momentum after news broke that Maduro had been captured, an event that effectively settled the prediction markets in favor of the “Yes” outcome.

While Polymarket operates permissionlessly and does not verify the identity or intent of traders, the episode raises questions about the vulnerability of prediction markets to insider activity during sensitive geopolitical events.

Featured image via Shutterstock