Despite criticism of individuals with insider knowledge of the inner workings of companies investing in the same organizations’ stocks, they seem to continue trading these shares unbothered, with the most recent example involving United States Senator Ted Cruz.

As it happens, Cruz has recently sold nearly $500,000 worth of Goldman Sachs (NYSE: GS) stock while, at the same time, critics pointed out that his wife, Heidi Cruz, was a managing director at the said investment banking and securities behemoth, and therefore privy to insider information.

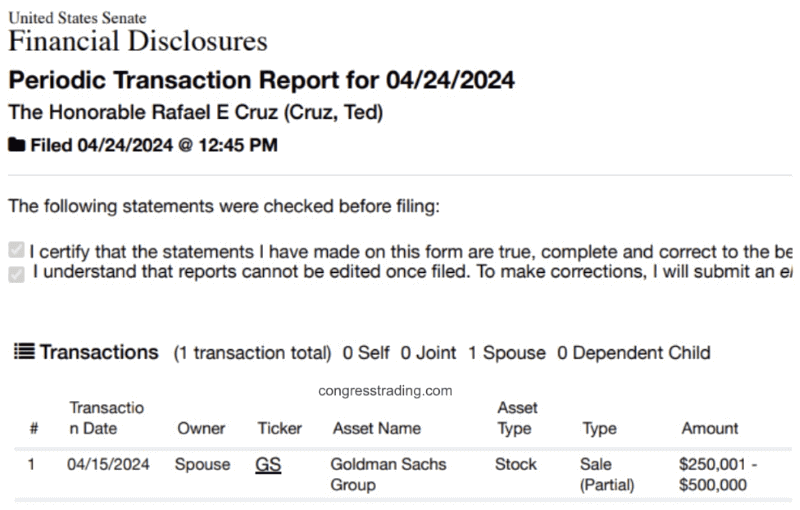

Specifically, the politician disclosed a sale of between $250,001 and $500,000 worth of GS shares from April 15, 2024, in the most recent US Senate financial disclosures period transaction report, according to the information shared by politician stock trades monitoring platform congresstrading.com on April 24.

Goldman Sachs stock price analysis

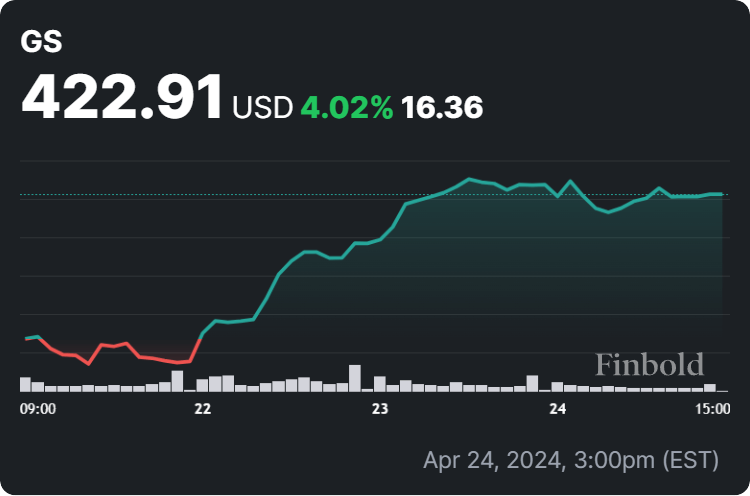

Meanwhile, Goldman Sachs shares were at press time trading at the price of $422.91, recording a slight decline of 0.23% on the day but nonetheless climbing 4.02% across the past week and advancing an accumulated 3.91% on its monthly chart, as per the most recent data on April 25.

All things considered, there is a possibility that the Cruz couple could hold important information about Goldman Sachs that could negatively impact the GS share price in the future, and they are trying to make as much profit as possible before this happens.

One example could be Goldman Sachs getting out of the robo-advisory business with the sale of its Marcus Invest digital investing accounts to digital investment adviser Betterment while focusing on the GS’s core strengths – investment banking, asset management, and trading.

However, the Goldman Sachs stock is currently demonstrating a strong technical rating, trading near its 52-week high and outperforming 79% of the other 210 stocks in the capital markets industry. That said, time will tell if GS shares retain their bullish momentum triggered around four months ago.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.