Although the price performance of Bitcoin (BTC) has slowed down in the past several weeks, the corrections appear to be a natural part of its cycle, particularly as they mimic its movements from the past cycles, and a renowned cryptocurrency expert has revealed Bitcoin’s next cycle top.

As it happens, the price of the flagship decentralized finance (DeFi) asset has declined well below its recently attained all-time high (ATH) of $73,738 from mid-March this year and is currently trading in the area around $65,000, but its market cycle top could happen as early as the end of this year.

Bitcoin cycle top prediction

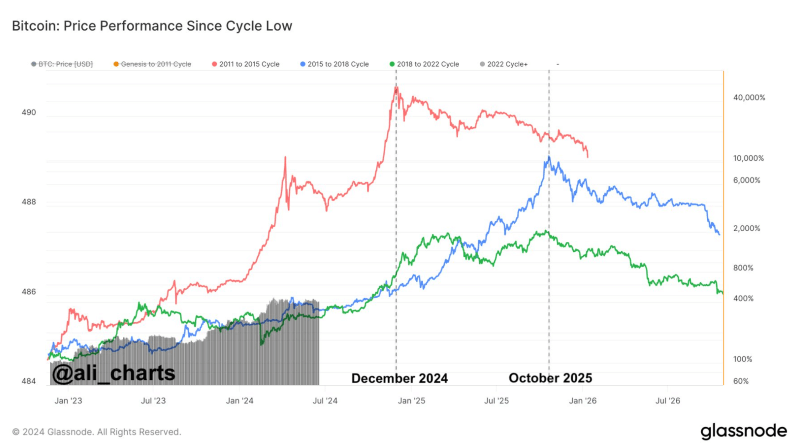

Specifically, professional crypto trader Ali Martinez has observed that if this Bitcoin market cycle mirrors the previous three cycles, the “top could actually come around December 2024 or October 2025,” according to the analysis he shared in an X post on June 18.

Indeed, as the chart that the crypto expert shared demonstrates, the largest asset in the crypto sector by market capitalization has been showing similar price action in the past three market cycles as it is is showing in the current cycle that has started in 2022.

In particular, if it follows the path of the 2011-2015 cycle, Bitcoin could hit the top (+40,000% from cycle low) in December 2024, whereas keeping up with the trends in the 2015-2018 and the 2018-2022 cycle would send it to the market cycle top as late as October 2025 (+10,000% or +2,000%, respectively).

Bitcoin price analysis

Meanwhile, BTC was at press time changing hands at the price of $65,160, which indicates a modest increase of 0.11% in the last 24 hours, while declining 4.13% across the previous seven days, and losing 2.95% over the month, at the same time accumulating a gain of 54.38% in 2024, as per data on June 19.

In the meantime, Bitcoin’s current corrections amid the market sell-off could present an ideal opportunity to ‘buy the dip’ and accumulate the pioneer crypto asset before its price inevitably rises towards one of the possible market cycle tops, as it has just hit its one-month low.

Ultimately, time will tell which of the two cycle tops (if any) predicted by the crypto specialist will happen for Bitcoin, but it is important to remember that trends in the crypto market can easily change, so doing one’s own research is critical when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.