Inflation concerns have been on the rise as the global economy continues to recover from the pandemic. As a result, governments and central banks worldwide have been under pressure to hike interest rates to curb inflation and maintain economic stability

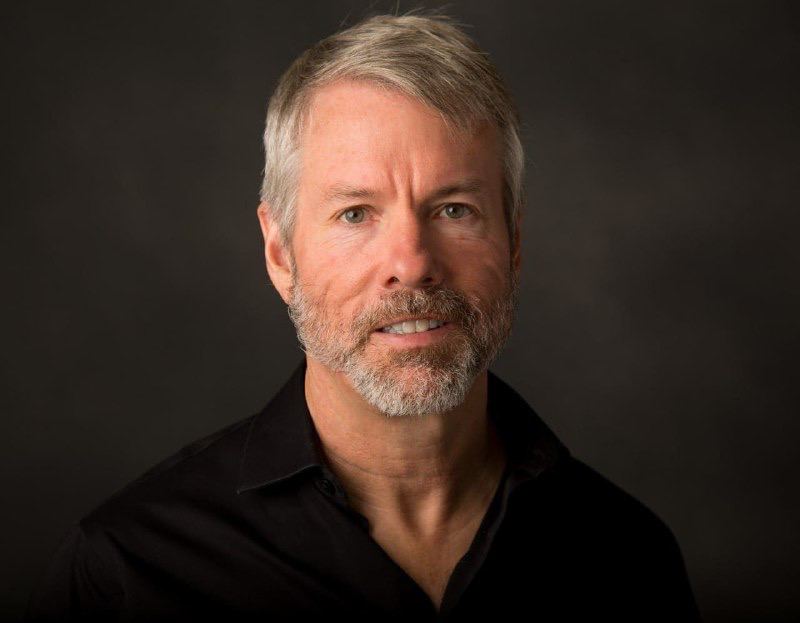

Microstrategy co-founder Michael Saylor discussed various topics, including Bitcoin (BTC), Ordinal inscriptions, inflation, and the future of money, in an interview with financial journalist and market reporter David Lin on May 11.

Among other things, the US billionaire said that “money is dying,” as highlighted by the recent “avalanche of currency failures.”

Saylor argued that the same goes for the world’s strongest currency, US Dollar. The entrepreneur reflected on the Wednesday consumer price index (CPI) report, which showed that US annual inflation rate currently runs at 4.9%. But that also means that the monetary inflation in the dollar is actually “much more” than 5% as the “CPI is the lowest inflation number the government’s going to endorse, not the highest.”

A loss of confidence in fiat money and banks

Saylor said that monetary inflation in weaker currencies is even higher, ranging anywhere from 20% to 100%, like in Argentina, for example.

Global governments are now facing a crisis of confidence in currencies and banks, he added, and as a result of that, consumers are also “losing confidence in fiat as money.”

“Therefore, money is dying, it’s obviously dying in Venezuela, and it’s obviously dying in Argentina, but it’s dying everywhere in the world, even in the United States and Western Europe.”

– said Michael Saylor.

Bitcoin ‘is the king commodity’

Later in the interview with Lin, Saylor talked about how it is not only fiat currencies that are proving ineffective, but it’s also the commodity assets.

He then outlined the challenges, such as the substantial costs people incur when moving commodities like gold, oil, property, securities, and even a single painting. Saylor says it costs from $500,000 to $2 million in auction fees to trade $10 million in money in the form of a painting.

For that reason, Bitcoin is “the king commodity,” the billionaire reiterated because it is digital and scarce. Bitcoin, he explained, allows traders to move millions of dollars cross-border “anywhere in the world,” while all other forms of commodity money are either slow, expensive to maintain, fragile, or non-fungible.