Silver, often seen as a dual-purpose investment due to its status as a precious metal and its industrial utility, is facing unprecedented challenges.

The 2024 World Silver Survey, released by The Silver Institute and conducted by the UK-based research firm Metals Focus, underscores a severe forecast: the silver market is entering its fifth consecutive year of supply deficits, intensified by robust industrial demand.

This year, the shortfall is set to nearly double, reaching a critical 265 million ounces, driven by heightened needs in technology and renewable energy sectors.

Picks for you

The surge in industrial demand, notably from the solar energy sector, is stark. Silver’s role in photovoltaic (PV) panel production has led to an additional demand of 120 million ounces annually since 2019.

Coupled with increases in other green energy initiatives like power grid enhancements and automotive electrification, the demand for silver has not just increased—it has transformed market dynamics.

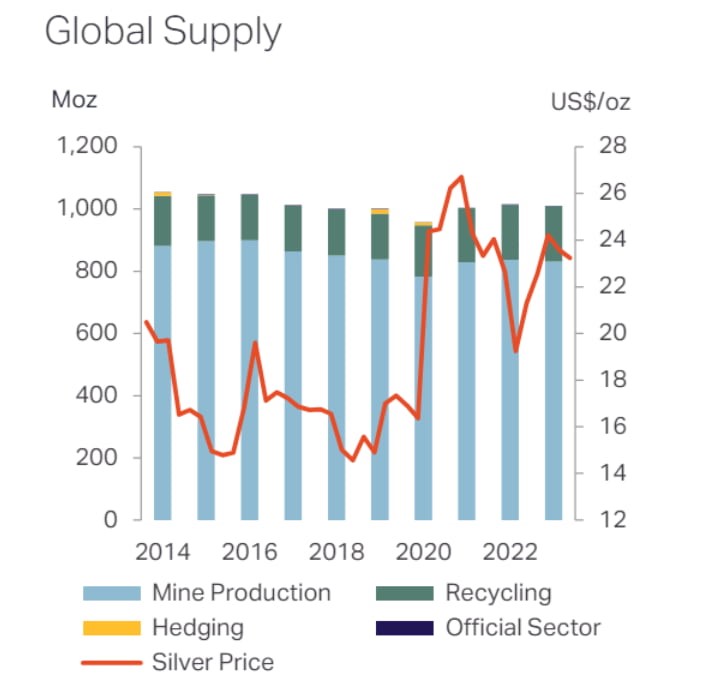

Conversely, the supply side is faltering. Challenges such as diminishing ore grades, escalating operational costs, and a strained supply chain are starkly evident. The global inventory struggles to keep pace with the surging demand, pushing the market further into a supply deficit.

Despite these shortages, investment demand for silver has dipped, with physical bar and coin purchases falling by 13% to 212 million ounces (Moz) this year.

Supply dynamics and future projections

In 2023, total silver demand decreased by 7% to 1,195 Moz, with the standout being the 44% rise in Chinese industrial demand due to expansion in PV production. Although silver recycling rose slightly, overall supply is projected to remain stagnant in 2024.

Metals Focus anticipates a slight decline in global silver mine production, compounded by operational disruptions and mine closures in key producing countries. However, some recovery is expected, particularly from Mexico’s Peñasquito mine post-strike resumption and potential expansions in the US and Morocco.

Investment perspective and market outlook

Despite the gloomy investment sentiment, market analysts remain optimistic about silver’s price trajectory.

It is also worth noting that Bloomberg’s senior commodities strategist Mike McGlone has also earlier shared a bullish perspective around silver, arguing it may only be a matter of time before the precious metal surpasses the price of $30 per ounce, based on the asset’s previous action.

Additionally,U.S. economist Peter Schiff stated that silver is performing better than Bitcoin as a hedge against geopolitical tensions earlier this month.

The ongoing and deepening supply-demand imbalance suggests a bullish future, with some analysts forecasting that silver prices could double or triple in the coming years.

This points to a significant window of opportunity for investors and industry stakeholders to capitalize on silver’s increasing indispensability in sustainable technologies.

Silver price analysis

XAGUSD 1 month chart.Source.TradingView

In April 2024, the silver market demonstrated notable volatility. The month began with silver priced at approximately $25.20 per ounce. It experienced a significant peak on April 12, when prices soared to $29.80 per ounce, suggesting a strong bullish momentum during this period.

Throughout April, the Relative Strength Index (RSI) mostly stayed within the typical range of 30 to 70, indicating a relatively balanced market condition for most of the time.

However, the RSI surpassed 70 on a few occasions, signaling overbought situations that corresponded with price peaks, including the notable high on April 12. The index also dipped below 30 a couple of times, hinting at oversold conditions during transient pullbacks.

Currently, with an RSI around 38, the market is closer to the lower threshold, which might suggest a cooling off from earlier highs and possibly a more cautious market sentiment.

While the silver market grapples with severe deficits and declining investor interest, the robust industrial demand, particularly from sectors driving towards sustainability, offers a silver lining.

The potential for significant economic returns makes this an opportune moment for investment in the silver industry.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.