James Donaldson, better known as MrBeast, is a veritable YouTube superstar. Once a media darling on account of several charitable videos, he appears to be attracting an endless stream of controversy in 2024.

Donaldson’s stroke of bad luck began when close collaborator Ava Kris Tyson was accused of impropriety involving a minor — just weeks later, a former employee alleged widespread fraud that would amount to running an illegal lottery — one aimed at children.

However, this latest development just might prove to be a turning point for the YouTuber’s career. An initial investigation showed that MrBeast profited as much as $10 million from backing low-cap IDO (initial DEX offering) crypto tokens, as per an X post from online-sleuth SomaXBT.

The strategy was a simple one – the good old pump and dump. After appearing in promotional content or hyping up the assets, Donaldson would sell off his holdings — securing significant returns while his followers were left out to dry as selling pressure caused prices to plummet.

Now, two weeks after SomaXBT’s original report, a much more detailed overview published by loock.io, and backed up with data derived from on-chain analysis, alleges that Donaldson profited more than $23 million from crypto pump and dump schemes since 2021.

The analysis is the result of a collaboration between Kasper Vandeloock (@KasperLoock), @hxnterson, @angelfacepeanut, @rfparson, and the author of the first investigation, @SomaXBT.

Damning report identifies more than 50 wallets associated with MrBeast

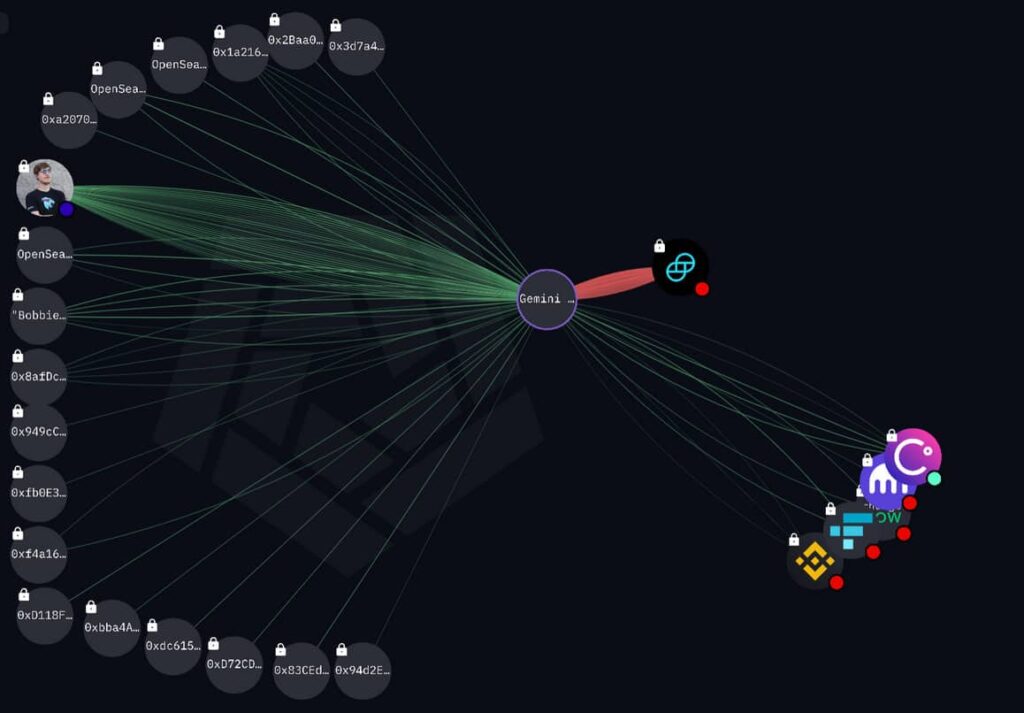

The address of Donaldson’s primary crypto wallet,

0x9e67D018488aD636B538e4158E9e7577F2ECac12, is well-known, as it was confirmed by MrBeast himself on several occasions — first in 2021, when he identified himself as the buyer in a transaction involving 50 Ethereum (ETH).

Through a clever bit of detective work, the team behind the investigation revealed that more than 50 other wallets use the same deposit address — 0xD6210f2dc5323f4a1B4b766a0e732d6DfA26935B. When multiple wallets send funds to the same deposit address, it often indicates common ownership or association. This shared address, alongside regular transfers among the addresses in question, suggests a coordinated operation.

MrBeast made $11.5 million from just one token

Although the roughly 5,000-word report is too lengthy to effectively summarize here, the most attention-grabbing part of the on-chain data is certainly MrBeast’s involvement with SuperVerse (SUPER), formerly known as SuperFarm.

Heavily promoted by marketers like EllioTrades, the project was slated to develop an NFT marketplace that was supposed to integrate with a gaming ecosystem.

Although the games in question suffered from being stuck in ‘development hell’, the pre-sale initial coin offering (ICO) saw SUPER experience a 50x price increase — in part due to Donaldson’s open promotion of the token on social media platforms.

Early public investors, however, were suddenly refunded for their investments by the use of legal loopholes, as alleged in the report.

A leaked screenshot from one of EllioTrades’ streams shows a direct message on X where MrBeast writes ‘So we can do the $100k, thing is that I…’. Although not exactly conclusive, the findings do provide on-chain data that matches the leaked conversation.

After receiving 1 million SUPER tokens on February 22, 2021, Donaldson’s main wallet sends the entire amount to a side wallet on March 30, 2021. A day later, the entire holding was liquidated — netting MrBeast roughly $7.5 million.

Over the course of the next three months, the main wallet would receive eight supply unlocks — all of which would be dumped in short order. Once the initial $100k investment is subtracted, the report claims that Donaldson secured roughly $11,447,453.96 in profits.

We encourage readers to take a look for themselves and draw their own conclusions — the findings suggest that MrBeast also made $4,649,337, $1,724,652, and $484,817 from transactions involving Eternity Chain (ERN), PolyChain Monsters (PMON), and SHOPX respectively, as well as concerted efforts with other popular influencers to profit from a number of these pump and dump schemes.

Featured Image:

dennizn, Dallas, TX USA — February 26, 2024. Digital Image. Shutterstock.