MicroStrategy Inc (NASDAQ: MSTR) announced another Bitcoin (BTC) purchase on December 23 at an average price of $106,662. This marks an announcement made at a price below the dollar-cost average, signaling a buy at Bitcoin’s local top.

Nevertheless, the company is still profitable with its Bitcoin portfolio, and MSTR’s stock steadily sustains a premium against its holdings. According to Michael Saylor’s announcement, MicroStrategy has acquired 444,262 BTC at an average cost of $62,257.

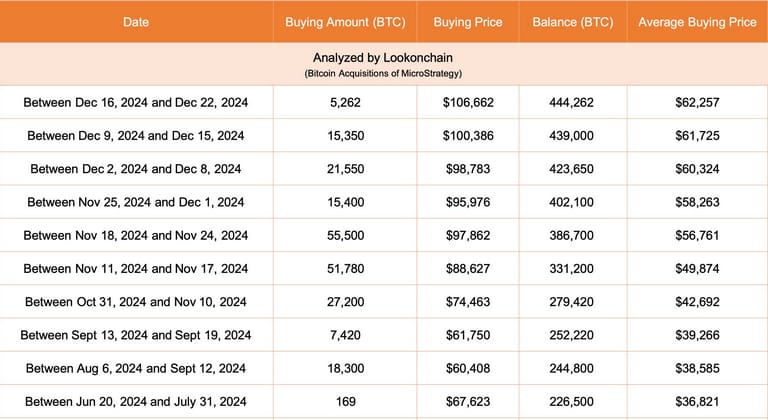

This most recent purchase was of 5,262 BTC for $561 million and MicroStrategy’s lowest disclosed buy since July 2024. On that note, the economist and known Bitcoin critic Peter Schiff has commented on X, highlighting a “firepower” loss. Schiff has been commenting against Saylor’s Bitcoin strategy for a while, as Finbold reported in one occasion.

“It seems like you are running out of firepower to keep propping up Bitcoin. Plus, not only is this your smallest buy, but the first time your average purchase price has been above the market price on the Monday you disclosed the buy.”

– Peter Schiff

MicroStrategy’s lowest Bitcoin buy at the top

Interestingly, this recent purchase is approximately three times lower than the previous purchase at $100,000, announced on December 16. Moreover, it is nearly four times lower than the one before that, announced on December 9, as Lookonchain analyzed.

The purchases were of 5,262, 15,350, and 21,550 BTC, respectively. In November, MicroStrategy made two buys superior to 50,000 BTC, or nearly ten times higher than last week’s acquisition.

Novacula Occami, former Wall Street analyst, also commented on Michael Saylor’s strategy, explaining it relies on two pillars. First, Saylor buys when “numbers go up,” the analyst said, and then on “exciting the less sophisticated herd,” he concluded.

Essentially, Occami believes the purchases are always made when Bitcoin shows strong momentum, usually amid a rally. This is supposedly done to attract retail traders with positive sentiment regarding BTC and MSTR.

MSTR stock and Bitcoin (BTC) price analysis

Indeed, MSTR stock is trading at $344.27, with a market capitalization that is two times higher than its Bitcoin holdings, making it a 100% premium against usual BTC investments for investors who want Bitcoin exposure through MicroStrategy.

Meanwhile, BTC is trading at $93,113, at a 12% discount from Saylor’s most recent average Bitcoin acquisition price.

Bitcoin (BTC) price vs. MicroStrategy (NASDAQ: MSTR) stock price. Source: TradingView / Finbold / Vini Barbosa

Looking at Bitcoin’s chart, we can see that, after every MicroStrategy purchase, BTC experienced an aggressive drop below the average. This validates the two analysts’ criticisms regarding Michael Saylor’s Bitcoin strategy, which now experiences one of the longest recent drawbacks.

However, it is notable that the company’s high time frame results are still massively positive, accumulating an unrealized profit of nearly $15 billion.

Featured image from Shutterstock.