The share price of electric vehicle (EV) manufacturer Tesla (NASDAQ: TSLA) continues to struggle despite the company implementing various strategies to boost investor confidence.

Undoubtedly, Tesla has been significantly impacted by the widespread slowdown in the EV market, with the stock plummeting by nearly 30% in 2024. This is a substantial decline, and the equity is currently facing resistance at the $200 level, trading at $175 by press time.

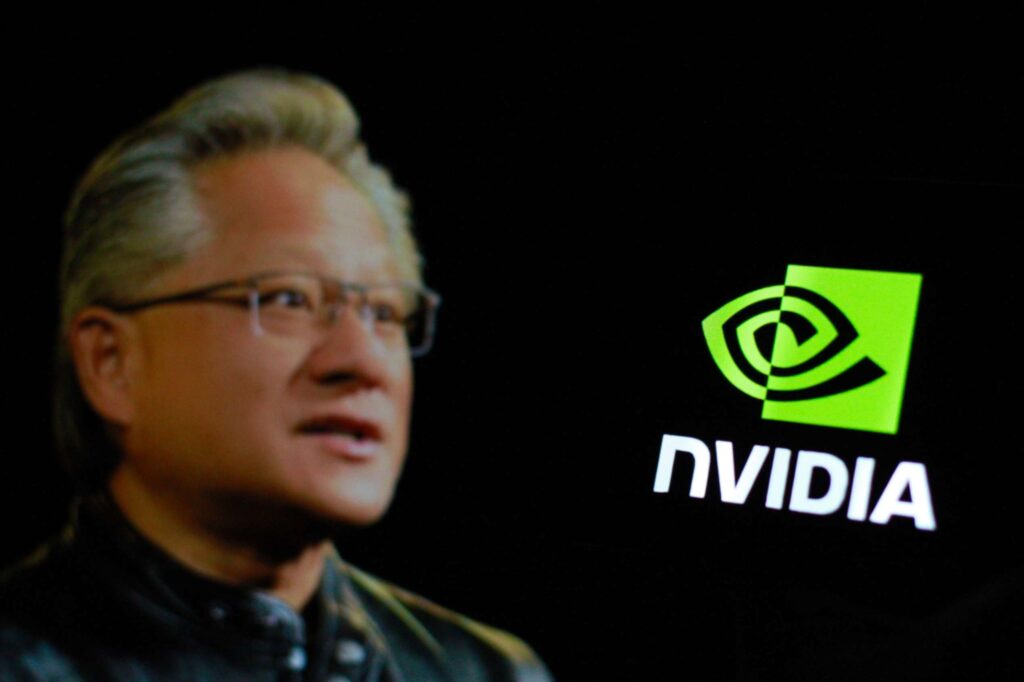

Consequently, investors are looking for triggers that are likely to help TSLA reclaim new levels. One such boost came from Nvidia (NASDAQ: NVDA) CEO Jensen Huang, who praised Tesla’s advancements in self-driving technology.

The backing comes as CEO Elon Musk is pushing ahead with Tesla’s Full Self-Driving (FSD) technology. Indeed, the technology has faced controversy stemming from its safety record.

“Tesla is far ahead in self-driving cars, but every single car, someday, will have to have autonomous capability,” Huang said in an interview with Yahoo Finance on May 23.

Tesla championing FSD in China

This development aligns with Tesla’s reported plans to register its ‘Full Self-Driving’ software in China, alongside intentions to introduce a technologically advanced feature of the system later this year.

According to a Reuters report, if the registration is approved, it will pave the way for the EV maker to conduct internal testing of the technology before a wider rollout to Chinese users. It’s worth noting that Tesla currently offers two less-advanced versions of its Autopilot driver assistance system in the Asian country.

Additionally, the rollout of the FSD feature has the potential to significantly boost Tesla’s sales in China, providing a new revenue stream for the company. Indeed, in recent months, Tesla has experienced declining sales in China amidst increasing competition.

Implication of Huang’s endorsement

This endorsement from Nvidia’s influential leader holds significant weight as Musk steers the company through a bold pivot towards artificial intelligence (AI). Notably, Nvidia’s AI chips are in high demand among tech giants such as OpenAI.

Indeed, Nvidia’s venture into AI chips has bolstered its equity, propelling it to join the $1 trillion market capitalization club.

At the same time, Tesla plans to invest over $500 million in Nvidia’s AI chips in 2024. This strategic shift towards AI represents a notable shift in Tesla’s original mission of becoming the leading car manufacturer.

Musk’s controversial pay package

Additionally, Huang’s stance is particularly noteworthy as Tesla’s shareholders prepare to vote on Musk’s controversial record compensation package, valued at around $55 billion.

It’s worth noting that Musk does not receive a salary from Tesla; instead, his compensation is tied to a series of performance milestones related to the carmaker’s financial growth.

The plan entails a 10-year grant of 12 tranches of stock options, which vest when Tesla achieves specific targets. Each time the company hits a milestone, Musk receives stock equal to 1% of outstanding shares at the time of the grant.

Notably, some shareholders have opposed the package, arguing that it is not commensurate with the company’s performance.

This contention comes amid disappointing results in the first quarter of 2024, where Tesla reported a 55% plunge in net income and a 9% decrease in revenue compared to last year, marking its most significant drop since 2012. However, Musk announced plans to “accelerate” production of new, cheaper vehicles.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.