Perplexity is one of the five artificial intelligence (AI) competing startups ChatGPT’s developer OpenAI fears the most, as Finbold reported. Perplexity AI can scan the web in real time, providing up-to-date information and trending insights – for example, for popular investments.

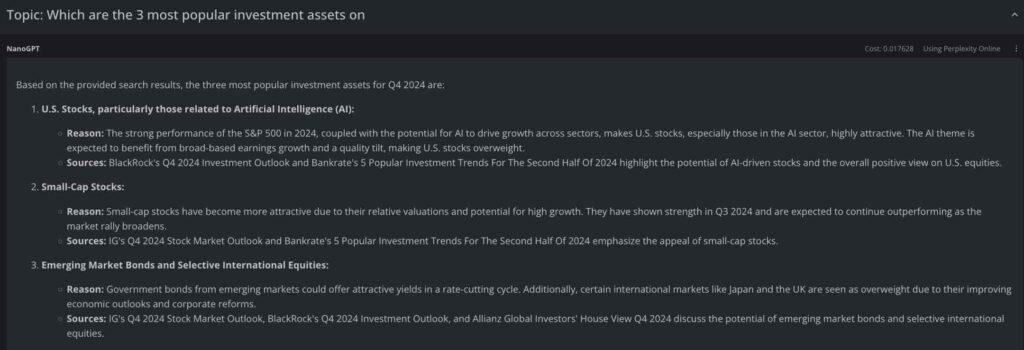

Leveraging this unique capacity in the artificial intelligence ecosystem, Finbold asked Perplexity for the three most popular investment assets for the 2024 fourth quarter (Q4).

Overall, the top three include AI-related stocks in the U.S. market, small-cap stocks, and emerging markets bonds. In addition to investing in emerging markets, Perplexity also mentioned investing in selective international equities from recovering economies.

Sources vary from IG’s and BlackRock’s Q4 2024 outlooks, together with other prominent investment firms that published their quarter reports.

U.S. stocks related to AI

Notably, Perplexity explained how the artificial intelligence theme has grown in popularity, directly impacting AI-related stocks. An example of this success is an exclusive report by Finbold, highlighting OpenAI among the world’s 100 most valuable companies.

“Finbold Research found that such a valuation [approximately $157 billion] would mean that the artificial intelligence (AI) powerhouse would be among the 100 most valuable companies in the world had it gone public.”

– Finbold Research

The real-time web scanner also identified a strong performance of the S&P 500 this year. This evidences the growth of the United States stock market across different sectors, particularly related to AIs. Nvidia (NASDAQ: NVDA) is an obvious leader in that field, escalating ranks to become one of the world’s most valuable companies.

Interestingly, another report explained how the market’s behavior suddenly turned to a “Buy stocks” response no matter what. Finbold has constantly suggested promising stock investments in the AI sector to consider.

Small-cap stocks surge as a popular investment for Q4 2024

Looking for higher returns than the S&P 500 itself, investors have started allocating a significant part of their portfolios to small-cap stocks – which are growing in popularity, according to sources. Perplexity AI explained the small-cap stocks pick:

“Small-cap stocks have become more attractive due to their relative valuations and potential for high growth. They have shown strength in Q3 2024 and are expected to continue outperforming as the market rally broadens.”

– Perplexity AI

However, the market has seen a significant $3.5 billion outflow from small-cap stocks, as we published in August. This “trading crowd flee” happened amid growing uncertainty on macroeconomic factors, making retail to panic out.

Emerging markets bonds and selective international equities

In a similar reasoning to investing in small-cap, Perplexity found out that investing in underdog economies has grown in popularity. This investment strategy also includes spotting opportunities in companies in the international market

“Government bonds from emerging markets could offer attractive yields in a rate-cutting cycle. Additionally, certain international markets like Japan and the UK are seen as overweight due to their improving economic outlooks and corporate reforms.”

– Perplexity AI

On that note, the Japanese Yen carry trade was one example of the opportunities outside the United States.

Artificial intelligence advancements now allow investors to easily access consolidated data almost in real time, leveraging research and planning. With that, it is now possible to navigate the trends and diminish the asymmetry from retail to big institutional participants. Perplexity AI is one example of these advancements.