On occasion, even industry leaders make missteps. Cybersecurity leader CrowdStrike (NASDAQ: CRWD) started out the year strong — on January 2, CRWD stock was trading at $246, and by July 8, it had risen to $390.71. Unfortunately, this 58.82% surge didn’t last.

A faulty update was distributed to the company’s software on July 19. Some 8.5 million operating systems across the world experienced crashes and were unable to properly restart. The incident is held to be the largest outage in the history of IT — and the financial damages are estimated to be at least $10 billion.

CrowdStrike shares crashed by roughly 42.9%, from $380 at the time of the outages to $217 in early August. While some analysts did cut price targets, on the whole, Wall Street remained bullish on CrowdStrike stock — and prices recuperated in the meantime.

The company released its Q4 FY2025 earnings call on November 26. It was a double beat — both revenues and earnings per share (EPS) came in above analyst expectations. Still, outlooks are mixed — following the earnings report, CRWD stock dropped from $364.30 to $347.50 at press time, in what seems like an instance of profit-taking. On a year-to-date (YTD) basis, the stock is up 40.75%.

Now, a company insider has joined in, cashing in on millions from his sale of CRWD stock, and raising suspicion that a bearish turn might be in the cards.

Director dumps millions of dollars worth of CrowdStrike stock

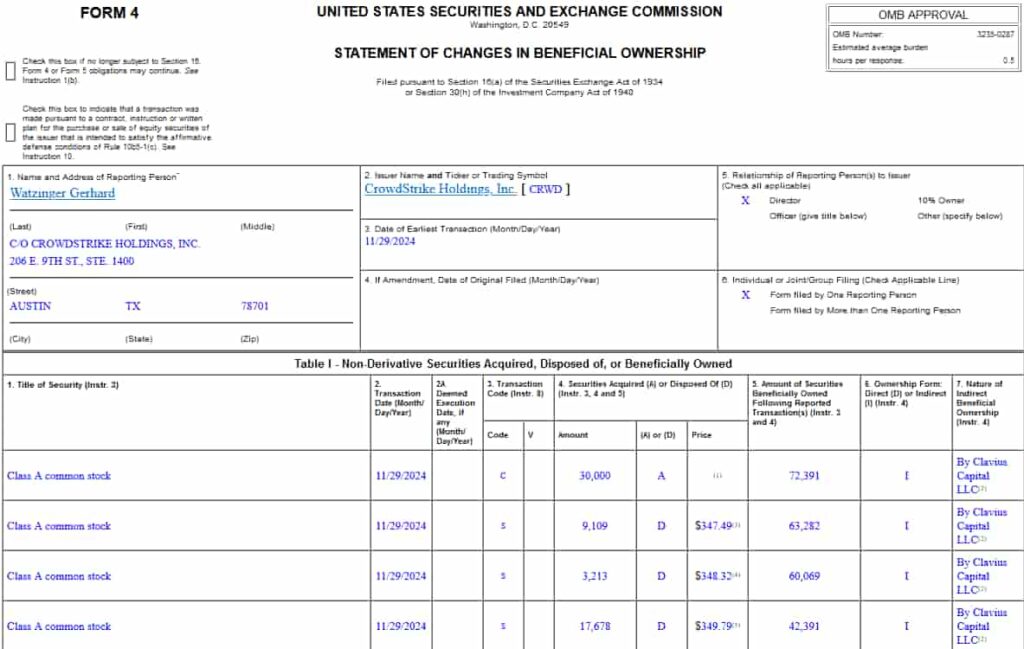

Gerhard Watzinger, a director at the cybersecurity company, sold 29,000 CrowdStrike shares on November 29, as revealed in an SEC Form 4 filing that was made public on December 2.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

In total, Watzinger’s trades saw the sale of 30,000 CRWD stocks, at prices ranging from $347.49 to $349.79 apiece. Put together, his sale netted the director a total of approximately $10,468,026. Following the sale, Watzinger still holds 42,391 shares.

However, the same filing reveals that he converted options into 30,000 stocks — so his holdings remain unchanged. Curiously enough, the transactions were not made in accordance with a 10b5-1 plan, meaning that they were not planned in advance. While it’s not enough to draw a definite conclusion, it does lend credence to the idea that the director decided to lock in profits.

On the whole, equity researchers from major Wall Street firms have remained cautious when it comes to CRWD stock, despite promising technical signals. In addition, the company put forth quite conservative guidance in its last earnings call.

CrowdStrike will most likely overcome all of these challenges in the long run. It remains the biggest pure-play cybersecurity stock, and long-term prospects are good — but it appears likely that headwinds will curtail growth in the short term.

Featured image via Shutterstock