In the first quarter of 2024, the gold market of the world’s second-largest economy, China, experienced a dramatic surge in demand, recording a 68% year-on-year increase.

This rise is mainly attributed to an influx of retail investors and diverges from the prior trends of speculative investment that typically spurred previous rallies. Simultaneously, central banks around the world, including the People’s Bank of China (PBoC), ramped up their gold acquisitions, setting a new record for net purchases during this period.

Globally, central banks showcased a robust appetite for gold, achieving a new first-quarter record with net acquisitions totaling 228 tonnes—a 68% surge over the five-year quarterly average, according to the World Gold Council.

This trend was notably strong in China, where the People’s Bank of China (PBoC) added 57 tonnes to its reserves in Q1 2024. This ongoing accumulation strategy not only strengthens China’s position in global markets but also aims to diminish its reliance on the U.S. dollar and diversify its financial reserves.

The dynamics of the gold market in early 2024 were unusual, driven not by speculation but by substantial physical demand within China. During this period, gold prices in the New York market saw a notable increase, reaching levels between $2,300 and $2,350 per troy ounce, up more than 10% since February.

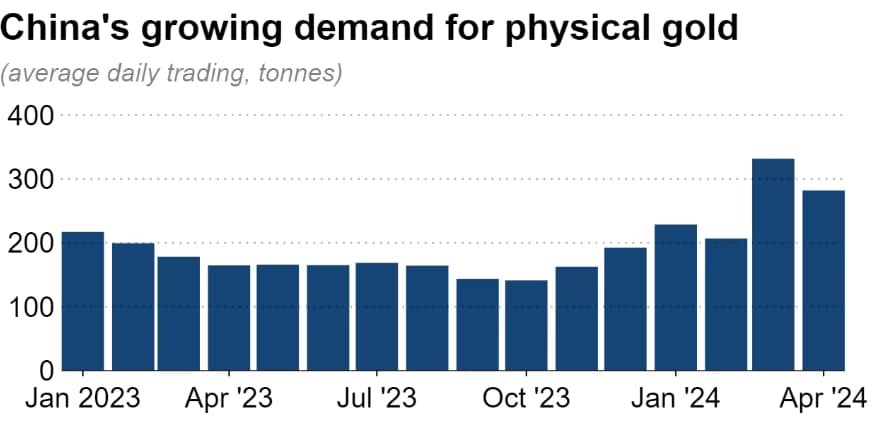

This rally was supported by robust trading on the Shanghai Gold Exchange, where daily volumes surged to 613.4 tonnes in March and April, an increase of 78.8% from the previous year.

Drivers of China’s gold interest

China’s growing attraction to gold is also being shaped by significant economic and political factors. With the domestic real estate market facing challenges and strict regulations impacting cryptocurrency and foreign currency investments, investors are increasingly turning to gold as a safer and more stable asset.

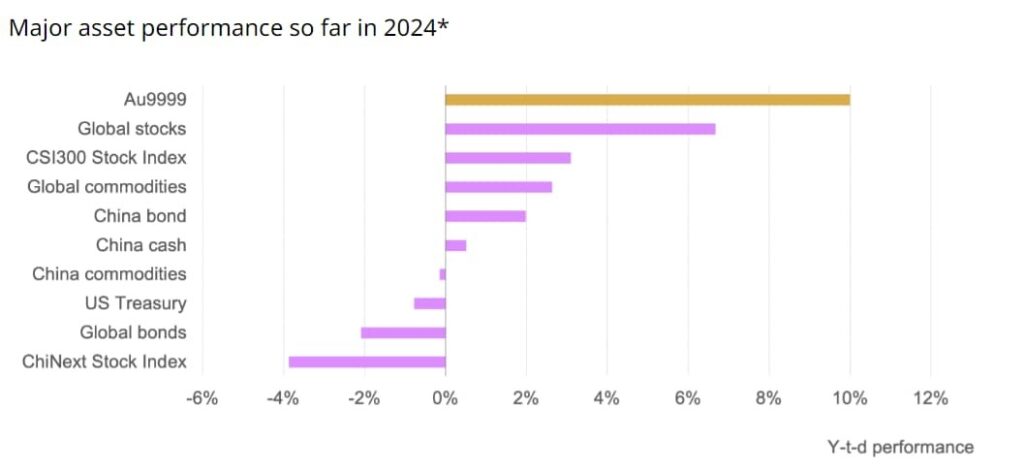

March boosted the RMB gold price’s Q1 return to 10%, outperforming leading assets. The attractive return, uncertainties in the property sector, and concerns for the local currency have elevated local investor appetite for gold so far in 2024.

