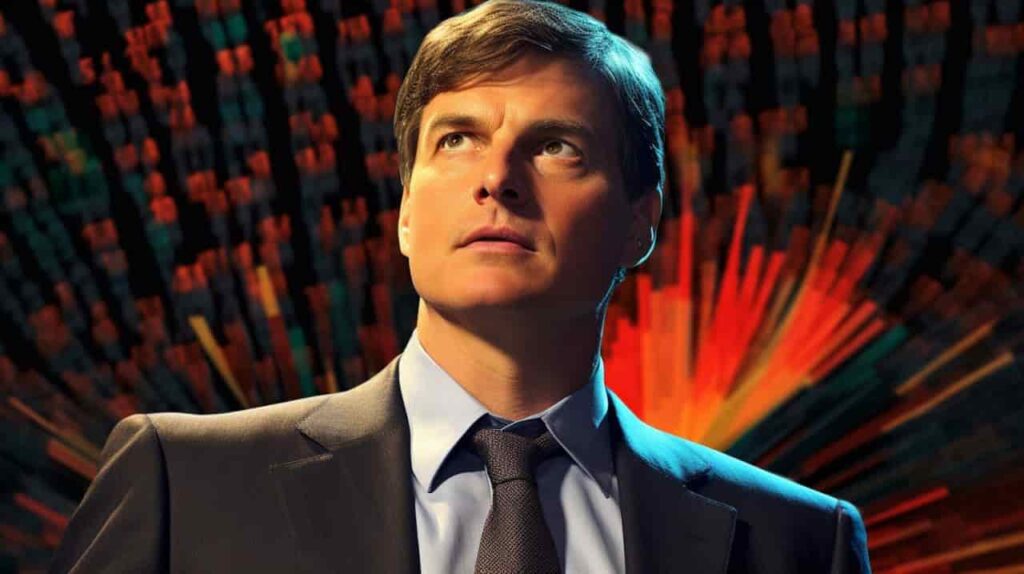

Though most famous for ‘The Big Short’ during the Great Recession of 2008, Michael Burry’s major recent bets have been long positions on a string of high-profile Chinese stocks.

For many months, these investments have been seen as controversial as the stock market of the People’s Republic had been experiencing a strong downturn that had ensured the shares of most firms remained severely depressed.

The most recent developments – including generous government stimuli – have sharply altered the situation. JD.com (NASDAQ: JD), one of Burry’s biggest positions, rose as much as 65.76% between the latest 13-f filing and the Tuesday, October 1 JD close at $42.93.

The rally proved strong enough that the 250,000 shares, valued at $6.4 million at the end of the second quarter (Q2), are now worth approximately $10.7 million.

The rise becomes even more impressive once the extended session between October 1 and October 2 is taken into account as JD surged another 9.13% after the closing bell. Indeed, between the 13-f filing date of August 14 and the early morning on Wednesday, the Chinese stock rallied 80.90% to its press time price of $45.85.

Chinese stock market enters a Q4 2024 renaissance

The stellar rise of Burry’s JD.com holding is hardly surprising as the Chinese stock market has been experiencing something of a renaissance in late September and early October.

For example, Monday, September 30, was one of the market’s best days on record as various indices tracking either Mainland or Hong Kong stocks rose between 4.2% and 22%.

The rally was driven by a string of measures implemented by the Chinese government, including the lowering of interest rates, a $114 billion boost for the equity markets, and a new bank scheme designed to make borrowing for investments easier.

American traders have also contributed to the surge, as many have scrambled to gain exposure to the Chinese market.

David Tepper, the founder of Appaloosa Management, for example, stated on September 26 he is buying ‘everything’ in the People’s Republic due to the recent stimuli.

Most of Michael Burry’s biggest holdings enter massive rallies

Beyond just JD.com, some of the other major Burry holdings have also been affected by the renaissance and have helped drive the portfolio higher.

‘The Big Short’ investor’s biggest holding, Alibaba (NYSE: BABA) is also up 43.17% in the last 30 to BABA’s price today of $117.79. Such a rise means that the value of the investment rocketed from $11 million, reported at the end of Q2, to nearly $17.5 million on October 2.

Baidu (NASDAQ: BIDU), reported as Burry’s fourth-biggest holding at the end of Q2, is likewise up 37.81% in the last 30 days to its October 2 price of $114.95.

The rally means that BIDU shares alone are, by press time, responsible for a $2 million increase in the value of ‘The Big Short’ investor’s portfolio.

Still, it is worth noting that there remain some dangers both for Burry and other investors, despite the strong rally of Chinese stocks.

On the one hand, it is not guaranteed Michael Burry has not reduced his Chinese holdings at some point between the latest 13-f filing and press time. On the other hand, it isn’t entirely certain the current rally in the People’s Republic will last as its market has experienced several false starts in recent years.

Finally, though Burry’s Chinese holdings have been drawing the bulk of attention thanks to the recent developments in the country, they are not the only ones likely to help drive the entire portfolio higher.

‘The BIg Short’ investor, for example, recently purchased 634,000 shares of a penny stock company called BioAtla (NASDAQ: BCAB) and achieved immediate success with the trade as the firm has, despite some turbulence, been trading upward since the acquisition.