Microsoft (NASDAQ: MSFT) has recently announced increased investments in artificial intelligence (AI), sparking optimism in the industry and stock market. Alongside these announcements, the company has reported strong financial results for its fiscal fourth quarter (Q4) of 2024.

According to sources, Microsoft exceeded market expectations with a revenue of $64.73 billion, marking a 15% year-over-year increase and earnings per share (EPS) of $2.95, slightly above the forecast of $2.93.

This strong performance is driven by Microsoft’s diverse business segments, including cloud computing, productivity software, and personal computing.

Despite these robust numbers, Microsoft stock experienced a slight dip in after-hours trading following the earnings release. Investor sentiment was tempered by concerns over the growth rate of Microsoft’s Intelligent Cloud division, which includes Azure.

Although the division generated $28.52 billion in revenue, a 19% increase year-over-year, it fell short of analysts’ consensus estimate of $28.68 billion, indicating a slowdown compared to previous quarters.

Strategic investments and market position

Microsoft’s significant investments in scaling AI infrastructure have impacted its Cloud business margins.

While the productivity and business processes segment benefited from growth in Office 365 Commercial, LinkedIn, and dynamic product categories, the Intelligent Cloud segment’s growth was primarily driven by a 29% jump in Azure and other cloud services revenues.

Despite the short-term concerns, several positive indicators suggest strong future growth for Microsoft. AI services accounted for a larger portion of Azure’s revenue increase in the June quarter.

Of the 29% growth in Azure and other cloud services, 8% came from AI services. Additionally, Azure AI now has over 60,000 customers, up nearly 60% year-over-year.

The demand for Azure AI services remains higher than the available capacity, implying that the company’s investments to expand capacity will lead to higher revenues in the coming years.

Moreover, commercial bookings exceeded expectations, increasing by 17%, driven by growth in large contracts for both Azure and Microsoft 365.

The company also emphasized its continued focus on innovation and market expansion, particularly in AI and cloud services. In gaming, Microsoft now has over 500 million monthly active users, including various consoles, PCs, and mobile devices, following the Activision Blizzard acquisition that closed in October.

Price target and analyst consensus

Microsoft’s strategic investments position it to benefit from long-term trends such as generative AI and digital transformation.

The company’s extensive range of AI accelerators and the Azure OpenAI Service, used by most Fortune 500 companies, underscore its growing influence in the enterprise sector. Microsoft has expanded its data center footprint across four continents, establishing long-term assets to drive growth over the next decade and beyond.

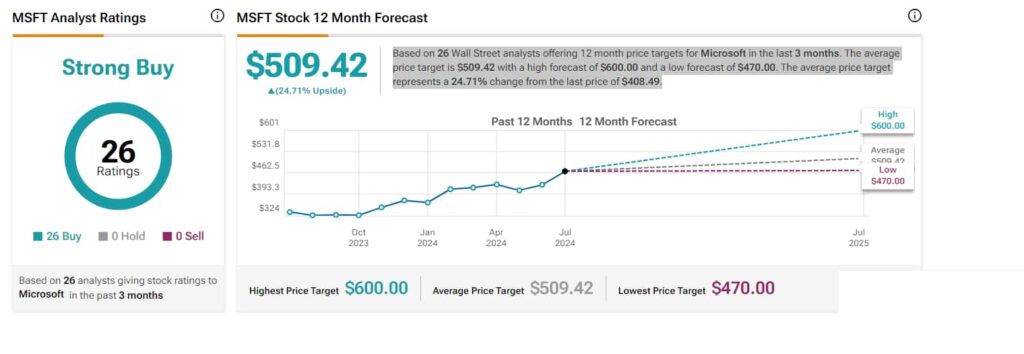

Analysts share an optimistic view of Microsoft, with 26 Wall Street analysts offering 12-month price targets. The average price target is $509.42, with a high forecast of $600 and a low forecast of $470. The average price target represents a 24.71% change from the last price of $408.49.

Considering the company’s strong financial performance, strategic investments, and favorable market position, Microsoft is well-positioned for sustained growth.

With a current price of $408.49 per share and a projected price target of $600 by 2025, Microsoft stock represents a compelling investment opportunity.

This projection is supported by Microsoft’s continued focus on innovation, market expansion, and strategic investments in AI and cloud services, ensuring sustained growth and value creation for its shareholders.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.