Replimune (NASDAQ: REPL) stock price soared sharply to an all-time high of $46 in Wednesday trading before settling around $36 a share at the end of the session. The shares of the biotechnology company that develops oncolytic immune-gene therapies to treat cancer jumped 46% in Wednesday trading, accelerating twelve months gains to 196%.

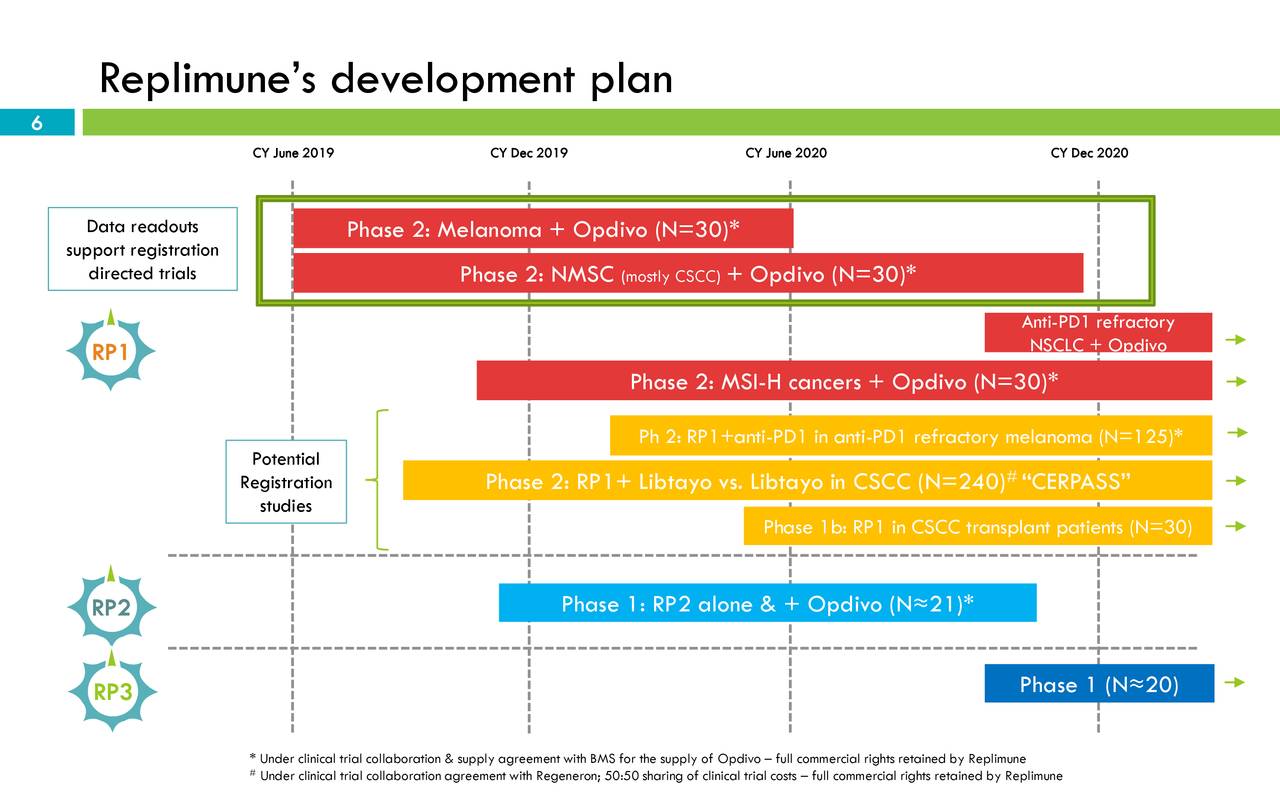

Replimune stock price has been receiving support from the successful results of the Phase 1 clinical trial of RP1 and RP2 in patients with solid tumors.

Gains potentially backed by leaked data

The latest gains are potentially backed by leaked data about RP1 and RP2 clinical trials that the company was planning to present at the 2020 Society for Immunotherapy of Cancer (SITC) Annual Meeting. The meeting is scheduled virtually from November 9-14, 2020. The document released on October 14th by the company states:

“The abstracts for these presentations appeared briefly and in error on the SITC website this morning, prior to their intended release on November 9th 2020,”

Consequently, the company has officially released the abstract in a news release after it was being appeared in error on SITC sites on Wednesday.

According to Replimune representative:

“The RP2 Phase 1 clinical data support the safety and efficacy of single-agent P2, including demonstration of uninjected tumor response in patients with difficult to treat advanced cancers. This data supports the hypothesis that anti-CTLA-4 delivered intra-tumorally through oncolytic virus replication, with accompanying antigen release and presentation, can provide potent anti-tumor effects.”

The company has also updated about RP1 phase 1/2 clinical trial for a range of solid tumors. RP1 is its leading product. It is a new form of herpes simplex virus 1. Replimune’s RP1 product has previously indicated tolerable safety and tumor regression in patients that are facing a number of tumor types.

In a news release, the company said RP1 along with nivolumab has presented promising anti-tumor activity with skin cancer patients.

On the other hand, the company appears in a strong cash position to support its clinical trials.

It has recently raised $115 million of cash proceeds through a common stock public offering. At the end of the latest quarter, its cash, cash equivalents, and short-term investments came in at $261.8 million, up from $168.6 million in the previous quarter. The company claims that its cash position will enable it to support additional studies in the year ahead.