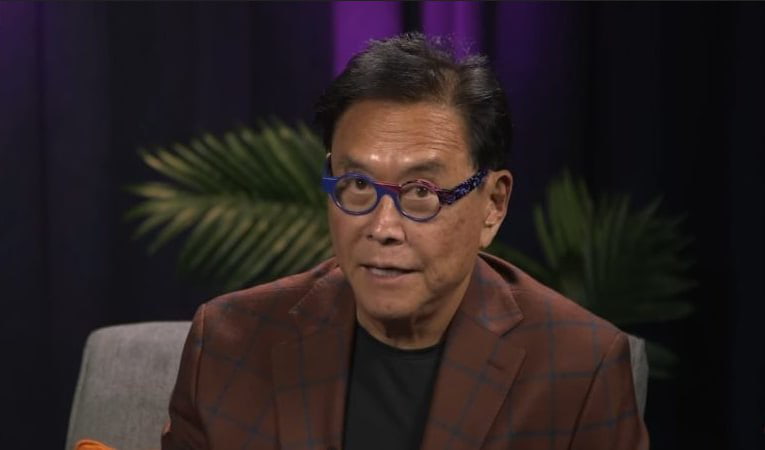

Businessman and author of the personal finance book “Rich Dad Poor Dad,” Robert Kiyosaki, discussed how investors might utilize debt to build wealth, as well as the direction of the cryptocurrency markets.

Speaking on his podcast The Rich Dad Channel, Kiyosaki discussed how the decentralized nature of crypto puts it at a crossroads between technology and macroeconomics.

The author underlined his support for the flagship digital asset Bitcoin which has recently been on a resurgence after climbing back above the crucial $40,000 mark, noting the benefits of using Bitcoin.

Picks for you

Kiyosaki, who was also joined by cryptocurrency expert Jeff Wang, among other guests, highlighted the crypto’s decentralized benefits, given that governments, nations, or boundaries do not constrain it.

“They wanna centralize control everything. So the reason I support Bitcoin, and especially blockchain, as it’s decentralized. It’s people’s money. Gold and silver are God’s money,” he said.

All of the individuals who are mining or supporting the infrastructure that underpins crypto, such as Bitcoin or Ethereum, must adhere to a set of rules for the system to function correctly.

Crypto is a hedge against inflation

With inflation at a record 40 year high, with the ‘real value’ of one U.S. dollar decreasing by 86% in the last 50 years, the American businessman reiterated that he doesn’t save his wealth in dollars as the money loses its value because of inflation.

The United States is witnessing historical inflation, and as a consequence, financial professionals are debating how to hedge against inflation in the event that the equity markets continue to climb in 2022.

Thus, Kiyosaki opts to save in precious metals such as gold and silver and what has come to be known as ‘digital gold’ (Bitcoin) to not lose out on the effects of inflation.

The author confirmed:

“I have millions of dollars of gold, silver, and Bitcoin. We don’t save dollars. That’s the macro picture.”

CBDC’s will still cause inflation

Recently there has been plenty of talk around the notion of a central bank digital currency (CBDC), especially following President Joe Biden’s Executive Order earlier this month which enabled the White House to authorize government departments to explore the legal and economic implications of establishing the U.S.’ own CBDC.

“By placing urgency on research and development of a potential United States CBDC, should issuance be deemed in the national interest. The Order directs the U.S. Government to assess the technological infrastructure and capacity needs for a potential U.S. CBDC in a manner that protects Americans’ interests.”

Kiyosaki points out Govcoin or Fedcoin are digital currencies issued and backed by a federal government’s central banks that will ultimately lead to hyperinflation.

“If you go to Govcoin or the Fedcoin, it’s actually good news for everybody that they’re coming after us. Then there will be hyperinflation like we’ve never seen before because when there is a Govcoin, they’re gonna bypass the bank system.

Ultimately, Kiyosaki points out that the system is compelling everyone to become gold, silver, and crypto buyers right now.

Watch the video: Robert Kiyosaki calls Bitcoin the people’s money