With the ongoing conflicts in Ukraine, Sudan, Gaza, and Ethiopia, the world is facing the harsh reality that the era of peace might be at its end. As governments increase their military spending, companies in the defense sector witness increased demand and new growth prospects.

This military stock in particular is poised to make the best of the current global tensions and potentially surge in price. Today, you will find out how RTX Corporation (NYSE: RTX) could yield profitable returns by leveraging its technological advancements and benefiting from new government contracts.

Global conflict on the rise

Unfortunately, after a period of relative world peace, the world is getting increasingly more violent. In fact, the International Crisis Group stated that fatalities in global conflicts reached a record high since 2000. The ongoing wars in Ukraine and Gaza have been widely reported. Still, a growing number of armed confrontations are gripping the world, including in Sudan, Ethiopia, Myanmar, and the Middle East.

In October 2023, the U.N. reported that over 71.1 million people were displaced by war and conflict worldwide in 2022, with the number likely even higher today.

Governments around the world are getting increasingly aware and worried about global hotspots and the ensuing geopolitical instability. With more attention given to security and defense, the allocated funds are greater, and the demand for defense is likely to surge.

Best stocks to buy during war: RTX gains from defense and air travel

In its 2023 financial report, RTX reported significant results that reinvigorated its investors and caused its stock price to rise. The company reported $19.93 billion in revenue for Q4 2023, which is a year-over-year increase of 10.1% and an earnings per share of $1.29 compared to $1.27 in Q4 2022. Both metrics surpassed the expectations of the market.

The company’s Collins Aerospace division increased sales to $7.12 billion, a hike of 14%, amid the air travel boom and increased airline demands. Furthermore, the Pratt & Whitney engine unit increased its revenue by a quarter, or 25%, to $6.44 billion after a 2023 recall of the Airbus engines. When it comes to Raytheon, the defense compartment of the company that produces and sells AMRAAM rockets and Patriot systems, it experienced a slight boost of 3% in revenue to $6.89 billion.

RTX’s CEO, Greg Hayes, stated the company will continue its efforts in commercial aerospace recovery and provide critical advanced technology systems to its customers, likely referring to its defense systems.

What does RTX do?

Officially founded through the merger of Raytheon Company and United Technologies Corporation, the company was rebranded as RTX Corporation in July 2023. The company operates through three segments, Collins Aerospace, Pratt & Whitney, and Raytheon, to deliver commercial and military systems and technology to customers in the U.S. and worldwide.

RTX’s most sought-after products include air defense systems (the Patriot system), cybersecurity, airplane engines, satellites, drones, and missiles. It is a vital player in national security and global aerospace development.

RTX stock is a component of the S&P 100 and S&P 500 indices. It trades on the NYSE under the RTX ticker symbol.

RTX stock price today

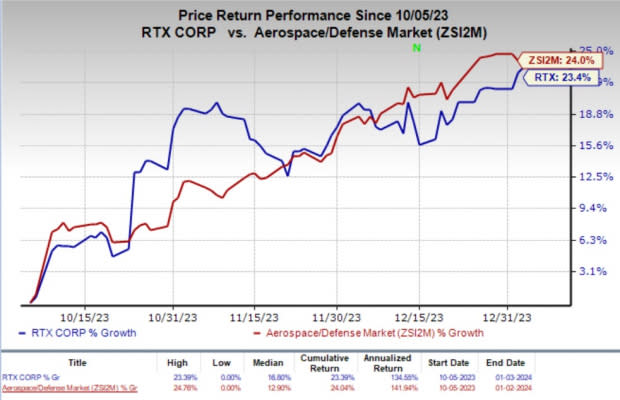

At the time of writing, RTX stock price stands at $91.40, reflecting an 8.74% increase in year-to-date price. However, it is still behind -4.44% behind its year-to-year high of $97.46.

In addition to its face value, RTX is a dividend stock with a decades-long history of regular payments. As of March 2024, it has a dividend yield of 2.60%.

What is the sentiment of RTX stock?

In light of the rising number of global conflicts and deteriorating geopolitical situations in Eastern Europe and the Middle East, the military sector and RTX Corporation in particular, are likely to experience reinvigoration.

Furthermore, RTX remains a likely candidate for U.S. government contracts. Coupled with an air travel rebound and a backlog of $118 billion of commercial and $78 billion of defense products and services reported in the 2023 annual report, the company isn’t winding down anytime soon.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.