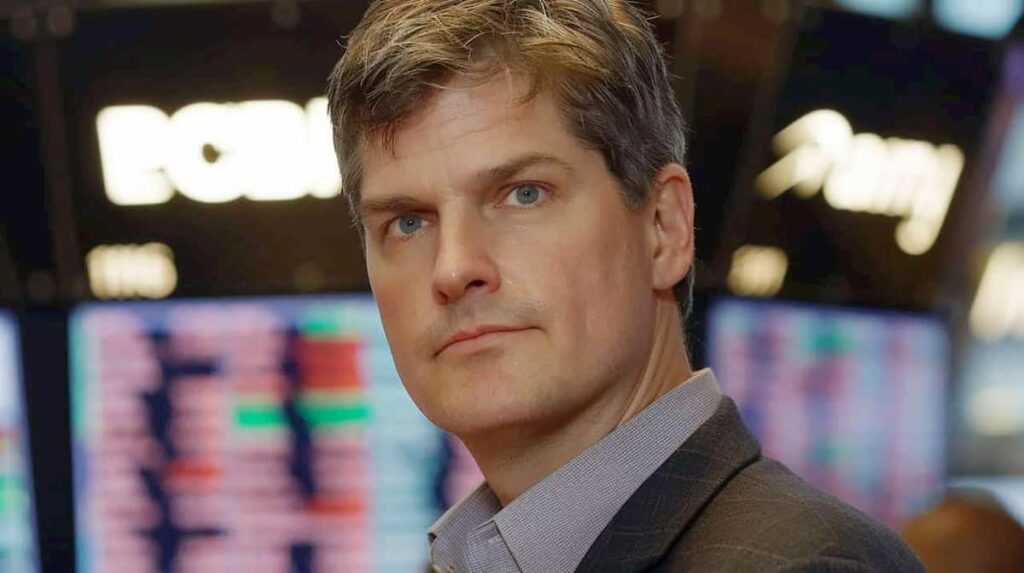

Widely renowned for his handling of the 2008 subprime mortgage crisis, Michael Burry of ‘The Big Short’ fame is one of the most attentively-watched investors of the last decade and a half.

Taking a look at the latest 13-f filing of Burry’s hedge fund, Scion Asset Management, reveals that the investor has been increasing his exposure to the Chinese market — with just three stocks accounting for 45% of his total holdings.

Those three stocks are also in the middle of a surge, owing to strong stimulus measures announced on Tuesday, September 25 by The People’s Bank of China. Such measures were to be expected, as Chinese stocks have been trading at the lowest price since 2019.

The most significant investment in the portfolio is tech and e-commerce giant Alibaba (NYSE: BABA), constituting 21% of the investor’s portfolio.

BABA stock price has risen by 11.02% over the past five days, with a notable spike in volume as soon as trading opened on Wednesday.

The remaining two Chinese stocks are e-commerce competitor JD.com (NASDAQ: JD) and tech giant Baidu (NASDAQ: BIDU).

The first of these has seen the largest increase in price, amounting to 18.81% over the course of the last five trading days. Looking at the same timeframe, BIDU experienced a 9.85% gain.

Burry’s bet on Chinese recovery

Burry’s first notable entry in the Chinese market was Alibaba in Q2 2019 — although the 50,000 shares he purchased then were sold by the time of the next 13-f filing.

Since then, the investor seems to have reoriented his thesis, betting on a broad Chinese recovery.

His current holdings date back to Q3 2023, when 50,000 BABA stocks and 125,000 JD stocks were purchased.

By the next quarter, those positions were expanded to 75,000 in Baidu Stock and 200,000 stocks in JD — with another 50,000 and 160,000 added in Q1 2024, along with the 40,000 Baidu shares.

Finally, per the latest 13-f filing, Burry’s portfolio contains 155,000 BABA shares, 250,000 JD shares, and 75,000 BIDU shares — with a notable decrease of 110,000 JD shares compared to the last quarter. We should note, however, that the decrease in JD holdings might very well have been due to the company’s $5 billion stock buyback program.

Have Burry’s Chinese investments paid off?

Since the positions haven’t been closed out yet, only time will tell whether this ends up being a profitable venture. While 13-f filings are public, they only state the quarter when stocks were purchased — not the exact date.

To further complicate matters, Burry has consistently been purchasing shares since Q3 2023 — so we can’t pinpoint an average entry price.

However, looking at the 1-year charts of the stocks in question can give us an approximation. Q3 2023 spans from July 1 to September 30. Let’s take a look at the charts, one by one.

A year ago, BABA was trading at roughly $85.82 — it has since entered into the green after recent news but has spent the vast majority of the time in between in the red.

A similar situation occurred with JD, although a notable spike in May was present. At press time, the stock is up 13.19%, although a majority of those gains have occurred over the last two days.

Finally, BIDU has the direst chart — it has seen significant price depreciation and the 9.85% price increase over the last few days has only slightly taken the bite out of a -29.17% loss on the yearly chart.

These are all prices seen at the tail end of September in 2023 — however, if the shares were purchased earlier in the quarter, Burry’s portfolio would have had an even worse performance, as the stocks would have been bought at even higher prices.

Chinese stimulus measures

Although Burry is not out of the woods yet, the catalyst behind the sudden price action in the last couple of days is likely going to have long-term effects. China’s central bank, the People’s Bank of China, has announced the biggest stimulus since the Covid-19 pandemic.

Governor Pan Gongsheng revealed that reserve requirement ratios (RRR), the amount of cash that banks must hold as reserves, will be slashed by 50 basis points — which will allow for $142 billion in new lending, per Reuters.

Additionally, the governor remarked that the RRR could be lowered by another 25 or 50 basis points by the end of the year, depending on the market liquidity situation.

Measures also included a 50 basis point reduction on interest rates for existing mortgages along with reducing minimum down payment requirements to 15% for all types of homes, in a bid to stabilize the shaky Chinese housing market.

Should these measures bear fruit, it’s likely that the three stocks that comprise nearly half of Burry’s holdings, as established businesses with stable revenues, would see even further gains, along with the possibility of spurring on a wave of new investments.