With Bitcoin (BTC) failing to make notable moves in either direction, on-chain data suggests that investors might be anticipating a pump in the cryptocurrency’s price.

Particularly, according to Ki Young Ju, founder of crypto analysis platform CryptoQuant, Bitcoin whales have opened massive long positions at the $69,000 mark, signaling potential bullish sentiment.

This move indicates confidence among large investors in Bitcoin’s future price trajectory amid the ongoing consolidation.

Picks for you

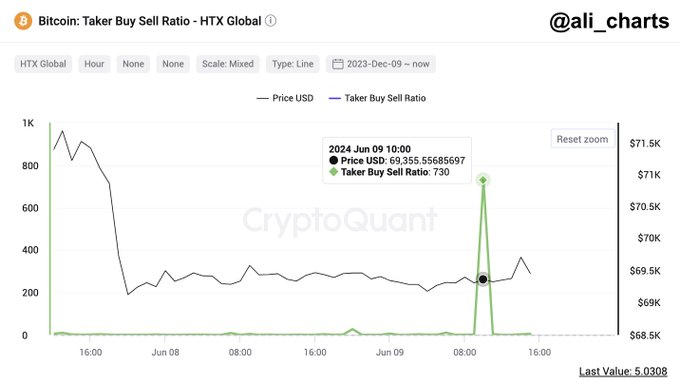

Data shared by another analyst, Ali Martinez, supports this optimistic outlook. In an X post on June 7, Martinez highlighted a spike in the ‘Bitcoin Taker Buy Sell Ratio’ on the HTX cryptocurrency exchange.

The ratio soared to 730, indicating overwhelming buy pressure and strong bullish sentiment among traders. This surge in buying activity suggests a potential upward movement in Bitcoin’s price in the near term.

Surge in whale activity

Notably, the data comes in the wake of a report by CryptoQuant, which identified a surge in demand for Bitcoin from whales and permanent holders. The report noted that accelerating demand growth is necessary for a sustainable price rally, implying that Bitcoin might soon experience a price increase.

It is worth noting that the current activity of Bitcoin whales mirrors their movements in 2020, just before the asset rallied from $10,000 to above $60,000. Back then, BTC hovered around $10,000 for six months, marked by over-the-counter deals.

Additionally, as reported by Finbold, Martinez identified a breakout in the daily active addresses trend on Santiment. On June 8, Martinez observed a significant uptick, with 765,480 Bitcoin addresses becoming active within the last 24 hours.

This surge in active addresses is interpreted as a positive sign, suggesting a continuation of the cryptocurrency market’s bull run.

Bitcoin eyes breaching $70,000

Currently, Bitcoin is eyeing the $70,000 resistance level. Earlier in the week, the asset failed to hold this position after rising as high as $71,000.

Despite this, the consensus appears that the ongoing bull run is far from over. As reported by Finbold, crypto trading analyst TradingShot pointed out that Bitcoin has the potential to rally, advising investors to look out for potential buying opportunities within the range of the 50-day moving average (MA50).

Meanwhile, as of press time, Bitcoin was valued at $69,518, gaining about 0.1% in the past 24 hours.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.