The Magnificent Seven stocks reached a new milestone, totaling a $15 trillion market capitalization for the first time in history.

In finance, the moniker refers to Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), Meta (NASDAQ: META), and Tesla (NASDAQ: TSLA)—the seven high-performing technology stocks.

As reported by The Kobeissi Letter on June 15, the stock market category officially exceeded the $15 trillion market cap. Notably, the report highlights a $2 trillion surge in the last two months alone, representing 13% of the combined capitalization.

Moreover, the post mentions a 60% rally year-over-year for the Magnificent Seven. In contrast, the other 493 stocks from the S&P 500 (NYSE: SPY) experienced only a 20% 12-month surge.

Together, the Magnificent Seven valuation equals half the United States’ $28 trillion gross domestic product (GDP). This helps to evidence the group’s relevancy for the U.S. economy and the remarkable growth of the tech sector.

Magnificent Seven performance year-to-date

As of this writing, here is each stock’s year-to-date (YTD) performance that composes the Magnificent Seven on NASDAQ.

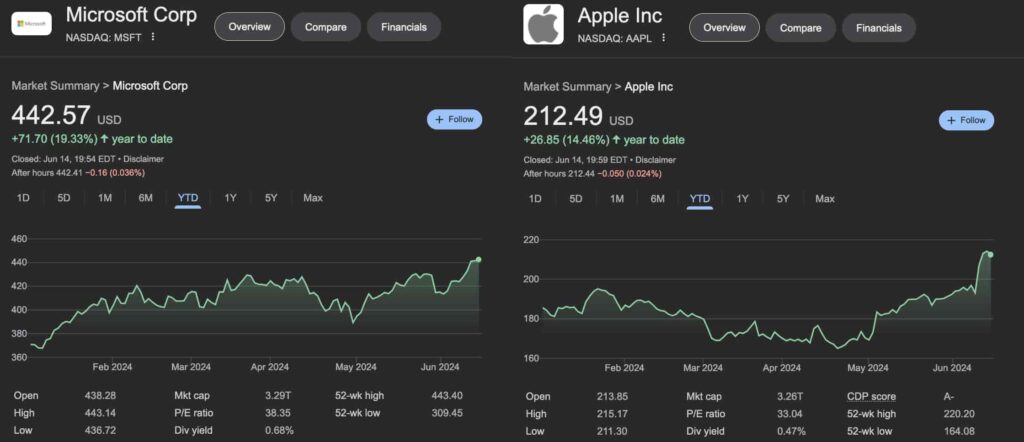

First, Microsoft closed June 14’s Friday at $442.57, up 19.33% year-to-date with a $3.29 trillion market cap. Apple closed at $212.49, up 14.46% YTD, slightly behind MSFT with a $3.26 trillion capitalization.

Nvidia (NVDA) stock performance in 2024

Interestingly, NVDA was the best performer, with nearly 174% gains since January 2, trading at $131.88 per share. Nvidia also became the third most valuable stock in the world, valued at $3.24 trillion, surpassing the other four.

The last four stocks of the Magnificent Seven: GOOGL, AMZN, META, TSLA

Alphabet, Amazon, and Meta rallied 27.8%, 22.5%, and 45.6%, respectively. They closed Friday with a capitalization of $2.19 trillion (GOOGL), $1.91 trillion (AMZN), and $1.28 trillion (META).

Conversely, TSLA was the only one of the seven with a negative year-to-date performance, down 28.34% in the period. Tesla currently holds a $567.7 billion capitalization and is ranked as the 10th most valuable United States company.

Now, stock market investors await to see how the economy will develop in the following months. The fear of a recession has dominated the recent narrative, imposing challenges to the further growth of the Magnificent Seven. Traders and investors must be cautious while allocating capital and do their due diligence on each desired company.

Buy stocks now with eToro – trusted and advanced investment platform

]Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.