The consistent enhancement of the country’s gold reserves by the PBoC reassures investors, encouraging a bullish outlook on gold.

Jeff Toshima, a market analyst, said.

“Funds are flowing into gold after losing other investment avenues amid the real estate slump and the restrictions imposed on crypto assets and dollar-denominated assets.”

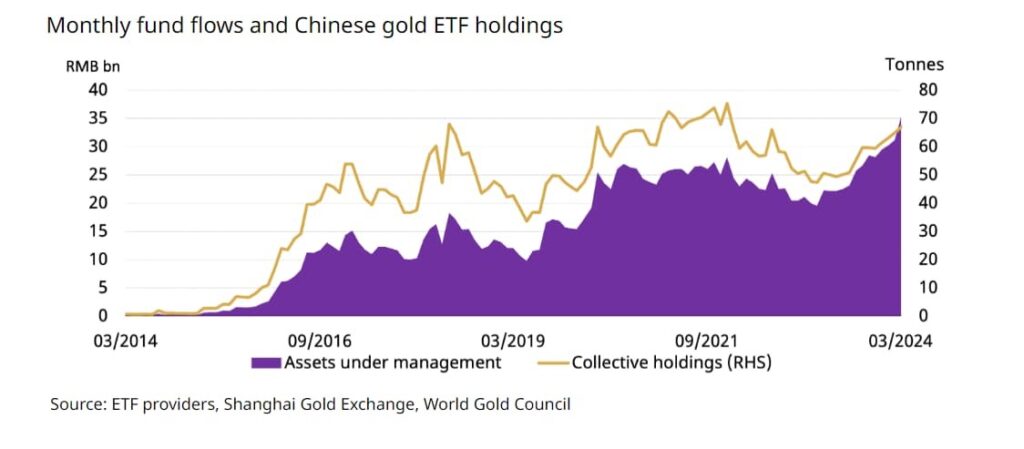

This period also saw Chinese gold ETFs grow substantially, with inflows reaching RMB2.8 billion, pushing total AUM up by 20% in Q1 alone.

Sectoral Impact: Jewelry vs. Bars and Coins

In Q1 2024, while overall gold consumption in China increased, the demand for gold jewelry slightly declined by about 3%, totaling 183 tonnes. Conversely, the demand for gold bars and coins surged by 68%, reaching 110 tonnes—the strongest quarterly total in over seven years. This rise was fueled by the need for value preservation, seasonal gifting, and strong gold price performance.

The weaker local currency and market volatility at the start of the year, combined with cultural purchases during the Chinese New Year, notably of dragon-themed items, significantly drove gold demand. The substantial gold price rally in March further boosted investor interest, amidst poorly-performing alternative investments. This trend was reinforced by ongoing official gold purchases by the People’s Bank of China, which bolstered confidence in gold among investors of all scales.

Despite a temporary easing in local premiums in March, the average premium for Q1 was historically high at US$40/oz, indicating robust investment demand. Looking ahead, the investment in bars and coins is expected to remain strong due to anticipated monetary easing to support economic recovery, sustained investor interest amidst housing market weaknesses, and global geopolitical tensions. However, potential challenges such as increased gold price volatility or economic slowdowns could impact investor behavior and purchasing capacity.

Golden opportunity

As 2024 progresses, the momentum in China’s gold market is expected to continue, driven by both macroeconomic instability and strategic shifts in consumer and institutional behavior. With the ongoing global geopolitical tensions and economic uncertainties, gold is likely to remain a favored asset among investors seeking stability and security.

The proactive measures taken by the People’s Bank of China in bolstering its gold reserves and the rising trend in ETF inflows further suggest a robust and vibrant gold market in China throughout the year.

With gold trading slightly above the $2,300 mark, a section of the market still believes that the metal’s long-term bullish sentiment is intact, and the current prices present an excellent opportunity to enter.