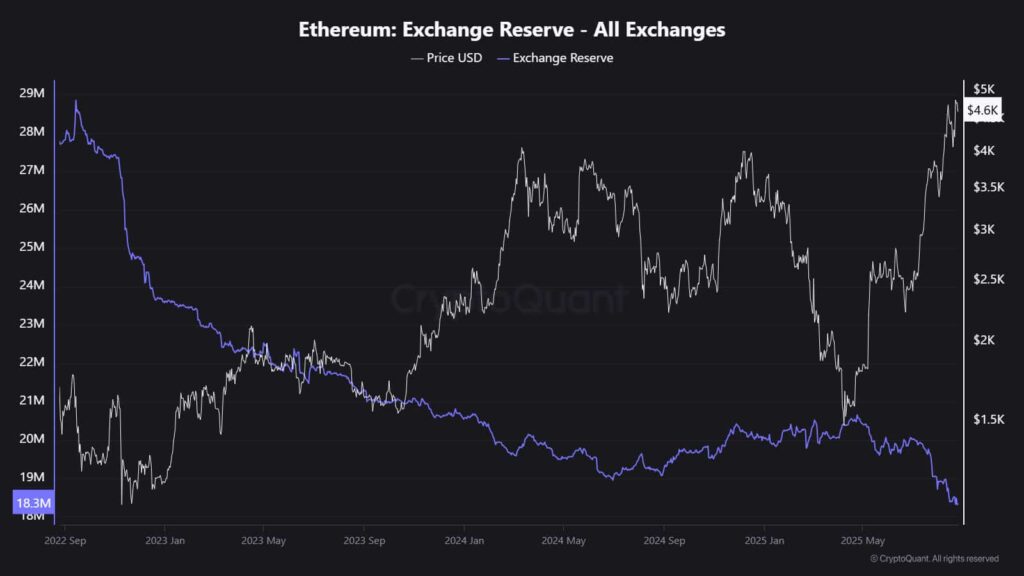

Ethereum’s (ETH) supply on centralized exchanges (CEXs) has dropped to just 18.5 million ETH, the lowest it’s been in years.

In part, the decline comes as a result of the weakening Bitcoin (BTC) dominance, with investor demand increasingly tilting toward Ethereum due to its yield potential.

Accordingly, the market is speculating whether falling supply and rising demand could pave the way for a significant squeeze.

Ethereum ever more popular as a long-term holding

At press time, Ethereum’s total circulating supply stands at 120.7 million ETH, yet reserves on exchanges have now dropped to 18.5 million according to August 25 data from on-chain and market data analytics platform CryptoQuant.

What’s more, roughly 29.6% of the cryptocurrency is now staked, with approximately $89.25 billion locked across staking protocols.

As alluded to, one reason for this is that yields are incentivizing long-term holding over short-term trading.

Meanwhile, in Q2 2025, burns outpaced new issuance, shrinking the effective circulating supply even further.

Institutional demand continues to grow

Ethereum’s institutionalization has accelerated sharply in 2025, and corporate treasuries now hold nearly 1.9% of the total supply.

Of course, ETH exchange-traded funds (ETFs) have played a crucial role, with BlackRock (IBIT) and Fidelity (FBTC) alone reporting a 65% surge in assets under management (AUM) last quarter.

The recent reclassification of Ethereum as a utility token has further legitimized its role in institutional portfolios.

All in all, the supply squeeze potentially represents the asset’s transformation from a speculative asset to a core institutional holding.

Featured image via Shutterstock