As the cryptocurrency market evolves, Ethereum (ETH) has continued to face growing challenges.Despite its leadership in decentralized finance (DeFi) and smart contracts, Ethereum has experienced several controversies, particularly around scalability and network upgrades.

Consequently, these issues are starting to weigh on ETH’s appeal to investors, causing the pioneer smart-contract network to lose significant market share over the past two bull cycles

As of October 2024, Bitcoin’s (BTC) market cap had surged to $1.35 trillion, with Ethereum lagging far behind at $317 billion, reflecting a widening $1.04 trillion gap between the two.

Furthermore, Ethereum’s dominance has declined by 38% since November 2021, while Bitcoin’s dominance has increased by 11.28%.

Ethereum rivals surge amid shifting market dynamics

These dynamics, in turn, have created a fertile environment for other competitors, which have achieved remarkable gains over the past few years.

Finbold has already reported on Ethereum rival MultiversX (EGLD), formerly Elrond, which is arguably the most technically advanced blockchain today.

Meanwhile, other networks like Solana (SOL), driven by its memecoin frenzy, and platforms such as Cardano (ADA) and Avalanche (AVAX) have also experienced significant price surges.

In this context, Finbold has identified one promising Ethereum rival with high growth potential for 2025. If expectations are met, it could deliver over 10-fold returns for investors, potentially turning a $100 investment into $1,000.

Avalanche: A rising ETH rival with massive upside

Earlier, Finbold utilized an artificial intelligence (AI) model to analyze the market positions and growth potential of Ethereum and Avalanche.

Notably, ChatGPT-4o identified Avalanche as the more attractive investment, citing its smaller market cap and rapidly expanding ecosystem as key drivers of its strong upside potential.

Avalanche, with a current market cap of $11.25 billion, offers a highly scalable, fast, and cost-efficient blockchain solution that addresses many of Ethereum’s limitations.

Its innovative consensus mechanism, sub-second transaction speeds, and significantly lower fees have attracted developers and investors alike, positioning Avalanche as one of the top contenders to challenge Ethereum’s dominance.

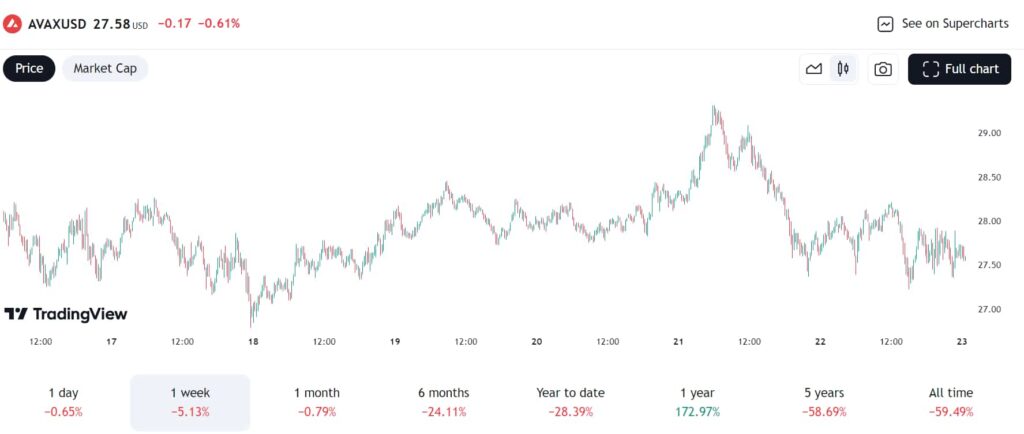

Avalanche has seen strong performance this month, climbing over 4% to reach $28. This boost follows the announcement that the popular crypto game ‘Off The Grid’ is utilizing the Avalanche blockchain for NFT item ownership, which was highlighted during the recent Buenos Aires Avalanche Summit.

Furthermore, a $40 million developer grant has been rolled out to support further innovation on the Avalanche network, driving additional growth and interest in its ecosystem.

Key partnerships and institutional support

Avalanche has also gained significant traction with institutional players, further enhancing its growth potential.

Notably, Franklin Templeton, a global investment firm with $1.6 trillion in assets under management, has expanded to the Avalanche network for its pioneering on-chain U.S. Government Money Fund (FOBXX).

In addition, Avalanche’s expanding DeFi ecosystem has been supported by the introduction of the Avalanche Visa Crypto Card.

Launched in collaboration with Visa, the card allows users to spend their AVAX and other supported cryptocurrencies like USD Coin (USDC) and Wrapped AVAX (WAVAX) wherever Visa is accepted. The flexibility of this card, available in both physical and virtual forms, has broadened its appeal.

Moreover, Agora has launched its fully collateralized US digital dollar, AUSD, on the Avalanche network. Leveraging Avalanche’s EVM compatibility, sub-second transaction finality, low fees, and customizable infrastructure, AUSD could attract increased users and liquidity to the platform.

At press time, AVAX is trading at $27, with a one-week loss of 4%. However, technical indicators suggest that a breakout could be imminent.

Why $100 could become $1,000 by 2025

Avalanche’s potential to turn a $100 investment into $1,000 by 2025 is rooted in its innovative technology, expanding ecosystem, and strong partnerships. With a market cap of $11.25 billion, Avalanche has significant room for growth, especially when compared to Ethereum’s $317 billion market cap.

Furthermore, Avalanche’s capped token supply of 720 million AVAX supports the possibility of substantial price appreciation as demand for its platform increases across DeFi, NFTs, and gaming.

As more developers and projects adopt Avalanche’s scalable and cost-efficient platform, the potential for significant growth remains high.

While there are no guarantees that Avalanche will achieve the predicted 10x returns, its strong fundamentals, expanding ecosystem, and growing institutional interest have positioned it as a serious contender in the blockchain space.

Investors who focus on building portfolios centered around Avalanche are likely to position themselves for sustainable, long-term gains, especially as the crypto market continues to evolve into 2025 and beyond.