Not long after revealing that real estate is the perfect asset for the “ultimate tax-free” income strategy, Robert Kiyosaki, a renowned investor, entrepreneur, and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ has gone further, arguing that paying taxes is not patriotic.

Indeed, making a bold claim that “the biggest lie told to people” is that paying taxes is patriotic, Kiyosaki joined tax expert Tom Wheelwright in explaining how to legally avoid paying taxes in an episode of his The Rich Dad Channel podcast streamed on September 5.

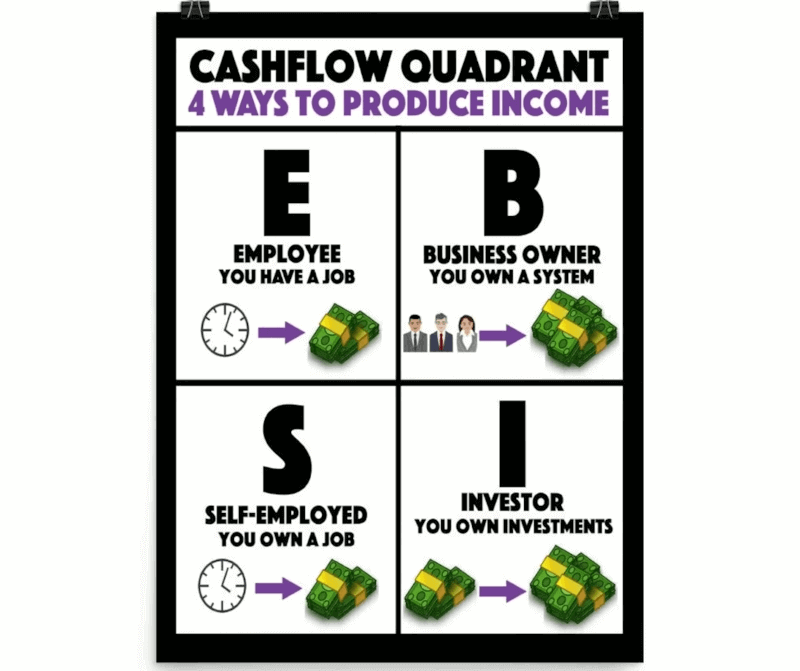

Specifically, the ‘Rich Dad’ author has divided the cashflow system into four groups – ‘E’ for employees who work for money, ‘S’ for self-employed people who own their jobs but also work for money, ‘B’ for business owners who own a system and hire employees, and ‘I’ for investors who invest to earn.

Differences in taxation

As he further highlighted the massive differences in how much different categories pay in taxes, Kiyosaki stated that:

“Employees pay about 40% of taxes worldwide, (…) and if you’re a doctor, lawyer, self-employed, or somebody who says I’m going to quit my job and start my own business, you become a small business owner (…),” taxes can go as high as 60% as they pay two taxes – employer and employee.

Furthermore, as he explained, a big business, which typically has about 500 employees, pays around 20% in taxes, a lot less than the previous groups, because:

“The government needs these people (‘B’) to hire these people (‘E’), (…) and so if you hire a lot of people, they’ll give you a tax break for that.”

Finally, the “‘I’ stands for ‘investor,’ but it’s an inside investor. In other words, over here (‘E’ and ‘S’), a lot of people invest, but they invest in a 401k or an IRA; they invest in public markets like stocks, bonds, mutual funds, and ETFs, which I don’t. (…) But over here is an insider or investor (‘I’)” who pays zero tax.

How to avoid paying taxes legally?

Ultimately, Kiyosaki has opined that, in order to pay zero taxes without getting into trouble with the authorities, one must learn how to move from the ‘E’ or ‘S’ group to the ‘B’ or ‘I’ group, pointing out that “there are so many different ways the government wants you to not pay tax.”

Hence:

“These guys (‘E’ and ‘S’) here can do this if they have a good attorney also. (…) But you have to act like these people (‘B’ and ‘I’), you can’t act like these people (‘E’ and ‘S’). (…) You can shift your thinking over to this side here and do it legally.”

As one example, the finance educator used a purchase of an apartment building and increasing the rent so that tenants actually pay the tax to the government and not the actual owner of the building but has also advocated for getting in debt “because money is created out of debt.”

“I use debt because debt is tax-free. If I don’t borrow money, no money is created because money is created out of debt, and so I get tax incentives for being in debt. (…) If you’re a capitalist, you want as much debt as you possibly can get legally.”

With the $2 million in proceeds collected this way out of a refinance, Kiyosaki said he borrowed out the equity that appreciated as he raised the rent and was able to invest in gold, buying a “partnership with the biggest gold miner in the world with tax-free money from my real estate.”

Watch the entire video below:

Featured image via The Rich Dad Channel YouTube

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.