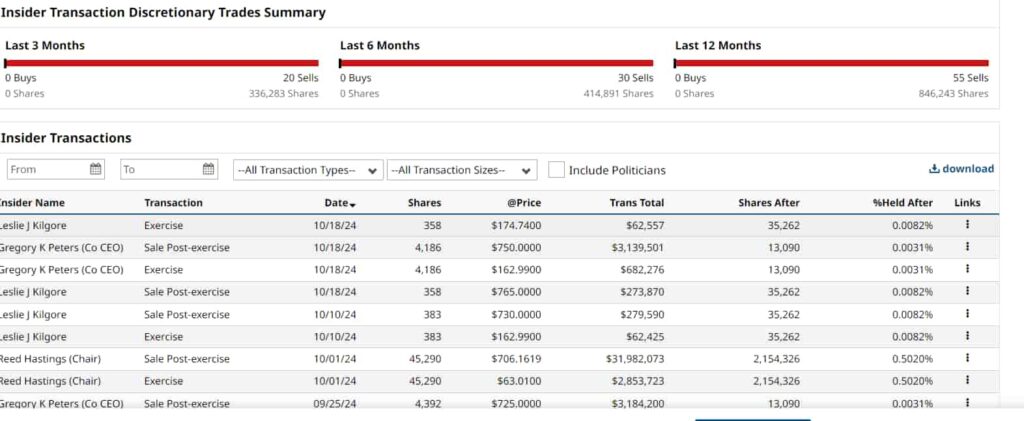

Netflix (NASDAQ: NFLX) is witnessing a surge in insider selling activity, with several top executives offloading significant portions of their holdings.

According to an SEC filing, Co-CEO Gregory K. Peters sold 4,186 shares of Netflix common stock on October 18, 2024, as part of a pre-established Rule 10b5-1 trading plan, which he adopted on July 26, 2023.

Peters executed this transaction for $750 per share, resulting in proceeds of approximately $3.14 million. Prior to the sale, Peters exercised stock options to acquire the same number of shares at a significantly lower price of $162.99 per share, amounting to a total value of $682,276.

Following this transaction, Peters now holds 13,090 shares of Netflix stock, a decrease from the 17,276 shares held before the sale.

In a similar move, Director Leslie J. Kilgore also engaged in insider transactions on the same day, exercising stock options to acquire 358 shares at an exercise price of $174.74 per share.

Kilgore subsequently sold these shares at $765 per share, resulting in a total sale value of $273,870.

Kilgore now holds 35,262 shares of Netflix stock, a slight reduction from her previous holding of 35,620 shares. This sale was also executed under a Rule 10b5-1 trading plan, which Kilgore adopted on January 29, 2024.

Additionally, SEC filings reveal that other top executives, including Netflix co-founder and chairman Richard Barton and board member Timothy Haley, have also established similar trading plans to sell substantial portions of their Netflix shares by the end of 2025

Richard Barton adopted a Rule 10b5-1 plan on July 26 to sell up to 12,062 Netflix shares by December 31, 2025, as disclosed in a filing with the SEC. Timothy Haley followed suit and adopted a plan on August 6 to sell up to 11,737 Netflix shares, worth approximately $9.1 million, by November 16, 2025.

Interestingly, similar insider selling has been observed at Marvell Technology (NASDAQ: MRVL), where executives sold significant amounts of stock, as reported by Finbold.

As of the market close on October 19, Netflix stock is valued at $764.24, marking an 8% gain over the past month.

What it means for investors

The recent insider selling at Netflix, while significant, follows pre-established Rule 10b5-1 trading plans, allowing executives to sell stock based on predetermined conditions.

These plans are designed to prevent concerns about trading on non-public information, meaning the sales don’t necessarily indicate a lack of confidence in Netflix’s future.

However, given the involvement of key insiders, investors are closely monitoring these transactions, particularly as Netflix’s stock continues its upward momentum.

Valuation metrics and analyst projections

From a valuation standpoint, Netflix remains strong, with an enterprise value of $335.97 billion.

Despite the insider sales, analysts maintain a positive outlook on Netflix’s stock performance. The company’s strong Q3 2024 financial results, coupled with its success in generating ad revenue and cracking down on password sharing, suggest future growth potential.

Citi analyst Jason Bazinet predicts that Netflix could increase U.S. subscription prices by 12% in 2025, further boosting revenue.

“Given Netflix’s low cost per viewed hour, we see scope for the firm to raise US prices by 12% in 2025,” Citi analyst Jason Bazinet

Additionally, Netflix’s short interest currently stands at 7.22 million shares, representing only 1.69% of the outstanding float, indicating relatively low bearish sentiment.

Analysts remain bullish on the stock, with the average consensus price target at $786. Some technical analysts have even set more ambitious targets, forecasting a rise to $840 by the end of 2024.

While insider selling has drawn attention, Netflix’s strong operational growth, diversification strategies, and favorable market conditions suggest a positive outlook.

Investors should consider the insider activity alongside Netflix’s growth trajectory when making their decisions.

https://www.youtube.com/watch?v=S5WiwfNmkiI