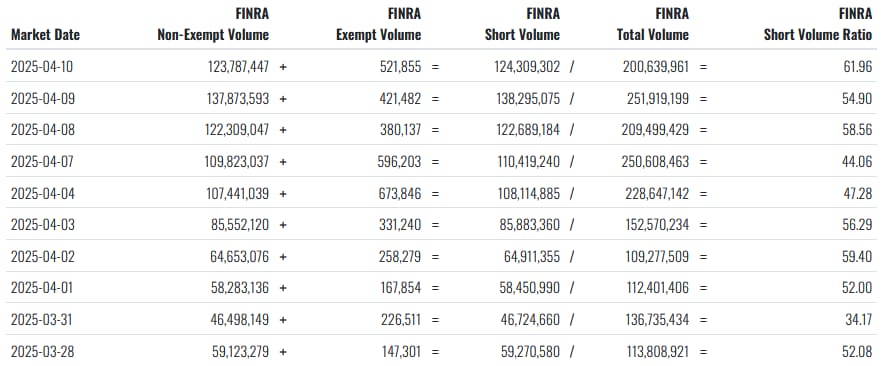

With the exception of Tuesday, April 8, Nvidia stock (NASDAQ: NVDA) has experienced a rather steep and consistent increase in short interest.

To be more precise, the short volume ratio of NVDA shares reached a 2-week high of 61.96 by April 10, per data retrieved by Finbold from Fintel.

The development represents a significant uptick in bearish sentiment. In mid-March, the short volume ratio of Nvidia stock stood at much lower levels on average — with surges above 50 being relatively rare occurrences. Even the April 2 announcement of President Trump’s tariff salvo, as well as its immediate aftermath, did not raise the ratio to current levels.

Will Nvidia stock regain the $110 level?

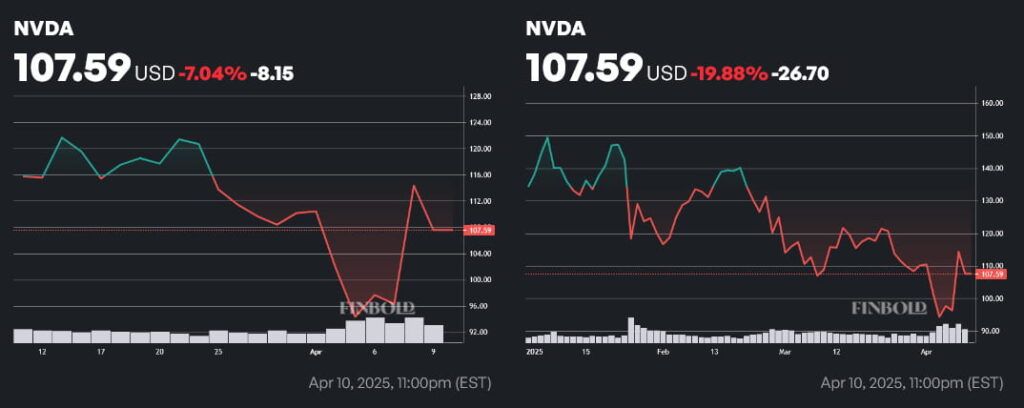

At the time of writing, NVDA stock was changing hands at a price of $107.59, down 5.89% from a recent April 8 high of $114.33. Over the course of the past 30 days, Nvidia stock has lost 7.04% in value, and remains in the red at 19.88% on a year-to-date (YTD) basis.

Ultimately, market-wide dynamics will most likely play the key role in determining near-term price action.

Research from Gartner indicates that semiconductor revenue grew at an impressive pace of 21% over the course of 2024. While that is certainly a tailwind, investors are currently uncertain, and even Wall Street analysts have taken to issuing more cautious outlooks.

Since tech stocks are still at extremely high valuations (even with the recent dips factored in), significant moves to the upside for Nvidia stock, outside of a market-wide rally, remain unlikely.

Featured image via Shutterstock