As investors look ahead to 2024, two tech giants stand out as potential opportunities – Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN). Both companies have demonstrated significant resilience and innovation in their respective fields, making them attractive options for various types of investors.

Amazon and Microsoft are leaders in cloud computing and artificial intelligence (AI), continuously driving innovation and setting industry standards. Amazon Web Services (AWS) and Microsoft Azure are two of the leading cloud platforms, constantly competing to offer the best generative AI services.

This competition fuels their growth and ensures that both companies remain at the forefront of technological advancements, leaving investors to wonder which company offers the better investment opportunity in this rapidly evolving sector.

To address this question, Finbold asked ChatGPT-4o which company, Amazon or Microsoft, is poised to be the best performer.

Amazon’s strong start in 2024

Amazon has made a remarkable recovery in 2024, bouncing back from a difficult 2022. The company’s market capitalization now stands at $2.01 trillion, driven by robust growth in its Amazon Web Services (AWS) division, which reported $25 billion in revenue for Q1 2024.

Additionally, Amazon’s retail business has shown improved profitability, with strategic price cuts in its grocery segment to compete with Walmart (NYSE: WMT) and Target (NYSE: TGT). Despite regulatory challenges and stiff competition, analysts remain optimistic, projecting further growth.

Microsoft’s AI and cloud computing dominance

Microsoft continues to solidify its position as a leader in AI and cloud computing. Its strategic partnership with OpenAI has enhanced its Azure cloud services and Office productivity applications, driving strong fiscal performance.

For the quarter ending March 31, 2024, Microsoft reported a 20% increase in earnings and a 17% rise in sales year-over-year. The acquisition of Activision Blizzard has also strengthened its gaming portfolio, adding popular franchises to its offerings. Microsoft’s diverse product range and robust financials provide a stable investment outlook.

ChatGPT-4 investment outlook

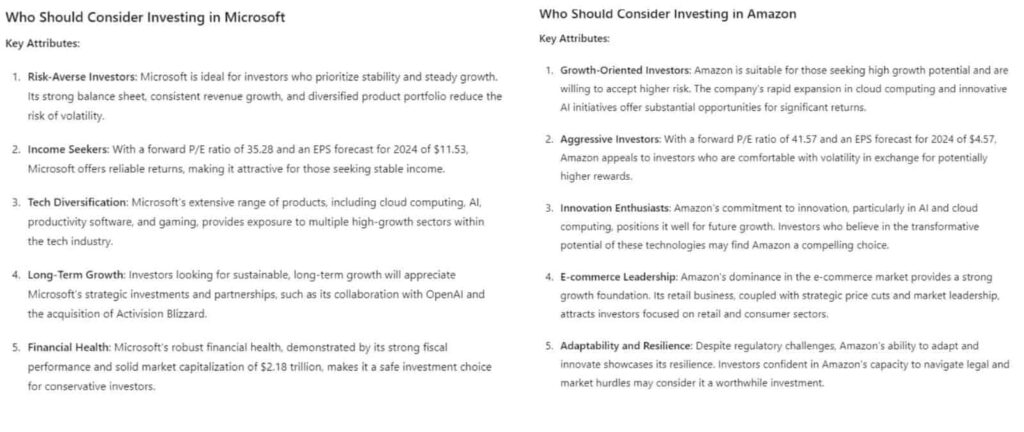

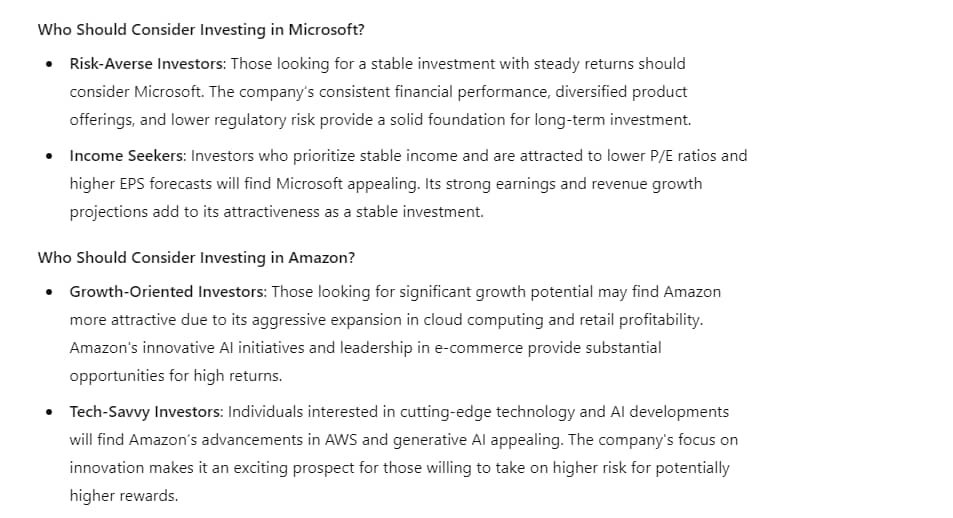

For 2024, ChatGPT-4 suggests Microsoft as the better buy for risk-averse investors seeking stable income and diverse tech exposure. Microsoft’s strong financial performance, diversified product portfolio, and lower risk profile make it a reliable investment option.

Its consistent financial performance is one of its key strengths, supported by a diverse product portfolio that spans cloud computing, AI, productivity software, and gaming. Microsoft’s lower risk profile, compared to Amazon, is evident in its strong balance sheet and consistent revenue growth.

With a market capitalization of $2.18 trillion, a forward P/E ratio of 35.28, and an EPS forecast for 2024 of $11.53, Microsoft presents a solid foundation for investors seeking stable returns.

Conversely, Amazon offers high growth potential, appealing to aggressive, growth-oriented investors. Amazon’s rapid expansion in cloud computing, innovative AI initiatives, and market leadership in e-commerce present significant opportunities for substantial returns.

The company’s efforts in AI, including potential updates to its Alexa platform with generative AI, highlight its commitment to innovation and market expansion. Despite facing regulatory challenges, Amazon’s ability to adapt and innovate positions it well for future growth.

With a market capitalization of $2.01 trillion, a forward P/E ratio of 41.57, and an EPS forecast for 2024 of $4.57, Amazon is an attractive option for those willing to take on higher risk for potentially higher rewards.

Conclusion: Balancing growth and stability

While Amazon has strong growth potential, it comes with the risk of volatility. The company frequently faces regulatory scrutiny and legal challenges, particularly concerning its market practices and antitrust issues, which can create uncertainty and lead to stock price fluctuations.

Amazon’s aggressive growth strategies, including significant investments in new technologies and market expansions, can impact its financial stability in the short term. While these investments often lead to long-term gains, they can cause fluctuations in quarterly earnings and revenue reports.

Additionally, macroeconomic factors such as changes in consumer spending, supply chain disruptions, and broader market trends can significantly impact Amazon’s stock. As a company heavily reliant on consumer behavior and global logistics, any changes in these areas can lead to rapid changes in its stock price.

In conclusion, Microsoft is the overall better option for most investors, providing a blend of growth and stability with lower risk compared to Amazon. This makes Microsoft a more prudent choice for long-term investment, especially for those who value steady returns and robust financial health.

Diversifying investments between both assets could also be a wise strategy to mitigate risks and capitalize on the strengths of each company.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.