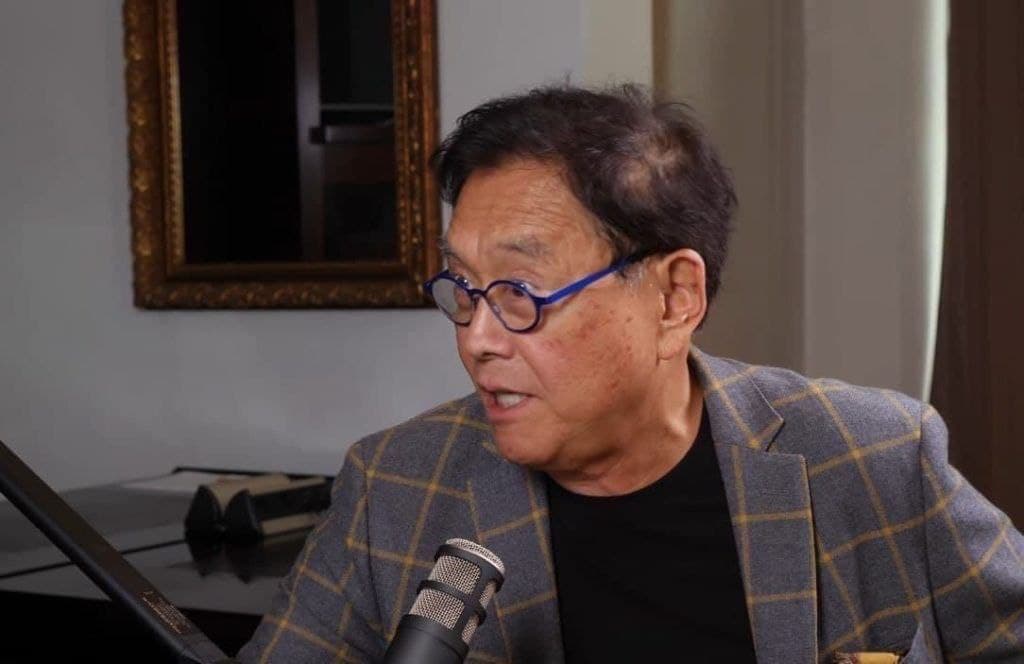

Although he openly admitted he didn’t know much about Bitcoin (BTC), famous investor and author of the bestselling personal finance book ‘Rich Dad Poor Dad’ Robert Kiyosaki has been a fan of the maiden cryptocurrency and has recently bought some of the largest altcoin, Ethereum (ETH), as well.

As it happens, Kiyosaki was discussing gold, silver, and Bitcoin as investments, as well as the declining value of the United States dollar (USD), with his guest Andy Schectman, the CEO of Miles Franklin Precious Metals, in the latest episode of ‘The Rich Dad Channel’ podcast premiered on May 8.

According to the finance educator, the declining dollar is the main reason to accumulate these alternative investments, especially considering his view that the already dire situation was only going to get worse and that schools, in his opinion, are not very good at teaching financial literacy:

“It’s a reason to buy gold, silver, Bitcoin, and all this because our currency is screwed up now, it’s going to get worse because our debt keeps going up. (…) The reason we buy gold, silver, and Bitcoin is the same reason – it’s not any different, just tell me how many ounces you have. (…) I buy gold, silver, Bitcoin, and I just bought some Ethereum simply for the same reason – our money is fake.”

Why people are getting poorer

Furthermore, he believes that “people are getting poorer and poorer in America, because most of our school teachers and Marxists and they hate the rich, that’s why they’re going after [former US President Donald] Trump, they hate him because he’s a rich man.”

On top of that, Kiyosaki pointed out the absence of counterparty risk issues when it comes to borrowing money in the ‘fake’ fiat currency like the dollar as opposed to the above assets, arguing that he wouldn’t know who is the person to pay him back:

“If I borrow money, who’s the guy to pay me back? And gold and silver – you don’t need that – the same as Bitcoin, you have no counterparty risk.”

Kiyosaki and Bitcoin

Finally, he also admitted he was something of a latecomer to the flagship decentralized finance (DeFi) asset, getting on board when the largest asset in the crypto market was already trading at $6,000, whereas today it costs about $60,000, highlighting the importance of the lesson provided by this experience.

As a reminder, Kiyosaki has recently warned that the financial crash has already begun and listed his rules to remember during this time, including being patient, studying, making friends with similar viewpoints, starting a side business, choosing better teachers, and saving the above assets instead of money.

It is also worth noting that, much like the founder and CEO of ARK Invest, Cathie Wood, the ‘Rich Dad’ author believes that Bitcoin price USD could hit $2.3 million. For now, however, the price of this crypto asset is $61,253, so doing one’s own research and keeping up with BTC news is critical when investing.

Watch the entire video below:

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.