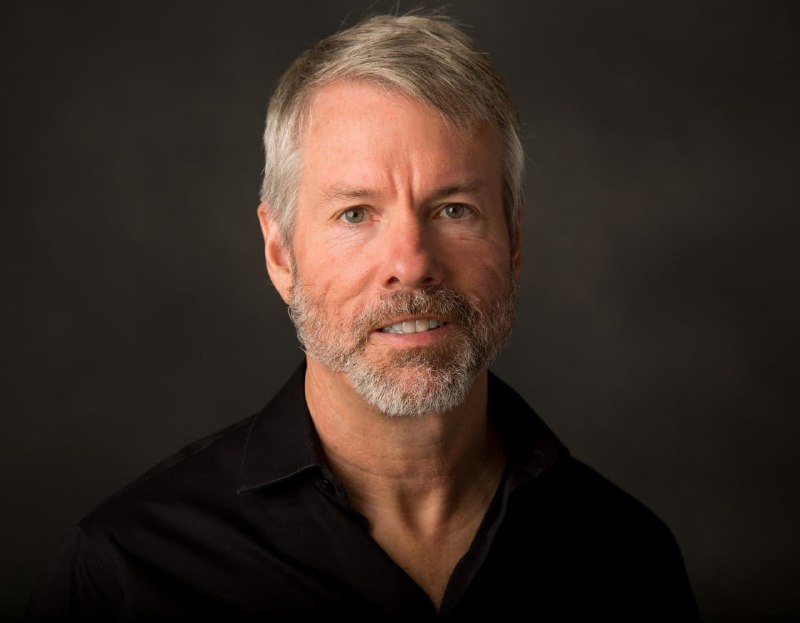

MicroStrategy executive chairman and former CEO Michael Saylor has extended his praise for Bitcoin’s (BTC) features, terming the flagship cryptocurrency as a channel towards freedom.

According to Saylor, Bitcoin’s decentralized nature pivots the asset as an economic machine built on the truth while solving some of the inefficiencies in the traditional finance sector, he said during a speech at The Atlas Society on October 18.

Saylor, a renowned crypto proponent, also equated Bitcoin to a union bound to grow stronger due to projected capital inflow in the future.

“As the money moves into the network, the monetary union gets more powerful. Everybody that joins the network has that much more power. Your only hope against the oppressive force of the collective is to unionize your own activities and organize your activities with people of like ideology that believe as you believe, more money, more people, more power,” Saylor said.

He added:

“Bitcoin is an economic machine based on a truth machine poised to emerge as a freedom machine.”

Bitcoin’s unique features

Saylor, who led MicroStrategy to accumulate Bitcoin in August 2020, noted that despite the existence of many digital assets, the maiden cryptocurrency stands out due to its unique features.

“There’s 20,000 cryptos. There’s one that’s 95% dominant, which is ethically sound, technically sound, and economically sound. Bitcoin is reared in metal. It’s the hardest substance in the universe. Most people don’t know it. Most people are afraid of it,” he added.

For years, he noted there had been calls to separate economics from the state, but there lacked a technology to achieve the mandate. However, he pointed out the emergence of Bitcoin ushered in an opportunity to remove government involvement in transactions.

Bitcoin and ‘economic slavery’

The executive stated that the onset of the pandemic pushed more people to realize that they needed a solution to the existing ‘economic slavery.’ According to Saylor:

“In March of 2020, the world came to a grinding halt. Suddenly billions of people woke up to the prospect of an economic collapse, losing faith in their institutions and the governments on.<…>We saw an escape from economic slavery in the form of what we thought was digital gold.”

It is worth noting that MicroStrategy is among the leading institutions that first placed a bet on Bitcoin. Despite the ongoing market correction, the company is actively accumulating more Bitcoin.

The recent purchase came between August and September, with an additional 301 Bitcoins bought at an average price of $19,851 per coin.

Watch full speech below: