Amid persistent geopolitical tensions around the world, the widespread uncertainties, combined with expectations of interest rate cuts from the United States Federal Reserve in September, have benefitted the price of gold, which has just hit a new all-time high (ATH) as investors hurl to it en masse.

Indeed, the precious metal has soared to break another price record this year, surpassing $2,500 per ounce and continuing upward as its momentum sustains at the beginning of the week, overshadowing base metals like copper, which has suffered poor growth in major economies, particularly China.

Meta AI’s gold price prediction 2025

In the above context, Finbold has asked Llama 3.1, the recent artificial intelligence (AI) model by Meta Platforms (NASDAQ: META), to provide insights into the possible price performance of gold in 2025, as well as specific gold price predictions from the standpoint as of August 19.

As it happens, Meta’s AI platform has offered two potential price ranges for gold in 2025, pointing out that they are quite wide, “reflecting the uncertainty and complexity of the global economy,” stressing that its current price is “already quite high, and some experts might argue that it’s due for a correction.”

In terms of explicit numbers, Llama 3.1 has listed the prices from various sources, including expert predictions and AI algorithm forecasts, placing the price of the yellow metal between $1,675 and $7,000 per ounce, as well as in a more conservative price range of $1,709.47 to $2,727.94 per ounce.

At the same time, it noted that “others expect the price to soar to unprecedented levels, citing factors such as ongoing political unrest, economic policies favoring lower interest rates and inflation fears,” and observed an overall bullish trend, “with many analysts predicting a continued increase in gold prices over the next year.”

Gold price analysis

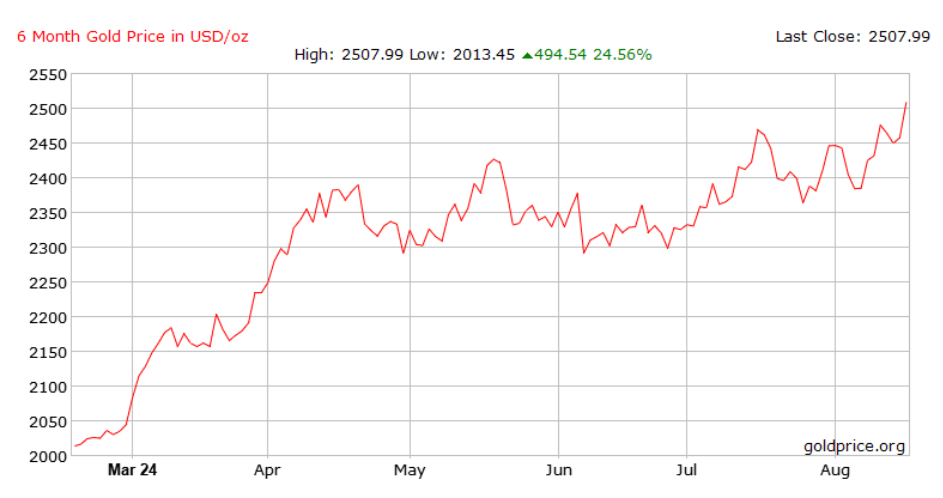

At press time, the price of gold stood at $2,502.72 per ounce, reflecting a 0.19% decrease on the day, a 3.15% gain across the past week, a growth of 4.68% in the last month, and an accumulated advance of 24.56% on its six-month chart, as per the most recent data on August 19.

And how much is a bar of gold worth? Notably, to determine a gold bar price, it is important to know the weight of the particular gold bar. So, how much does a gold bar weigh? In practice, a gold bar can weigh anywhere between 1 gram and 100 kilograms, but most commonly 12.4 kilograms or 400 troy ounces.

In other words, it means that a typical gold bar price at the time of publication cost around $1 million. Measured in kilograms, the price of a 1 kg (32.15 troy ounces) gold bar would amount to $80,462.45, taking into consideration the current market prices of spot gold.

It is also worth noting that Bloomberg’s senior commodities expert Mike McGlone has highlighted that the precious metal “may gain tailwinds from cash/stocks reversion,” or “low cash levels relative to elevated stocks,” in the upcoming period, as he explained in an X post on August 18.

All things considered, Meta AI’s chatbot could be correct in terms of its gold price prediction 2025, particularly considering the very wide ranges it retrieved from various online sources. That said, doing one’s own due diligence is important when investing, as things in any market can change dramatically.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.