Palantir Technologies (NYSE: PLTR) has been on an impressive upward trajectory, with its stock climbing to $37.09.

Over the past month alone, it has surged by 22%, adding over $6 to its price. Even more remarkable is its year-to-date performance, which shows a gain of 123.72%.

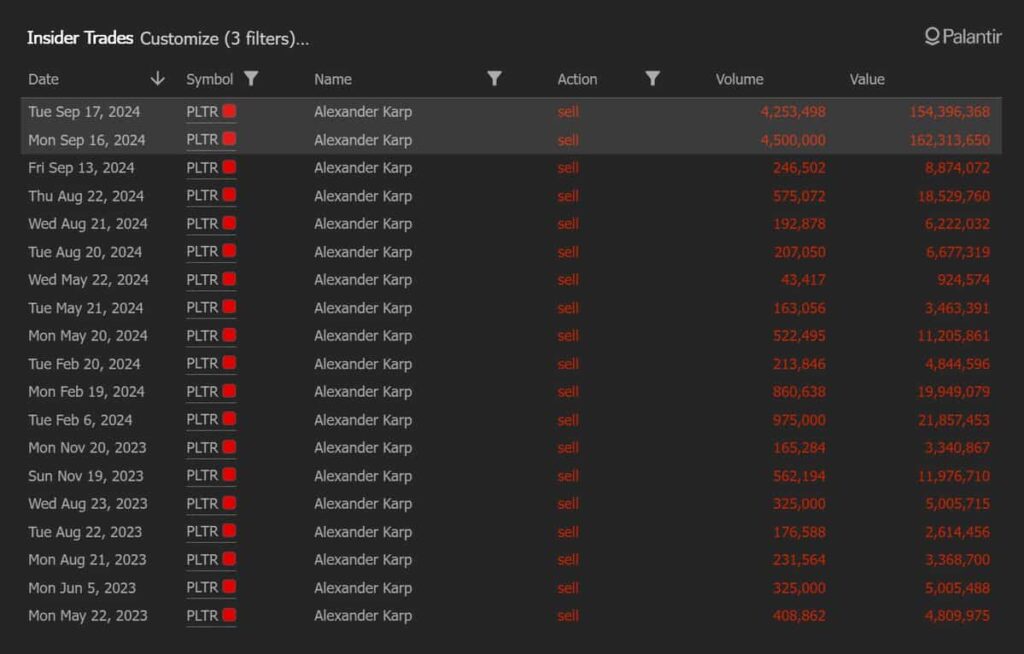

With this kind of momentum, you’d expect Palantir’s leadership to be riding the wave. But Alexander Karp, Palantir’s enigmatic CEO, is making moves of his own—and it’s not just about steering the company forward. Karp has been quietly, and now not-so-quietly, cashing out on Palantir stock.

Palantir CEO offloads large amount of PLTR shares

In 2024 alone, Karp’s sales have ramped up dramatically. His recent sales on September 16 and 17 saw him offload a massive 4.5 million and 4.25 million shares, respectively, raking in a combined total of over $316 million. This isn’t just your typical routine insider sale—these transactions are a whopping 20X larger than many of his previous sales.

To put it in perspective, earlier this year, Karp’s transactions were more modest: In May 2024, he sold 522,495 shares for $11.2 million—a mere fraction of his September sell-off spree.

Palantir’s stock has been on fire this year, and Karp’s accelerated sell-off may be part of a broader personal financial strategy—or perhaps a sign that the CEO believes now is the time to take some chips off the table.

In addition to the September mega-sales, Karp had already sold 860,638 shares in February 2024 for $19.9 million, along with other notable sales in August and May. But the leap to millions of shares in September suggests that Karp might be bracing for future market shifts

Palantir shareholders, take note

Investors shouldn’t necessarily be spooked by Karp’s sales. Insider selling doesn’t always mean an insider has lost faith in the company. In fact, it’s common for executives to cash out portions of their holdings after a major run-up in stock price.

For now, Palantir investors can enjoy the ride as the stock holds strong around $37 with bullish momentum still intact.

Whether you see Karp’s sales as a cautionary signal or a normal course of action, the big question remains: Can Palantir continue its meteoric rise?

Only time—and perhaps Alexander Karp—will tell.