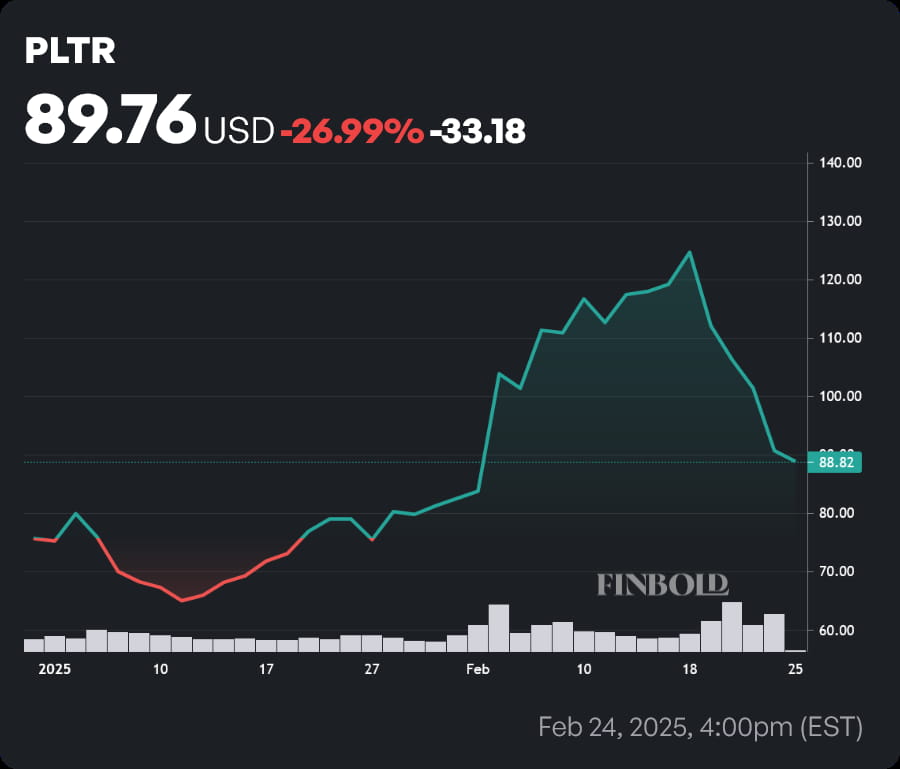

Despite a strong start to the year, Palantir stock (NASDAQ: PLTR) has seen a significant pullback after reaching an all-time high (ATH) of nearly $125 on February 18. By press time on February 25, PLTR shares were changing hands at a price of $89.76.

Two key factors have driven the recent decline in price, apart from the stock’s perennially taut valuation.

Firstly, Secretary of Defense Pete Hegseth recently announced an annual 8% cut to the Pentagon’s budget. Per a recently released Form 10-K filing, the data analytics business derives approximately 55% of its total revenue from government contracts. In much the same vein, 66% of total revenues come from the United States.

Picks for you

Secondly, the pace of insider selling has intensified as of late. In the first month of the year, Palantir insiders dumped more than $40 million worth of PLTR shares.

To boot, chief executive officer (CEO) Alex Karp recently adopted a new 10b5-1 trading plan, which could see him offload as many as 9,975,000 units of Palantir stock by September 12, 2025.

Now, Finbold’s insider trading radar has picked up yet another sale made by a company insider — and there is an interesting detail that makes the trade stand out.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

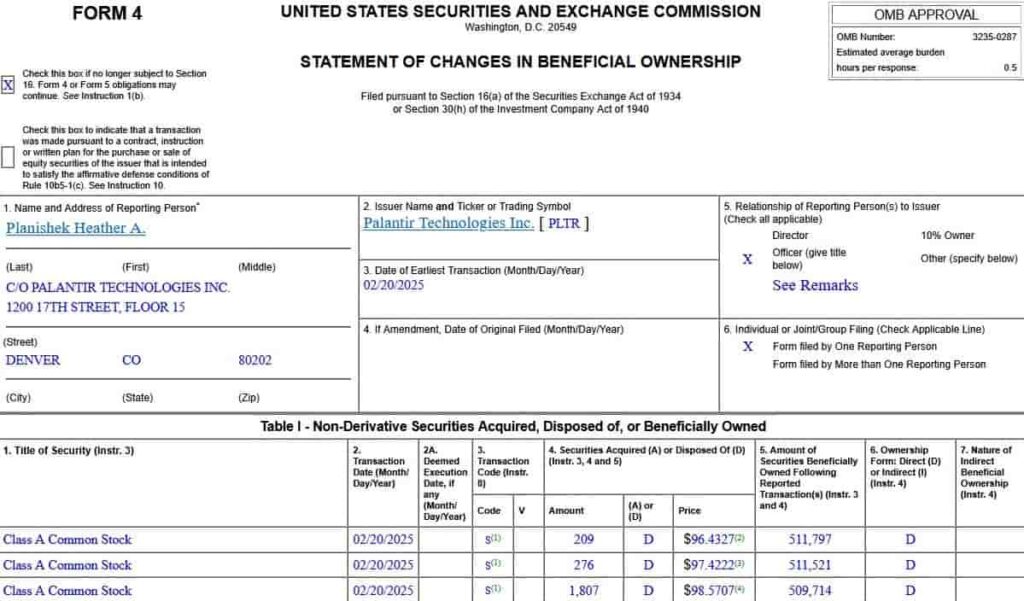

Chief Accounting Officer dumps $2.3 million worth of Palantir stock

On February 20 and February 21, Heather Planishek, Palantir’s Chief Accounting Officer (CAO) executed a total of 17 transactions, as revealed in a recently published Form 4 filing. These sales were executed at prices ranging from $96.43 to $108.28 per Palantir share. Put together, the trades are worth approximately $2,307,897.

So, what makes this different from previous insider sales? Most of the liquidations we’ve seen as of late were made according to 10b5-1 plans. In simple terms, the trades were prearranged. Planishek’s sale, however, was not, possibly indicating that the CAO was in a rush to lock in her profits before prices receded even further.

Notably, Planishek’s earlier $1.6 million sale, made on February 11, was indeed prescheduled.

Will PLTR shares keep crashing?

In spite of recent challenges, plenty of Wall Street analysts maintain a bullish outlook on Palantir stock. Loop Capital’s Rob Sanderson recently initiated coverage with a ‘Buy’ rating and set a $141 price target. On the whole, however, equity researchers are quite divided on the data analytics company’s short to medium-term prospects.

One key development that deserves mentioning is congressional support. Whereas U.S. politicians have generally avoided going long on Palantir, this has shifted in recent months. While Gilbert Cisneros and James Comer, who purchased Palantir stock in late January, are still in the green, Marjorie Taylor Greene’s investment in the company has thus far netted a 21.73% loss.

Finally, readers should note that while the planned Pentagon budget cuts are indeed a bearish signal, efforts to reduce U.S. defense spending have, historically, proven rather fruitless — as might very well turn out to be the case this time around.

Featured image via Shutterstock