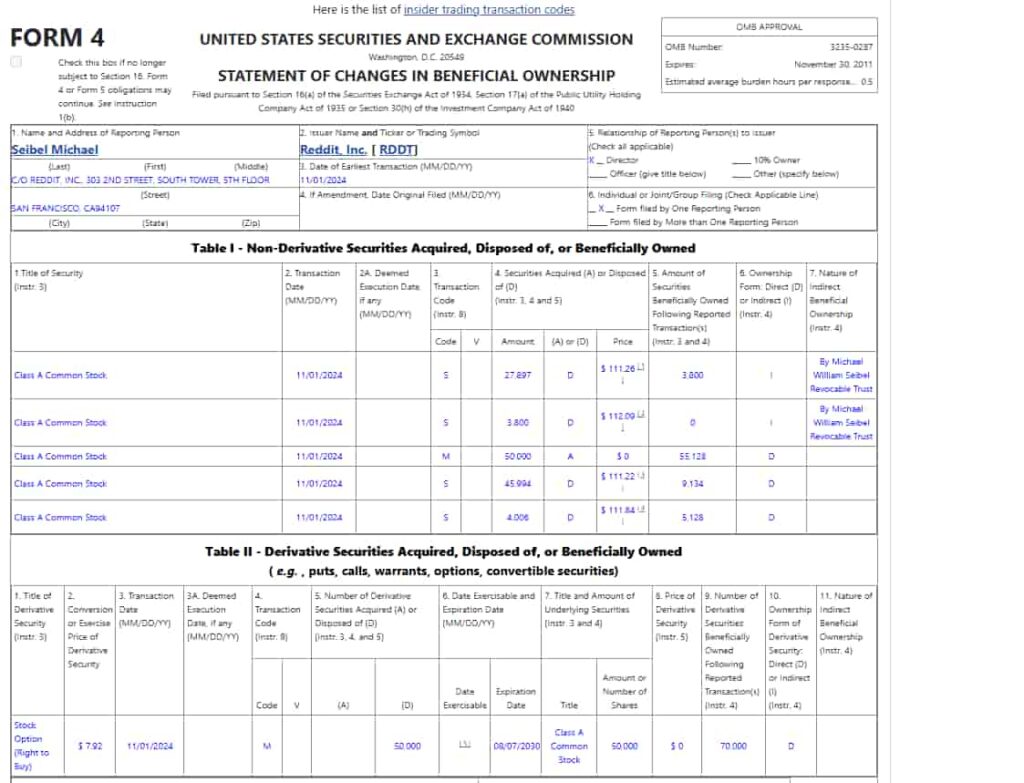

Michael Seibel, a director at Reddit, Inc. (NYSE: RDDT), recently sold a substantial portion of his holdings, as disclosed in a filing with the U.S. Securities and Exchange Commission (SEC).

On November 1, 2024, Seibel offloaded a total of 82,819 shares of Reddit’s Class A Common Stock across several transactions, generating approximately $9.22 million in proceeds.

The transactions included the sale of 27,897 shares at $111.26 per share, 3,800 shares at $112.09, 45,994 shares at $111.22, and 5,128 shares at $111.84.

Following these transactions, Seibel retained 55,128 shares directly and an additional 9,134 shares indirectly through the Michael William Seibel Revocable Trust.

Additionally, Seibel holds derivative securities, including a stock option to purchase 50,000 shares at an exercise price of $7.92, set to expire on May 1, 2027.

What it means for investors

While insider sales are not unusual, Seibel’s trades were not part of a pre-established trading plan, such as a Rule 10b5-1 plan, which would schedule sales in advance to comply with insider trading regulations.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

The absence of a pre-planned sale could attract regulatory attention and has piqued interest among investors. However, given that Seibel still retains a notable stake in Reddit, his recent sale does not necessarily signal a bearish outlook.

Reddit’s stock has experienced substantial volatility tied to its “meme stock” status and the lack of a lockup period for executives after its IPO.

This recent sale follows similar moves from other Reddit insiders, including CEO Steve Huffman’s $9.3 million sale on October 15 and board member Mary Porter’s sale totaling $572,000.

These transactions have raised questions about the company’s long-term prospects as executives continue to capitalize on the stock’s recent gains.

Reddit’s impressive growth and strong Q3 performance

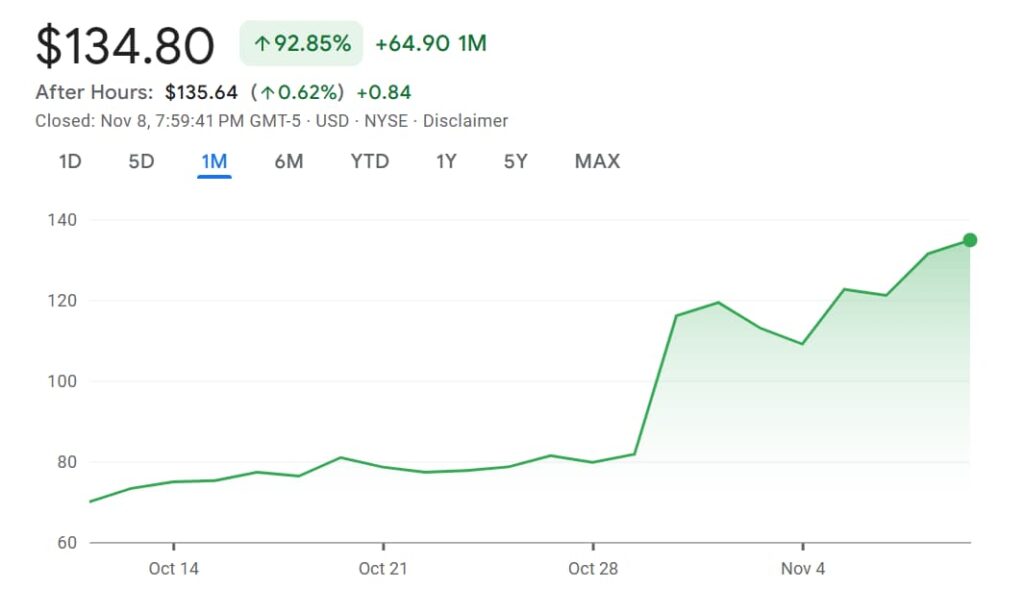

Despite insider selling, Reddit stock has surged, climbing around 150% in the past three months alone.

This growth has been fueled by a significant rise in user engagement and a strong Q3 earnings report, where Reddit posted its first-ever profit.

In a recent letter to shareholders, Reddit CEO Steve Huffman highlighted the company’s expanding user base and innovative initiatives that are powering Reddit’s strong momentum.

“In 2024 so far, “Reddit” was the sixth most Googled word in the U.S., underscoring that when people are looking for answers, advice, or community, they’re turning to Reddit.” -he said

The company’s revenue gains are largely attributed to its digital advertising successes and partnerships in AI content licensing, with major deals signed with Google and OpenAI for training AI models on Reddit’s content.

Additionally, Reddit’s new AI translation tool, enabling posts to be converted across six languages, has driven substantial user growth.

Currently, Reddit’s stock is trading at $134.80, with a monthly rally of 92%, bringing year-to-date returns to an impressive 167%.

As Reddit continues to navigate both impressive growth and increased scrutiny around insider trading activity, investors should closely monitor the company’s market performance, balancing its growth potential with potential regulatory risks associated with its insider trading patterns.

Featured image via Shutterstock