Monero (XMR) has shown price and network resilience following Binance’s delisting on February 20. The leading privacy coin re-conquered the $150 price zone and has set a new record with over 100,000 daily transactions.

Notably, the Monero network established a new all-time high in the number of its daily transactions on March 5. At that date, BitInfoCharts registered 96,495 daily transactions, superior to the 60,305 registered on August 12, 2022.

Nevertheless, this mark is already outdated. As of this writing, the network has 102,708 transactions confirmed on March 6.

This data highlights increased network usage, which could positively impact the market demand for XMR and thus reflect in its price.

XMR price analysis

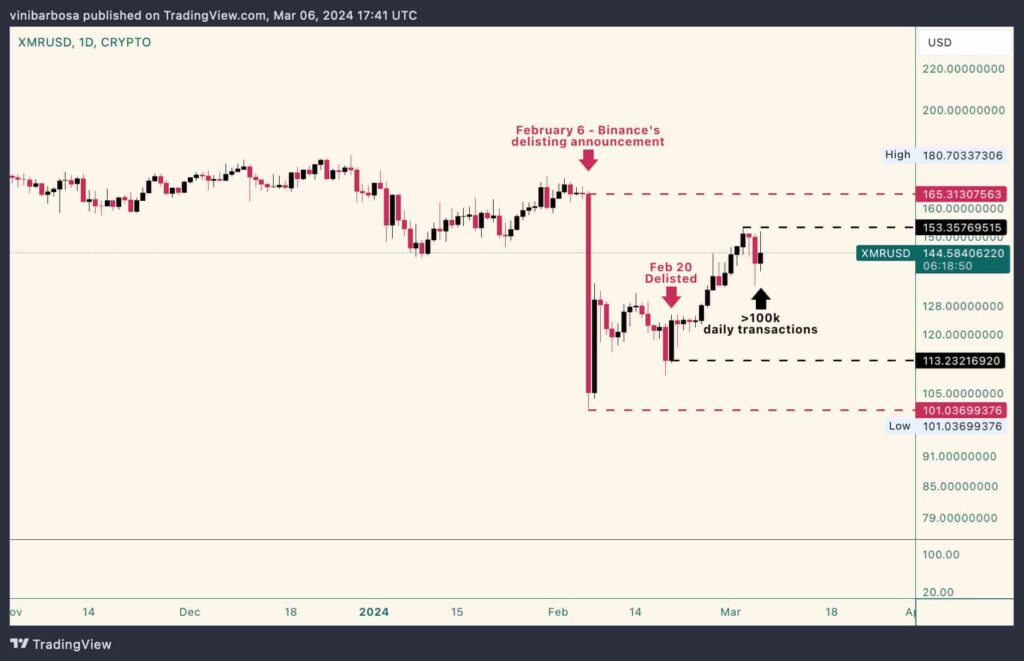

Monero’s recent price trajectory is remarkable. First, XMR dropped from $165 to $101 on February 6 following the delisting announcement. However, the nearly 39% loss was quickly challenged with an upward retracement to $129 on the February 7 daily closure.

On February 20, Binance finally delisted Monero, with a 10% 24-hour variation from the day’s opening and closure. Since then, XMR has traded in an uptrend, going as high as $153 and currently at $144.58.

Interestingly, Monero has surged by over 27% since Binance’s delisting day, followed by a record surge in transaction count.

Monero dynamic blocks to support transactions increase

One of the main criticisms against Bitcoin (BTC) is its limited transaction capacity, which usually leads to network congestion, long waiting times, and unaffordable fees. So, how does it apply to Monero during a historical surge of over 100,000 daily transactions?

The anonymous account on X, Untraceable, posted a thread explaining Monero’s dynamic blocks. Curiously, he explained that this was the first time the network had to use dynamic blocks. Additionally, reporting that the average block size increased from 300 kb per block to around 320 kb per block.

It is worth noting that network fees remained low, even during the transactions’ spike.

In summary, the aforementioned data evidences Monero’s resilience and demand even under adversarial conditions. Moreover, the network is proving to handle the increased demand for block space while adjusting accordingly.

If these trends continue, XMR could see an uptrend continuation in its exchange rate against the Dollar. Still, the cryptocurrency market is unpredictable, and cryptocurrencies are known for their high volatility. Further protocol and ecosystem developments will directly affect Monero’s performance moving forward.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.