The stock price of the digital payment platform PayPal (NASDAQ: PYPL) is poised to extend its positive 2024 run after reporting better-than-expected earnings.

Notably, the equity has defied market uncertainty, outperforming the stock market in a week marked by various economic data announcements.

By press time, PayPal was trading at $67.90, reflecting a surge of almost 2% for the day. Year-to-date, the equity has risen by over 10.48%.

PayPal earnings beat estimates

It’s worth noting that PayPal’s earnings report took a different approach this time with few tweaks to previous practices. Specifically, the payment giant reported earnings before the market opened, departing from its usual post-close reporting.

This new accounting method incorporates the impact of stock-based compensation expense and related employer payroll taxes.

For the quarter ending March, PayPal reported a 14% uptick in total payment volume to $403.9 billion. The company expects annual earnings per share to increase by a mid- to high-single-digit percentage compared to last year’s mark of $3.83.

Additionally, net revenues surged by 9% to $7.7 billion, surpassing consensus estimates of $7.51 billion. Non-GAAP earnings per share increased by 27% to $1.08.

With PayPal reporting robust earnings for Q1 2024, attention now turns to its equity performance and its ability to sustain gains made in the year. Notably, there is room for the stock to rise further as the company emphasizes revitalizing growth in branded checkout products amid big tech’s market expansion into payments.

Additionally, a possible upside comes from the fact that PayPal raised its forecast for full-year adjusted profit, aiming for a “mid-to-high single-digit percentage” increase compared to previous projections.

Wall Street PYPL projection

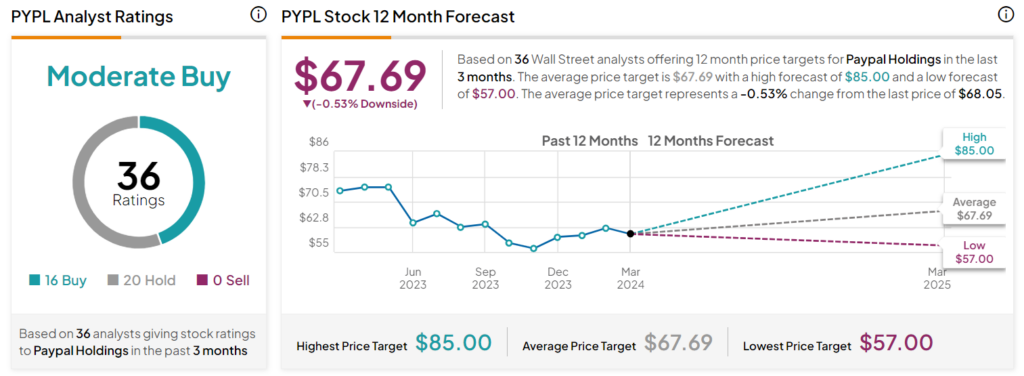

Elsewhere, according to 36 Wall Street analysts over at TipRanks, PayPal’s stock price trajectory is forecasted to be mixed. The average price target for the next 12 months is $67.69, signaling a -0.54% change from the last reported price.

The range of forecasts provided by analysts spans from a high of $85 to a low of $57. This disparity suggests a degree of uncertainty surrounding the company’s prospects in the coming months. The projection is based on the stock’s performance over the past three months.

Despite the projection, 20 analysts are for holding the stock, while 16 recommend buying PayPal.

In the meantime, the stock could face potential bearish pressure, considering that the US economy has shown signs of slowing down amidst lingering uncertainty regarding the Federal Reserve’s next monetary policy.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.