Amid ongoing negotiations on raising the national debt ceiling in the United States, Robert Kiyosaki, author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ has criticized the issue as “bad comedy,” arguing that the US is bankrupt and recommending assets to protect oneself in a possible crisis.

Indeed, Kiyosaki compared the US debt-ceiling crisis to “kabuki theater,” a form of traditional Japanese theater mixing dynamic, dramatic performance with traditional dance, while advising his followers to invest in gold, silver, and Bitcoin (BTC) in a tweet shared on May 24.

“Politicians debating raising $ 30 trillion US debt limit bad comedy, ‘kabuki theater.’ Facts are: US bankrupt. Unfunded liabilities as Social Security are over $250 trillion. Financial market ‘derivative assets’ measured in quadrillions…thousands of trillions. WTF. Buy G,S, BC.”

Bankruptcy fears

With this tweet, he was referring to the debate between lawmakers on both sides of the American political spectrum – Republicans and Democrats – on the issue of raising the $30 trillion US debt limit by June 1 in order to prevent the country from spiraling into bankruptcy.

However, the financial educator has also expressed his view that the US was already bankrupt, echoing his previous statements that the country was “sitting on the edge of a great depression” and that an “economic tsunami” was coming to sweep the US as the dollar loses its status as the world’s reserve currency.

Why Bitcoin?

Meanwhile, Kiyosaki has long advocated buying Bitcoin as one of the ways to provide safety in the face of the possible massive recession, as well as, in his words, the rising corruption and incompetence in the country that he believes is in for a “crash landing,” as Finbold reported on May 19.

In addition, he believes the flagship decentralized finance (DeFi) asset will continue to rise in value, eventually reaching $100,000, because “people support” it, not the Federal Reserve or the government, and that it did not need bailouts because it’s the “people’s money.”

That said, Bitcoin was at press time trading at $26,227, down 1.89% on the day, in addition to dipping 4.37% across the past week and declining 4.01% on its monthly chart, losing all its major support levels and threatening to decline below $24,000, as per the latest data on May 25.

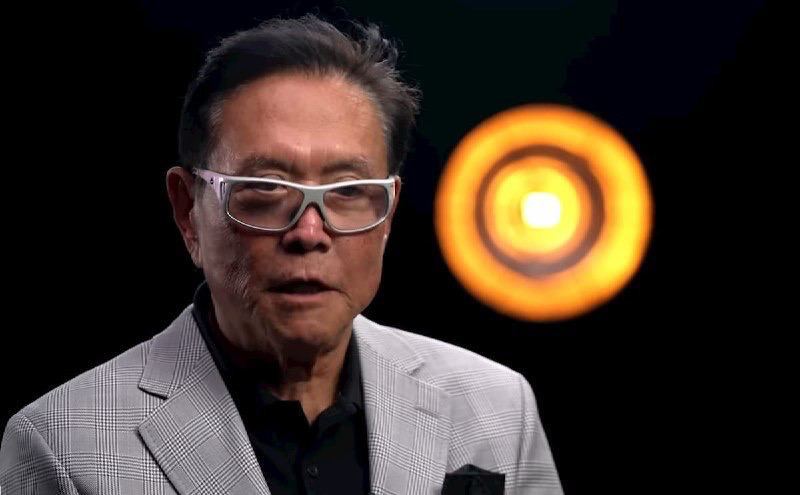

Featured image via Ben Shapiro’s YouTube.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.