Jeff Bezos is selling some of his Amazon (NASDAQ: AMZN) shares after the stock reached an all-time high of $200.2 this week.

On July 2, the Amazon founder filed a notice with the Securities and Exchange Commission (SEC) to sell 25 million Amazon shares, valued at nearly $5 billion.

Bezos took this step after Amazon’s stock price hit a new all-time high and its market cap surpassed $2 trillion for the first time, while AMZN stock is up 31% year-to-date.

Despite this sale, Bezos will still hold over 912 million Amazon shares or 8.8% of the outstanding AMZN stock; this sale is one of several significant transactions he’s made this year, indicating he is not stepping back from the company.

2024 has been an eventful year for Bezos

After a nearly three-year hiatus from selling Amazon stock, Bezos offloaded a record $13 billion worth of AMZN shares in 2024.

At the end of May, he sold about 1.1 million Amazon shares, stating the proceeds would fund his nonprofit preschools. Specifically, the billionaire sold 431,426 shares on May 29 and 667,260 shares on May 30, valued at approximately $117 million then.

Earlier in February, Bezos made another significant sale, selling about 50 million Amazon shares worth roughly $8.5 billion.

Other insiders have been selling AMZN stock as well in 2024

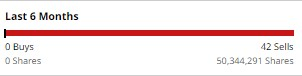

With 42 sales of 50,344,291 AMZN shares and zero buys, AMZN stock is yet another member of the “Magnificent Seven” that has experienced heavy insider selling activity this year.

After Bezos, Douglas Herrington, CEO of Worldwide Amazon stores, is the second on the list with a profit of $417 million from sales of AMZN stock in 2024.

He is closely followed by Amazon’s CEO, Andrew Jassy, who has pocketed $307 million from offloading his company stock.

These sales fall in line with the ongoing trend of higher executives of notable companies in the U.S. focusing on profit-taking, thanks to the impressive growth recorded in the first half of this year.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.