Although some experts believe that the latest Nvidia (NASDAQ: NVDA) stock sell-off is excessive, the artificial intelligence (AI) chipmaking titan’s CEO has continued to dump his company’s shares, selling more than $53 million worth of NVDA stock last week.

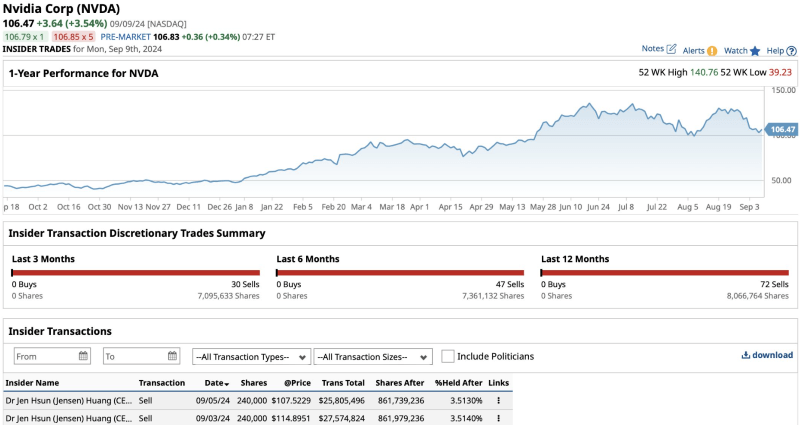

Specifically, Jensen Huang sold 240,000 Nvidia stocks worth $27,574,824 on September 3 and then another 240,000 worth $25,805,496 on September 5, according to the data shared by markets analytics platform Barchart in an X post on September 10.

As a reminder, the Nvidia CEO has now sold nearly 5.5 million NVDA stocks since mid-June this year, surpassing $680 million in value with the latest sale as part of a Rule 10b5-1 trading plan set up in March, according to which Huang plans to sell up to 6 million shares by March 31, 2025.

Meanwhile, the technology company shed around $400 billion in market value last week, bringing down the rest of the largest players in the stock market with it in what the Bespoke Investment Group said was the worst September start since 1953, but Goldman Sachs (NYSE: GS) analysts remain optimistic.

In fact, its lead analyst, Toshiya Hari, has maintained the ‘buy’ rating on NVDA stock, recently sharing his team’s views that the recent sell-off was excessive and telling Yahoo Finance during the Goldman Sachs 2024 Communacopia and Technology Conference that:

“The recent performance hasn’t been great, but we do remain positive on the stock. (…) First of all, the demand for accelerated computing continues to be really strong. We tend to spend quite a bit of time on the hyperscalers — the Amazons, the Googles, the Microsofts of the world — but you are seeing a broadening in the demand profile into enterprise, even at the sovereign states.”

Nvidia stock price history

At press time, the closing price of Nvidia stock amounted to $106.47, reflecting a decline of 8.23% across the week and an accumulated 2.34% loss in the past month while gaining 121.03% year-to-date (YTD) and advancing 1.73% in pre-market, as per the latest data.

So, why is Nvidia stock going down today and in recent weeks? Notably, Nvidia’s troubles culminated with a recent report claiming that the company had received a subpoena from the United States Department of Justice (DoJ) as part of an antitrust investigation and amid rising competition from the electric vehicle (EV) sector.

On the other hand, the semiconductor company expects to rake in over $3 billion in revenue in the fiscal Q4 ending January 2025 after the launch of its Blackwell products later this year, which, alongside strong forecasts for the October quarter and positive results in the previous one, suggest potentially strong recovery.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.