Long-term Bitcoin (BTC) critic and CEO of Euro Pacific Capital, Peter Schiff, has projected a global shift from fiat currencies to digital alternatives.

Schiff believes that one option likely to be embraced by global economies will be digital gold but expressed skepticism about Bitcoin’s ability to become one of the digital currencies in the future, he said in an interview with Mike Adams on March 17.

According to Schiff, people will start transacting in digital gold either through blockchain technology or private companies tokenizing the metal. He noted that the shift to digital currencies would be due to the dollar’s rapid devaluation.

“Eventually, I think the world will move away from fiat currencies, and I think a lot of people will start transacting in gold again. <…> I know there are some people out there that think they’re going to use Bitcoin, that ain’t going to happen,” Schiff said.

Devaluation of the dollar

As the United States continues to battle rising inflation, Schiff warned that the dollar risks being devalued similarly to currencies in countries such as Argentina with the Argentine Peso.

“When the dollar really starts to lose money rapidly, you know, when we’re like Argentina or something like that, and then you can’t even risk keeping your short-term money in dollars, it’s not that bad yet,” he added.

Despite Schiff advocating for a possible shift towards digital gold, the economist had initially stated that the precious metal partly lost interest during the 2021 cryptocurrency bull run. As per a Finbold report, Schiff stated that the attention placed on Bitcoin saw investors ignore gold.

Indeed, Bitcoin has earned a comparison to gold, with proponents touting the digital currency to replace the metal and become the ultimate store of value.

Schiff’s Bitcoin objection

Schiff’s gloomy outlook for Bitcoin’s possibility to serve as a go-to digital currency aligns with his long-standing objections to the maiden cryptocurrency. Indeed, the banker has advocated for investors to sell their Bitcoin holdings, maintaining that BTC will likely correct to zero.

Previously, Schiff suggested that the last rally was a bubble that would inevitably burst, and the significant correction observed in 2022 resulted from a massive pump-and-dump scheme. He emphasized that the market witnessed a surge in value, but investors failed to acknowledge the subsequent decrease in value.

Schiff has also predicted a continued deterioration of the global economy that would significantly impact the U.S. banking ecosystem, that’s already in a crisis. Finbold reported that Schiff warned investors to brace for a ‘bigger collapse ahead’ in the country’s banking system.

Watch full video below:

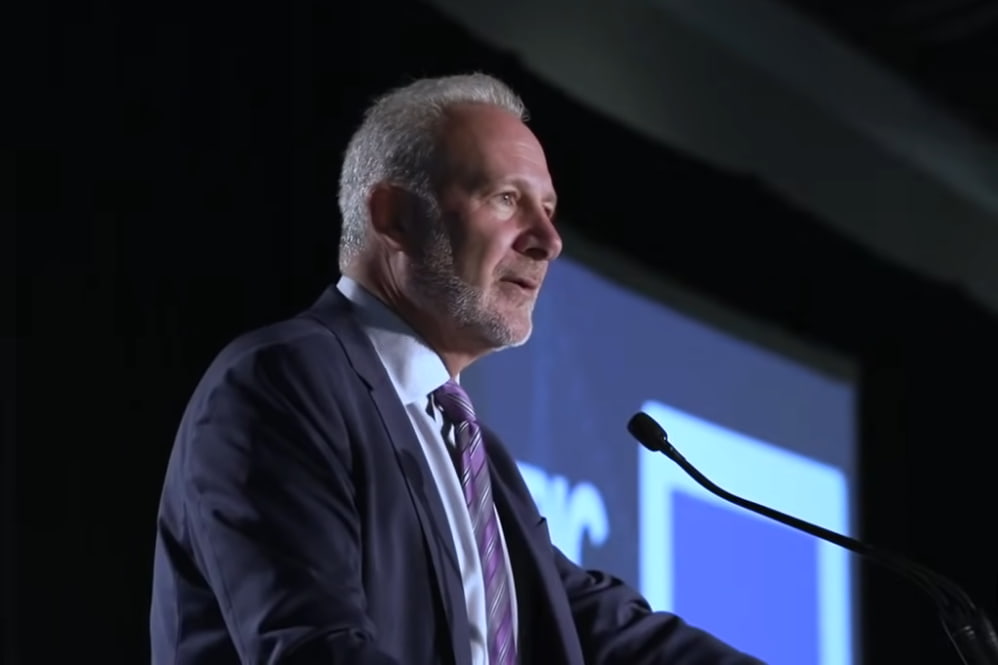

Featured image via Peter Schiff YouTube.