Legendary billionaire investor Ray Dalio recently discussed the possibility of an economic downturn within the next four years and its potential impact on the U.S. dollar.

The CEO of Bridgewater Associates gave Japan as an example. Japan’s currency depreciated rapidly due to printing large amounts of Japanese Yen, causing its decline and impacting the general population, which has seen 80% of its purchasing power erode—a scenario he warns could happen in the U.S., as he emphasized in a recent appearance on the podcast The Prof G.

Dalio anticipates that rising debt servicing in the U.S. will strain consumption, limit the difference between fixed debt repayments and actual revenue, and put pressure on the U.S. dollar with a similar timeline.

Dalio lays out the timeline for potential downturn and crash of the U.S. dollar

According to the founder of the world’s largest hedge fund, experts should be alarmed when investors start to sell off large amounts of U.S. bonds, which will, in return, trigger the reaction by the U.S. Federal Reserve and other central banks.

The situation will become particularly strained during an economic downturn sometime in the next four years. In the discussion, Ray Dalio was asked to share his perspective on the potential timeline for when things might start to get ‘really bad.’

Dalio warned, “the real issue will arise if we start seeing a sell-off of bonds. The next red flag will be when the government, the Federal Reserve, and other central banks step in to buy again. The most critical and risky moment will be during the next economic downturn, which I believe could occur within the next four years.”

Latest U.S. spending estimates for 2024 raise an alarm

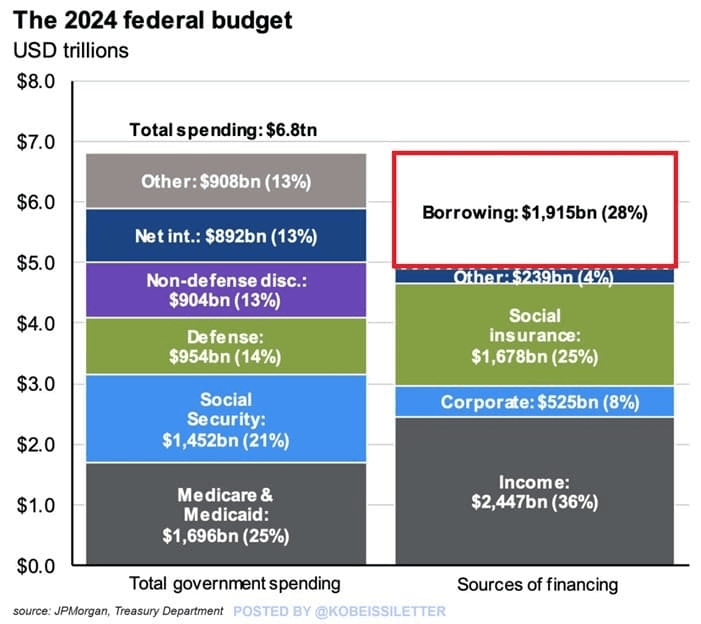

The latest projections for U.S. government spending further emphasize the warning from the financial experts, as the total expenditure is expected to reach $6.8 trillion, the highest level since 2021, which could further strain the U.S. dollar and contribute to the budget deficit.

Meanwhile, net interest payments and other debt expenditures are forecasted to reach $892 billion and $908 billion, each accounting for 13% of the total spending.

With projected revenues of $4.7 trillion, the federal government faces a substantial budget deficit of $1.9 trillion, the largest in three years, which will need to be financed through borrowing.